Transportation Index Points To Equity Market Weakness Ahead

Chris Vermeulen | Sep 01, 2019 12:34AM ET

The recent news that the U.S. and China will restart trade talks resulted in a fairly large upside price rotation as this “good news” suggests that some resolution to the trade issues may be in the works soon. Yet we want to warn traders that the U.S. will likely want to see progress and action regarding any trade resolution before tariffs are reduced and eventually removed.

We can’t imagine that the U.S. would take any promises stated by China as any real progress towards balancing trade or normalizing relations. We believe the process of resolving the U.S./Chinese trade dispute could still be many months away from any real opportunities for traders and the global markets.

The other issue on the table this week and in the immediate near future is the “no-deal” BREXIT. News that the Queen assisted Boris Johnson by shutting Parliament in the UK to help facilitate a “no-deal” BREXIT could send shock-waves throughout the global markets over the next 30 to 60+ days. Even though the U.S. and UK appear to have settled on some strong trade resolutions to help calm the waters, the fallout in the EU as well as the reverberations that may be felt throughout the world over the next 12+ months.

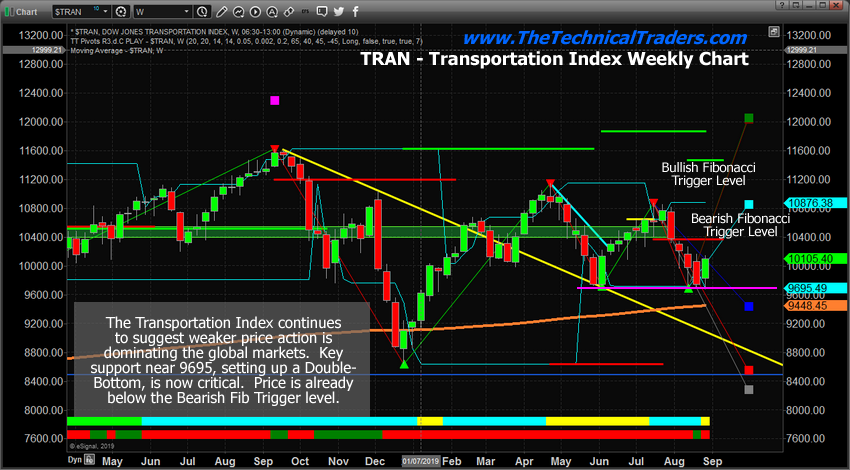

Weekly Transportation Index

Overall, we are relying on some of our favorite alternate charts to help us understand what the markets are really showing us in terms of price action and direction. One of our favorites, the Transportation Index, has recently crossed below the Bearish Fibonacci Trigger Level (early Aug 2019) and continues to trail below 10,400.

A double-bottom setup has formed near the 9695 level that appears to be a fairly strong level of support. If this level is broken in the future, our Fibonacci price modeling system is suggesting downside price targets below 8500 (below the lows in December 2018). This would suggest that any real downside risk could extend the U.S. indexes below the December 2018 lows on a breakdown move.

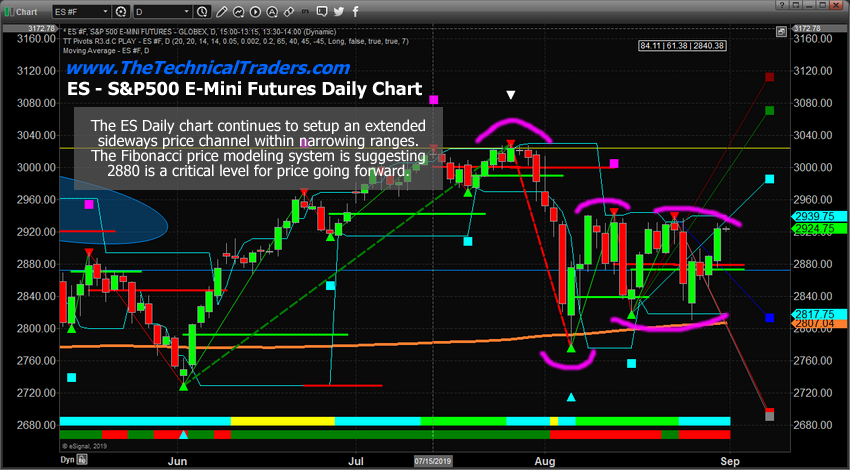

S&P 500 Daily Index Chart

As we try to translate the Transportation Index analysis into the ES chart, the very first thing we focus on is the tight, sideways price range that continues to “coil” before a breakout/breakdown move. The low set up in early August 2019 (near 2775.75) is still the most recent critical low in price formation. The other recent low presents a very interesting setup—a potential double-bottom setup near 2817.75, yet we also see a recent “new low” setup from the dip in price on August 26 (with a low of 2810.25). This new low follows the Fibonacci price theory rules to support a bearish/downside price trend setup that should continue to dominate the markets until we see any type of “new highs.” Therefore, the analysis of the TRAN chart and the current setup in the ES continues to suggest a breakdown move is likely.

S&P 500 Weekly Index Chart

This weekly ES chart highlights how the Fibonacci price modeling system is interpreting the recent volatility and price rotation over the past 18+ months. Pay very close attention to the current Bullish and Bearish Fibonacci Trigger Levels. While you are at it, pay very close attention to the previous Bullish and Bearish Fibonacci Trigger Levels. What you will notice is that the current price rotation over the past few weeks is right between the current and past Fibonacci trigger levels for both the Bullish and Bearish price rotation going all the way back to the downside rotation in November/December 2018. This would suggest that the current price level is very fragile in terms of future direction.

We are not seeing any real clear price direction or trend right now, the current Fibonacci price trigger levels are more than 100 points away from the current price (either direction) and the support level near 2800 is still holding. The daily chart suggests price is attempting to hold above support near 2880. Yet the new low on the Daily chart suggests price has recently shown a Fibonacci Trend with potentially confirms price weakness and a potential bearish outcome.

How are traders to interpret all of this information and make decisions?

Headed into this weekend, our research team suggests pairing back any open long positions you may have in your portfolio off of these recent highs and preparing for a bigger price move going into the end of 2019. Our researchers still believe a breakdown in price will occur as the BREXIT, U.S./China trade issues and further economic contractions continue to undermine real growth opportunities going into the end of 2019. But time will tell if we are correct in our interpretations or not.

We believe the news events are artificially supporting the markets with expectations that may prove to be many, many months away. Watching the other “alternative” charts (like the TRAN, XLF, IWM, YINN, and others), we can clearly see the price recovery in the ES, NQ, and YM are somewhat isolated price moves related to news related expectations. The rest of the market is not reacting like these major indexes.

We would advise traders and investors to take advantage of these higher prices to pull profits out of open long positions and take some risk off the table at this juncture in price. We entered a new trade Friday and our portfolio is primed and ready for big moves going into next week.

We believe super-cycle research and other proprietary modeling systems are suggesting that price weakness will dominate the markets for the next few months.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.