CHF/JPY To Test Trend Resistance

Littlefish FX | Feb 02, 2016 05:53AM ET

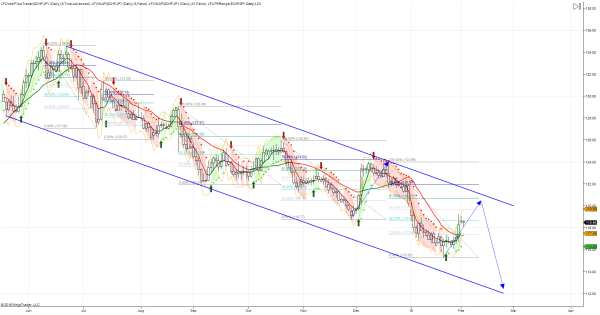

Trade Of The Day: CHF/JPY To Test Trend Resistance

Trade Of The Day: Improved risk sentiment and increased market expectations for additional stimulus by several central banks, including the SNB, have weighed on the CHF recently. Indeed, we expect this trend to continue as the CHF further corrects its over valuation. The recent CHF depreciation has fueled expectations of increased SNB FX interventions since December. In that respect, the SNB’s FX reserves (Friday) will be closely followed. The Bank of Japan shocked markets on the final trading day of January as they announced a move into negative interest rates, a move which in the words of BOJ Governor Kuroda is intended to “show people that the BOJ is strongly committed to achieving 2 percent inflation and that it will do whatever it takes to achieve it”. Despite noting the continued recovery for the Japanese economy Kuroda explained that the move is intended to combat the risks posed from the “recent further falls in oil prices, uncertainty over emerging economies,including China and global market instability”.

Trade Idea: I am monitoring the trend development in the CHF/JPY, which has been trading within a well defined down channel. Retracements of prior legs of declines have tended to terminate at the 61.8/78.6% retracement of the last leg lower. As such I am looking for the current correction to test the 120/120.50 level, I will set shorts on intraday reversal patterns at these levels looking for trend continuation, initially targeting a retest of 115 lows and 112 in extension as per the chart below.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.