Tracking The Smart-Beta Horse Race With ETFs

James Picerno | Mar 24, 2017 03:01PM ET

How’s that factor strategy been working for ’ya lately? That’s a topical question for a growing number of investors as “smart beta” products play a bigger role in portfolio design. You may not be drinking the factor Kool-Aid, but it’s still worthwhile to check in on these risk premia periodically for some context on what’s driving equity performance generally. With that in mind, let’s review a set of eight ETFs that represent the usual suspects in the US equity factor space.

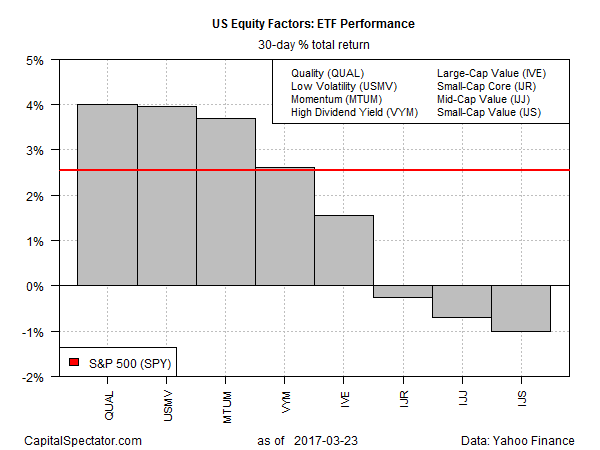

The first step is looking at factor returns for the past 30 trading days through yesterday (Mar. 23). Leading the field by a hair is the so-called quality factor, which targets companies with relatively strong fundamentals, such as high return on equity and low financial leverage. The iShares Edge MSCI USA Quality Factor (NYSE:QUAL) is ahead by 4.0% over the trailing 30-day window, or just slightly ahead of the return for iShares Edge MSCI Minimum Volatility USA (NYSE:USMV).

In last place for the past 30 days is the small-cap value factor via iShares S&P Small-Cap 600 Value (NYSE:IJS), which is off 1.0%. The ETF’s close on Thursday left it close to the lowest level so far this year.

For perspective in our factor-performance travels, we’ll use everyone’s favorite yardstick of the US market as a benchmark. The S&P 500, based on SPDR S&P 500 (NYSE:SPY), has delivered a middling gain of 2.5% vs. the factor ETFs over the past 30 trading days.

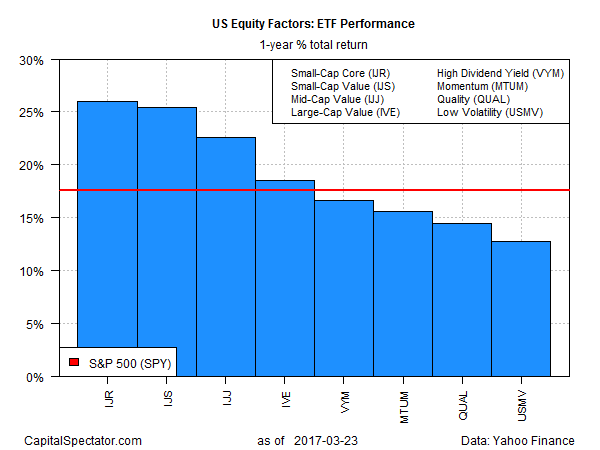

For the trailing 1-year window, small-cap core is in the lead. iShares Core S&P Small-Cap (NYSE:IJR) is up a strong 26.0% over the past 12 months, or roughly 50-basis points better than the number-two performer: iShares S&P Small-Cap 600 Value (IJS).

At the back of the field is the low-volatility factor. iShares Edge MSCI Minimum Volatility USA (USMV) is ahead by 12.7%, the softest gain for the factor ETFs in the one-year total-return column.

Meanwhile, the S&P 500’s performance is more or less in the middle for the one-year results, based on SPY’s 17.5% total return for the past 12 months.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.