Today’s FOMC Event Had Little Market Impact

Doug Short | Jun 18, 2015 12:26AM ET

The S&P 500 opened in the green but sold off through the morning prior to the 2pm ET Fed event. The index showed some predictable volatility with the release of the statement, which this month included their projections. It subsequently hit its 0.50% intraday high during Chair Yellen’s press conference. But the modest enthusiasm faded in the final hour. The index closed with a fractional gain of 0.20%. Here's an excerpt from the FOMC's statement today:

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. [source ]

The 10-year yield closed unchanged today at 2.32%.

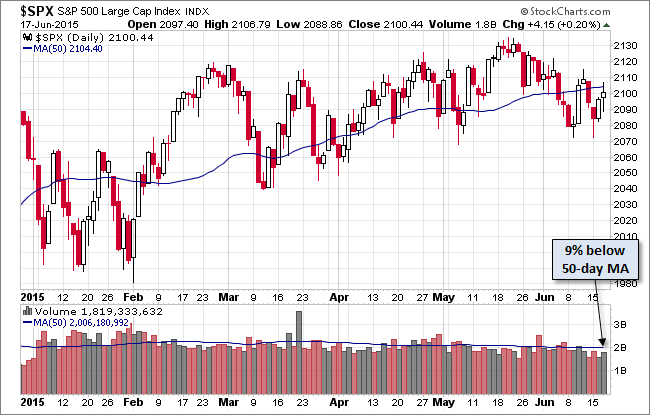

Here is a 15-minute chart of the past five sessions.

As we can see on the daily chart, the S&P 500 remains below its 50-day moving average. Trading volume on today’s Fed news was tepid.

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.