Be Patient, Pullbacks Are Normal; Market Setting Up For Year-End Rally

Jani Ziedins | Sep 26, 2018 12:30AM ET

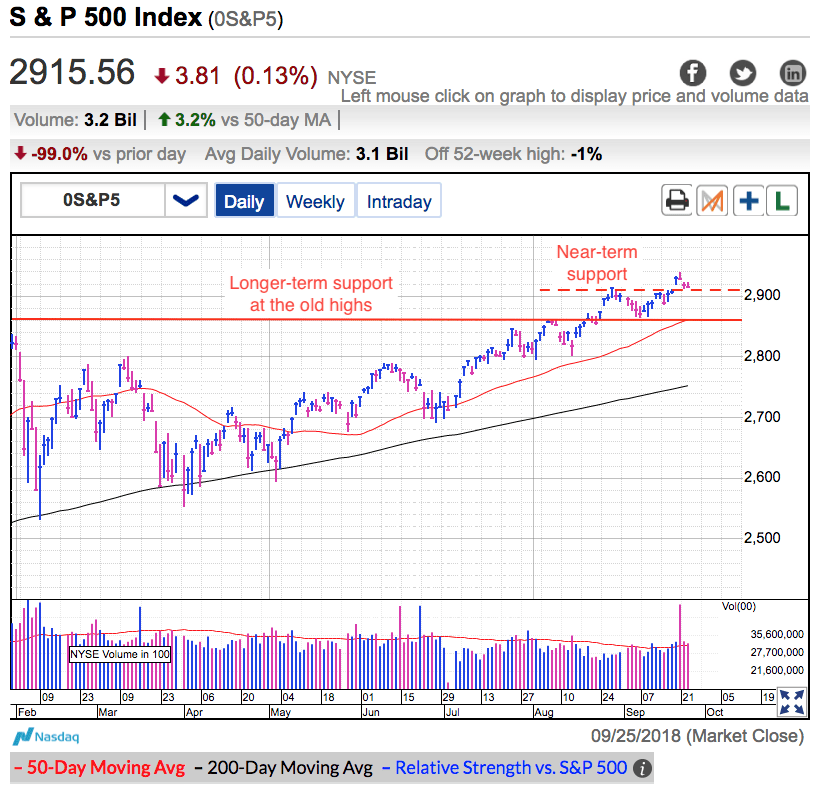

The S&P 500 traded sideways for a second day as it consolidates last week’s breakout to all-time highs. Trump and his trade war continue dominating economic headlines, but so far our stock market doesn’t mind. As usual, confident owners refuse to sell and that is keeping a floor under prices. But stubbornly tight supply is only half of the story. To keep going higher, we need demand and right now that is in short supply.

This market’s restrained breakout isn’t a surprise to readers of this site. Two weeks ago I wrote the following after prices finally reclaimed 2.900 support:

“Since we are not refreshing through a bigger dip, that means we should expect a prolonged sideways period. When the market doesn’t scare us out, it bores us out. Things still look great for a year-end rally, but we need to be patient and let those profits come to us. This is a slow-money trade and we will have to wait a while before the next fast-money trade comes our way.”

This market most definitely doesn’t want to go down. All summer it refused countless opportunities to tumble on bearish headlines. As I’ve been saying for a while, a market that refuses to go down will eventually go up. And that is precisely what happened here. But at the same time, there is enough headline uncertainty to keep those with cash from chasing prices higher. Their lack of buying is keeping a lid on this market. No doubt we will keep going higher over the medium- and longer-term, but it will take time for those with cash to warm up to these record high prices.

There is nothing to do with our favorite long-term positions except keep holding them and letting the profits come to us. This is a slow-money market and it rewards patience. As for our short-term money, there isn’t a lot to do here. Either we sit in cash and wait for the next trading opportunity (we cannot buy the next dip if we don’t have cash!), or we stretch our time horizon a little and enjoy this ride higher. But if you are buying, be prepared to ride through a few dips along the way. Remember, this is a strong market and we buy the dips, we don’t sell them.

This market is still setting up nicely for a year-end rally and we should keep doing what has been working. Don’t let the bears convince you otherwise.

Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) continue consolidating following last month’s impressive, but ultimately unsustainable climb higher. Pullbacks and consolidations are a very normal and healthy part of every move higher. These stocks are acting well and I would be far more worried about them if they didn’t pause to catch their breath.

Facebook (NASDAQ:FB) and Netflix (NASDAQ:NFLX) are basing following last month’s disappointing earnings. But this is a good thing. Traders that missed these highfliers had been praying for a pullback so they could jump aboard. Unfortunately, many of these same people are now too afraid to take advantage of these discounts. The thing to remember is risk is a function of height. These are some of the least risky places to be buying these stocks in six months. Without a doubt, this is a better time to be buying than a few months ago when the crowd thought everything was great.

Bitcoin continues holding $6k support, but I wish I could say that was a good thing. While we held $6k support firmly for nearly six months, every bounce has been getting lower.

First, we bounced to $17k. Then it was $12k. $10k came next. After that $8.5k. Earlier this month it was $7.5k and this weekend we stalled $6.8k.

At this point, it is only a matter of time before we tumble under $6k support. As long as owners are more inclined to sell the bounces than buying them, prices will keep getting lower. It is only a matter of time before owners are kicking themselves for not selling when prices were above $6k.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.