Tobacco Stocks Too Expensive To Provide Safety

Wall Street Daily | Jul 13, 2015 01:23AM ET

So much for the summer doldrums…

The Chinese stock market has crashed. Greece’s ongoing crisis has once again roiled European markets. Puerto Rico is on the verge of default. And Ben Affleck and Jennifer Garner are getting divorced.

Naturally, investors are seeking safety, and the Pavlovian response to market volatility is to buy “defensive” stocks.

Owing to their relatively high dividend yields and non-cyclical businesses, tobacco stocks do fit the bill. Over time, investors have been conditioned to expect a relatively high degree of protection in tobacco industry stocks.

For my purposes, I’ll reference the S&P 500 Tobacco Composite, a market capitalization-weighted index of the following large-cap tobacco stocks: Altria Group (NYSE:MO), Philip Morris International (NYSE:PM), and Reynolds American (NYSE:RAI). Lorillard, Inc. (NYSE:LO) was also included prior to June 2015, when the company was acquired by Reynolds American.

Let’s take a look at the performance of the Tobacco Composite during sizable broader market declines in recent history. As a result of the credit crisis, the S&P 500 experienced a traumatic peak-to-trough decline of 57.7%. Yet, from its high in 2007 to its low in 2009, the Tobacco Composite only fell 39.9%. In other words, cigarette makers had a 31% smaller drawdown.

In 2011, the S&P 500 suffered a drawdown of 21.6%. The Tobacco Composite only declined 12.4%, representing a 42.6% smaller drawdown.

Comparatively, the “sin stocks” held up rather well during both of these episodes. However, here’s the catch… they’ve now become very expensive.

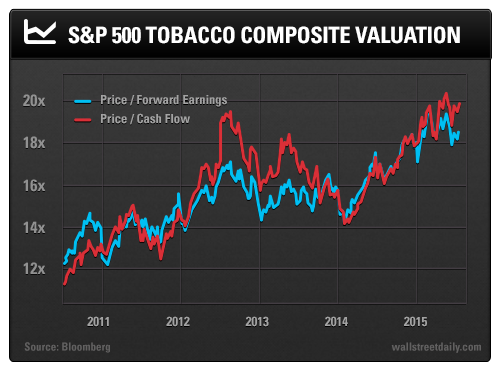

As you can see from the chart above, both the price-to-cash flow and price-to-forward earnings ratios for the Tobacco Composite have risen to lofty levels in 2015. Given the low-growth nature of this industry, the valuations for these cigarette makers call into question their risk-reward proposition. Furthermore, don’t expect e-cigarettes to be a savior, as they’re likely to cannibalize traditional cigarette sales.

Basically, Altria, Philip Morris, and Reynolds American offer more downside than upside potential.

These cancer stick makers may still be defensive in that they’re likely to outperform during a vicious market drawdown. However, there’s a difference between defense and safety.

Far too many investors are looking for safety in low-beta equities, and, in the process, are pushing valuation ratios to historic levels. Because of these high valuations, I wouldn’t expect these names to provide nearly the same degree of security during the next big broader market decline.

Slowly but surely, virtually every corner of the U.S. stock market is becoming expensive, and that’s very concerning. There’s nowhere to hide!

If you’re looking for safety, consider a bond fund run by a top-notch manager. After all, even cheap, low-beta equities aren’t a substitute for well-selected fixed-income securities.

Safe (and high-yield) investing,

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.