Today’s US Employment Report To Confirm Or Deny EUR/USD Reversal

Saxo Bank | Mar 08, 2013 05:28AM ET

EURUSD made a stand yesterday on Draghi’s bluster, but today’s US employment report tell us whether the reversal will extend or face immediate rejection. Meanwhile, USDJPY pulls to a new 43-month high.

JPY weakens apace…

JPY crosses blasted higher, with USDJPY crossing the 95.00 level for the first time since August of 2009. The driver may have been the residual reaction to the BoJ member’s proposals for open-ended easing now, but more likely, it was due to the big rise in yields as major bond markets sold off and stretched spreads to Japan’s collapsing yields even wider (the long end of the Japanese curve is seeing near record lows as bond buyers anticipate the BoJ going out the curve in its JGB purchases. The 10-year JGB yield has been as loas as 0.60% this week after trading above 1.00% at times as recently as early 2012.) The JPY crosses, by not consolidating more than they have already, are probably set for an even larger bout of volatility – either around the end of this month with the end of the Japanese financial year, or in April. In many times in past years, the direction in April has been strongly contrary to the prevailing trend as the new year gets under way. That will of course depend on how the market greets the reality of the new BoJ leadership after its first meeting on April 3-4.

Kiwi turning…?

New Zealand house prices rose a bit more than expected to record levels. I googled an article from January describing the severity of New Zealand’s housing bubble, with current prices over 5 times average annual salaries. This will not end well for New Zealand. Note as well that New Zealand is suffering a drought that could affect its milk exports. There are signs of the NZD beginning to weaken in the crosses, and this may gather pace as the economic surprises have been nearly universally positive out of the country recently and can hardly see more upside from here.

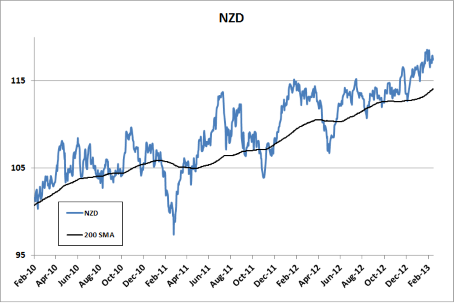

Chart: NZD

Kiwi is still very strong in the big picture versus an evenly weighted basket of the rest of the G-10, but the most recent surge has been rejected – let’s see if we get follow through lower. Particularly interesting are whether the technical breaks in NZDUSD and AUDNZD turn into something bigger from here.

Nonfarm non-preview

I’ve seen a number of credible arguments for nonfarm payrolls surprising the one way or the other, but I’ve got no expectations heading into the number, though I suspect the market is pricing in a strong data point. On that account, the biggest surprise would be a mere +100k or thereabouts rather than an upside surprise of +30-40k. I will be more interested if we get an outlier in the unemployment rate (either a surprise move higher to 8.0% or a 0.2% drop to 7.7% (that would be a post-GFC low, by the way) due to the zany jumps in the household survey and/or a big move in the participation rate). A very ugly surprise to the weak side with a strong bond market response could lead to an interesting reversal in JPY crosses, but I’m firmly in wait and see mode.

Also, I'm very skeptical of the ability for EURUSD to cut much higher from here - a pattern reversal is a pattern reversal (yesterday's clear bullish engulfing candlestick), but the political uncertainty level for the EU is extremely high.

Looking ahead

We’ve also got the Canada employment report up today, which will help the direction for USDCAD – I’m impressed by the pair’s ability to maintain an orderly range after the big move higher, which suggests more upside potential – though the structural interest only really gathers pace if the pair moves above the 1.0500 level and there’s still plenty of room for consolidation back to the 1.0200 area without threatening the up-trend if CAD does try to put up a bit of a fight on today’s data mix..

AUD and NZD slipped on the weak imports data out of China overnight (which helped feed a stronger than expected trade surplus – let’s see the March and April data before we draw conclusions – I don’t see how China is increasing exports sustainably in this environment), especially looking for the close in AUDUSD today to see whether the weekly candlestick closes strongly (towards 1.0300) or weakly (below 1.0225) as it appeared recently that both were headed for a technical breakout lower against the greenback.

Have a great weekend and stay careful out there.

Economic Data Highlights

- New Zealand Feb. QV House Prices rose +6.3% YoY vs. +6.2% in Jan.

- Japan Jan. Adjusted Current Account out at +¥364.6B vs. +¥112.2B expected and +¥114.7 in Dec.

- China Feb. Trade Balance out at +$15.25B vs. -$6.9B expected and +$29.15B in Jan.

- Switzerland Feb. CPI out at +0.3% MoM and -0.3% YoY as expected and vs. -0.3% YoY in Jan.

- Sweden Jan. Industrial Production out at -2.0% MoM and -7.8% YoY vs. +0.5%/-4.8% expected, respectively and vs. -2.2% YoY in Dec.

- Sweden Jan. Industrial Orders out at -3.1% MoM and -5.4% YoY vs. -2.8% YoY in Dec.

- Germany Jan. Industrial Production (1100)

- US Fed’s Bullard to appear in TV interview (1200)

- Canada Feb. Housing Starts (1315)

- US Feb. Change in Nonfarm Payrolls (1330)

- US Feb. Unemployment Rate (1330)

- US Feb. Average Hourly Earnings/Average Weekly Hours (1330)

- Canada Feb. Net Change in Employment (1330)

- Canada Feb. Unemployment Rate (1330)

- China Feb. CPI.PPI (Sat 0130)

- China Feb. Industrial Production (Sat 0530)

- China Feb. Retail Sales (Sat 0530)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.