Today's Trading Plan: Six Days and Counting

Ryan Mallory | Apr 23, 2014 09:45AM ET

Pre-market update:

- Asian markets traded 0.4% higher.

- European markets are trading 0.3% lower.

- US futures are trading 0.1% lower ahead of the market open.

Economic reports due out (all times are eastern): MBA Purchase Applications (7), PMI Manufacturing Index Flash (9:45), New Home Sales (10), EIA Petroleum Status Report (10)

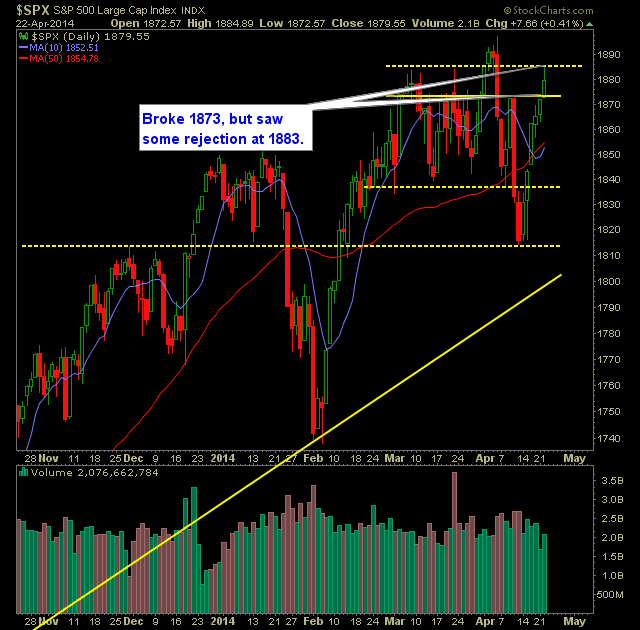

Technical Outlook (SPX):

- SPX extended its longest winning streak of the year to six straight days.

- Key resistance at 1873 was broken yesterday which bodes well for the bulls going forward.

- Resistance at 1883 came in and created some selling in to the close that erased about 40% of its gains at the close.

- The probability of a relief point or possibly a pullback dramatically increases. Rallies that extend beyond six days becomes very difficult to sustain without one.

- Volume on SPY continues to be lacking.

- Continue to watch whether the bulls give up 1873 on any kind of pullback in the coming days.

- After forming a lower-low two weeks ago, SPX has now formed a higher high by breaking above 1873.

- Despite this, SPX remains range-bound over the last two weeks.

- VIX all the way down to 13.19.

- Inverse head and shoulders that was possibly being developed has been compromised on the SPX 30 minute charte.

- The Market doesn't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Did not add any positions yesterday.

- Did not close out any positions yesterday.

- Will look to add 1-2 new positions today.

- Remain long JOY at 61.31.

- Remain short HPQ at 31.99, BAC at 16.08.

- Long 10% / Short 20% / 70% Cash

Chart for SPX:

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.