Top 5 Stocks Likely to Gain From U.S. Infrastructure Spending

Zacks Investment Research | Nov 16, 2021 07:26AM ET

U.S. stock markets have been witnessing an impressive rally this year, with just around seven weeks to complete 2021. However, market participants seem a little nervous as the coronavirus-led massive fiscal stimulus has ended and the Fed has decided to systematically eliminate the monetary stimulus paving the path for the first rate hike next year since March 2020. Moreover, soaring inflationary pressure has compelled many investors to think that the central bank may hike rates early next year instead of mid-2022.

At this stage, the new law of the Biden administration to spend $1 trillion in infrastructure development will act as a new catalyst for Wall Street. Various companies will gain from this project. Notable among them are Nucor Corp. the complete list of today’s Zacks #1 Rank stocks here .

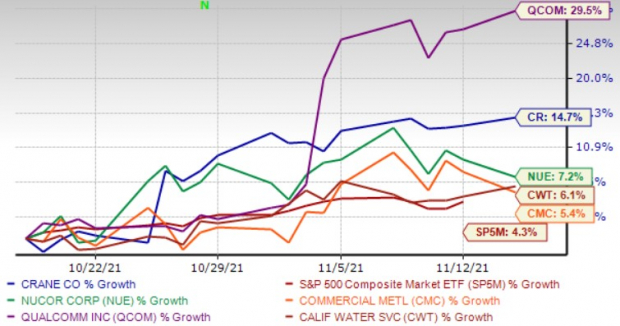

The chart below shows the price performance of our five picks in the past month.

Nucor Corp. is a leading producer of structural steel, steel bars, steel joists, steel deck and cold-finished bars in the United States. NUE operates through three segments: Steel Mills, Steel Products, and Raw Materials.

Nucor has been seeing consistent momentum in the non-residential construction market. Demand in the non-residential construction markets was strong in the most recent quarter. The downstream products unit of Nucor has been benefiting from continued strength in the non-residential construction markets.

Zacks Rank #1 NUE has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 7.2% over the last 30 days.

Qualcomm Inc. is well-positioned to benefit from a solid 5G traction with greater visibility to meet its long-term revenue targets. For calendar-year 2021, 5G handsets with QCOM chip are expected to witness 150% year-over-year growth at the midpoint to about 450-550 units.

Qualcomm has raised the bar for driverless cars with the launch of the first-of-its-kind automotive platform — Snapdragon Ride — which enables automakers to transform their vehicles into self-driving cars using AI.

Zacks Rank #2 QCOM has an expected earnings growth rate of 23.1% for the current year (ending September 2022). The Zacks Consensus Estimate for current-year earnings improved 1.1% over the last 7 days.

Crane Co. manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally. Crane Co. is poised to benefit from its diverse portfolio and efficient management team. CR has exposure in many end markets like non-residential construction, aerospace, electronics, automated payment solutions, chemical, power and various general industries.

Zacks Rank #2 CR has an expected earnings growth rate of 67.5% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 7.6% over the last 30 days.

Commercial Metals Co. is poised to gain on robust steel demand, stemming from elevated spending on residential and construction sector in North America and recovery in the manufacturing sector. Steel sales volumes in Europe are anticipated to remain healthy on increasing demand from construction and industrial end market.

Construction activity in Poland remains particularly strong aided by the residential markets. These factors will boost steel shipment levels in North America and Europe, and support CMC’s results in fiscal 2022.

Zacks Rank #1 CMC has an expected earnings growth rate of 3.7% for the current year (ending August 2022). The Zacks Consensus Estimate for current-year earnings improved 25.3% over the last 30 days.

California Water Service Group has invested in infrastructure. This along with CWT’s strategic acquisitions will help it provide customers with efficient water and wastewater services. New rates coming into effect will constantly drive the earnings of California Water Service. Also, the utility is benefiting from consistent customer wins.

California Water Service is not only boosting its operations via inorganic activities but also resorting to organic prospects. In August, it completed a water main replacement project in northern Salinas while in September CWT concluded similar large-scale projects, one each in Woodside (OTC:WOPEY) and Bodfish.

In July, the utility retired its old 100,000-gallon elevated water tank from service as it did not meet the new seismic standards. Such strategic actions to upgrade California Water Service’s infrastructure are likely to boost its customer base in the future, by increasing the resilience and reliability of its operations.

Zacks Rank #2 CWT has an expected earnings growth rate of 0.5% for the current year. The Zacks Consensus Estimate for current-year earnings improved 7.6% over the last 30 days.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.