Three “Tweaks” To Fortify Your ETF Portfolio

Pacific Park Financial Inc. | May 14, 2013 12:00PM ET

Extraordinary rallies off bear market bottoms are typical. Bullish run-ups in March of 2003 as well as March of 2009 registered enviable unrealized gains of 35% and 65% respectively; each advance experienced little resistance for roughly 9-10 months.

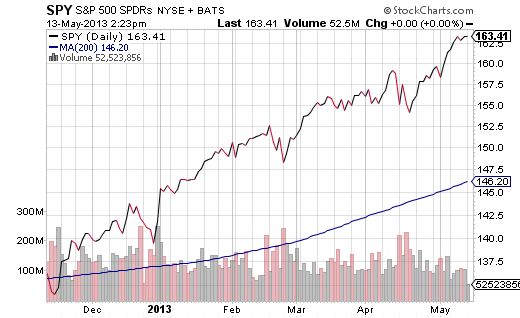

Powerful moves off minor corrections are less typical, if not downright suspicious. Investors in the S&P 500 SPDR Trust (SPY) since mod-November have witnessed a soothing 22% ride to all-time highs in just seven months. In the last quarter century, you could probably count the number of times on your hand when U.S. stocks traveled a similar vertical trajectory for more than a half year without a significant hitch or pullback.

Regardless of the reasonable nature of current valuations, there are plenty of reasons to doubt the slope of the movement. For example, equities have out-shined comparable bonds by nearly 7% over the last four weeks -- a feat that is particularly flashy for the prior two years. Similarly, several high yield bond (a.k.a. “junk”) indexes show a modest 2.6% in additional yield over comparable treasury bond funds; the spread is more reasonable when it is greater than 3% (300 basis points).

It follows that sensible ETF enthusiasts might consider “tweaking” their holdings. Here are three moves that would lower portfolio risk, yet maintain a desirable level of reward for that risk:

1. Lower the Average Maturity of Your High Yield Bond ETF

Both iShares High Yield Corporate (HYG) as well as SPDR High Yield Bond (JNK) have been terrific in the modern era of quantitative easing; both of these vehicles hold corporate bonds with average maturities in the sweet spot of the Federal Reserve’s bond-buying program (i.e., seven years).

On the other hand, the Fed is beginning to hedge its public statements such that… perhaps the central bank will begin to taper the money printing and subsequent bond purchasing. While I don’t believe that this will actually be the case in 2013, it is certainly possible. And if the Fed does begin to taper, one should expect intermediate- and longer-term treasury yields to rise, pressuring comparable high yield corporate bonds.

The answer? Reduce HYG and JNK exposure, downshifting into PIMCO 0-5 Year High Yield (HYS) or SPDR Barclays Short-Term High Yield (SJNK). The annual dividend yields that are paid out monthly are only slightly less than the big brothers, but one would have less concern with respect to significant capital depreciation.

2. Shift Away from an All-Market-Cap Weighted Portfolio

If you have invested in the ever-popular SPDR S&P 400 Mid Cap (MDY), you may have a great deal to crow about over the last 12 months. Owners of MDY have 27% unrealized profits on a year-over-year basis.

However, as the bull market rally has strengthened, a number of savvy individuals have started to shift their attention to funds that track different types of indexes. For instance, WisdomTree Mid Cap Dividend Fund (DON) tracks a fundamentally weighted index that measures the performance of mid-caps of the U.S. dividend paying equities. Dividend stocks tend to hold up better in down markets as well as sideways markets due to the fact that fewer people sell their income producers. What’s more, the relative strength of DON over MDY has increased in recent weeks.

3. Disregard Sector Rotation Hype by Adding to Your Defensive Equity ETFs

It’s as though some analysts are getting cocky about the state of market affairs. While noting that defensive non-cyclical stock sectors (e.g., consumer staples, health care, telecom, etc.) have been the wait for a pullback to the 50-day trendline.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.