Time To Short 10-Year T-Bills?

Blackwell Global | Jul 21, 2015 04:45AM ET

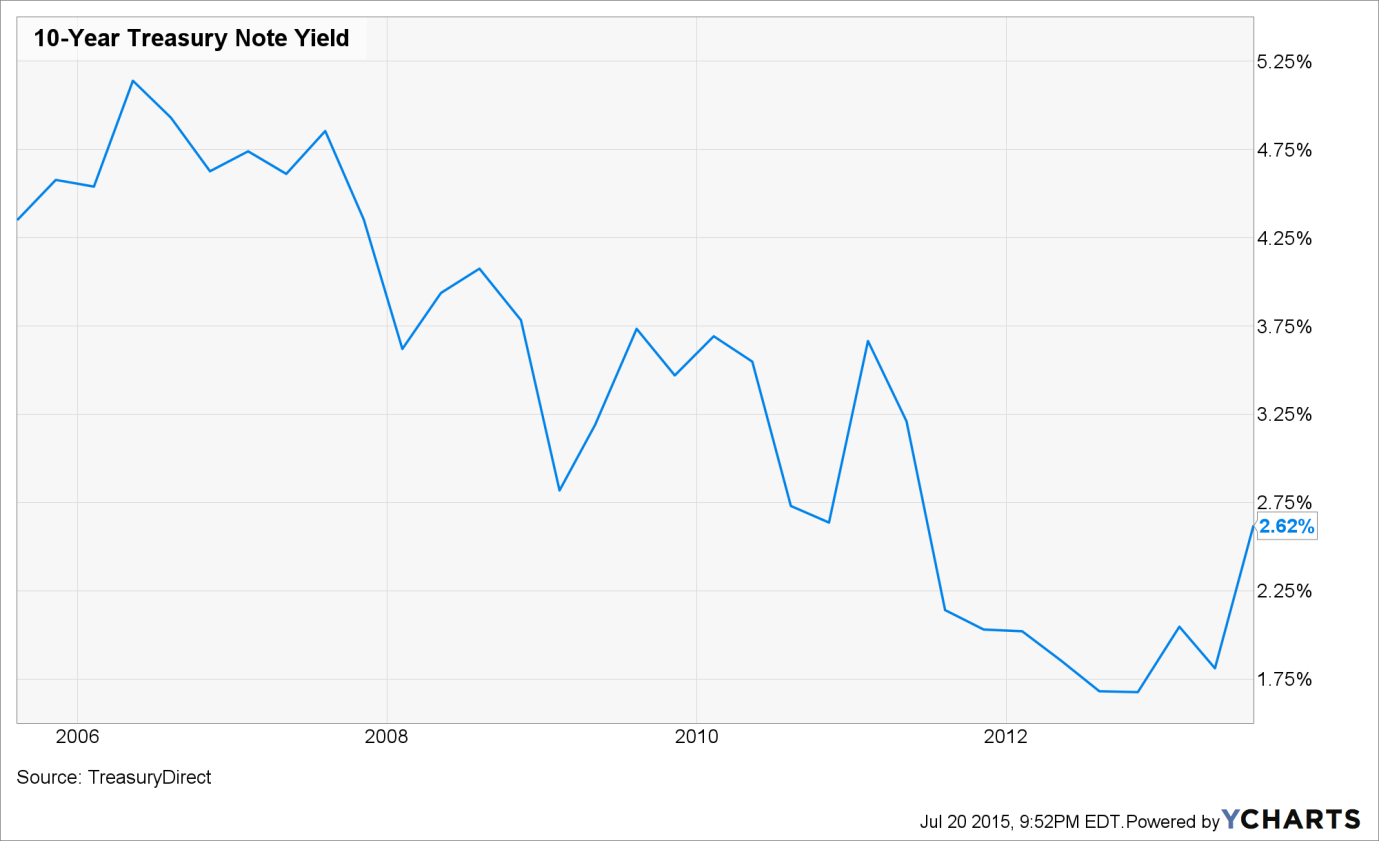

There is seemingly a widening gulf in macro and monetary policy between the US and Germany. This is evident in the yield differential—currently 153bps—between the 10-Year Treasury and 10-Year Bunds. However, forward forecasting is showing yield increases to 190bps as the US looks to tighten their monetary policy during the later part of this year. Subsequently, the question remains, to what extent has the market priced in these potential changes.

Taking a near-term view, there's a widening gap between the US and Germany on a raft of monetary and policy changes. Primarily, changing monetary policy conditions and differences in medium term inflationary forecasts are the key determinants of the current yield structure. Considering that statements by the US Federal Reserve have pointed to their desire to tighten their monetary policy through rate increases, the chance of the yield differentials has increased.

Subsequently, US markets have responded by attempting to price in a Fed Funds rate rise by the end of the year. However, the market has taken a more dovish tone on the chance of further tightening in 2016 and this is where a surprise could occur. This is especially salient considering that the Goldman Sachs US Current Activity Indicator stands at 2.6% in June and a raft of economic data is forecast to strengthen significantly throughout 2015. Consequently, this is likely to impact the bond yield curve directly through the term premium.

In contrast, most notable European economists forecast the ECB monetary policy will remain unchanged until at least 2017 despite their ever-expanding balance sheet. The reality is that Europe is undertaking some structural changes within their economy that will take some time to flow through and impact growth. Subsequently, you can expect the EONIA curve to remain anchored near the official deposit rate. It should also be noted that as the ECB continues their QE program that this is likely to have a marked impact upon the term premia.

Although, European growth will pick up throughout 2017-2018, the divergence is likely to continue in the long term with the US Fed Funds rate forecast to rise to around the 3.38% level by the end of that period. In contrast, forward modelling shows the ECB’s MRO rate at around 0.75% during the same period, a significant divide of 2.6%. Subsequently, the widening yield differential is likely to continue in the long-term and isn’t simply a short-run response to economic conditions.

In short, be prepared to position your holdings for a wider long-dated US-German bond yield differential…because it’s not going away anytime soon.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.