SPX: Seeking Follow-Through

Ryan Mallory | Oct 16, 2015 08:25AM ET

Technical Outlook:

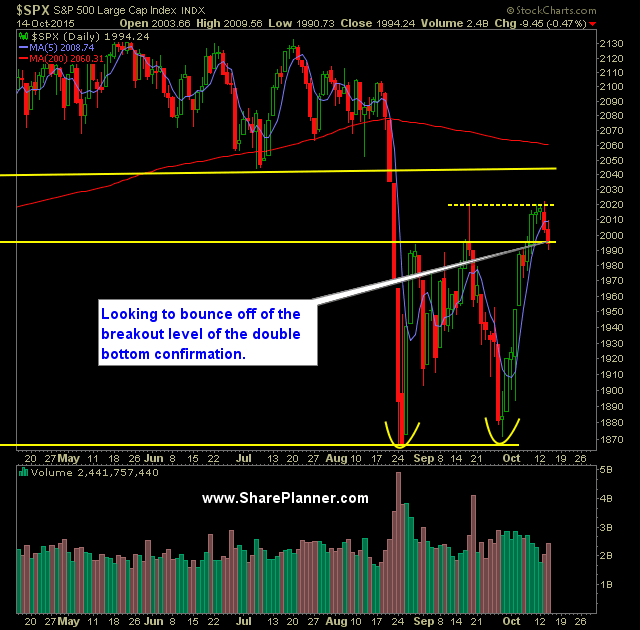

- S&P 500 managed to breakout above Tuesday's intraday highs, and more importantly managed to close above 2020 again after a two-day pullback that threatened to rollover the market.

- Volume rose for the third straight day and almost was at recent average levels.

- SPX now poised to challenge the 200-day moving average in the coming weeks which is right at the year's breakeven level of 2059.

- In the meantime, expect for there to be some resistance in the 2040's.

- Second straight day where SPX tested the 10-day moving average - this time it rallied hard off of the MA.

- 5-day moving average was reclaimed yesterday.

- VIX dropped 11% yesterday to finish the day at 16.05. I still maintain that the current rally in equities continues until VIX goes sub-12 again.

- T2108 rallied a hard 14.6% yesterday to close the day at 66%

- Inverse head and shoulders pattern formed and confirmed over the last two trading sessions. The parabolic rise in afternoon trading yesterday with no pullback of any kind leads me to think that the bears were being forced into a short squeeze rally.

- Weekly Chart of SPX suggests that it needs to close over 2020 this week to clear resistance at that price level.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

My Trades:

- Added one new long position yesterday.

- Did not close out any long positions yesterday.

- 60% Long / 40% Cash

- Remain long: (O:SBUX) at $58.67, (N:DIS) at $105.88, (O:GOOGL) at $676.40, (O:FB) at $95.09, (N:MA) at $95.51

- My focus in trading remains to trade to the long side.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.