How To Profit From The Upcoming Market Crash

Phoenix Capital Research | Jun 06, 2016 09:01AM ET

We are now in the worst seasonal period for stocks.

The old adage “sell in May and go away” does have some merit. According to the Ned Davis (NDR) database, had you invested $10,000 in the S&P 500 every May 1st starting in 1950 and sold October 31 of the same year, your initial position would only be worth $10,026 as of 2008.

Put another way, by investing only from May through October, a $10,000 stake invested in 1950 would have only made $26 in 57 years.

In contrast, $10,000 invested in the S&P 500 on November 1st and sold April 30th over the same time period would have grown to $372,890. Out of 58 years, you would have had 45 positive and only 13 negative.

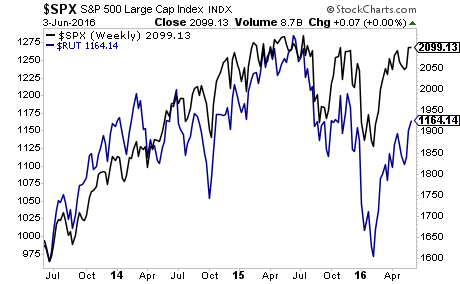

Now consider that stocks failed to produce new highs during this recent rally. Despite being manipulated higher by someone determined to get stocks to 2,100, we’ve slammed into resistance.

Moreover, the Russell 2000, which usually leads the S&P 500, is lagging far behind: not a good sign if this rally is meant to be the start of something more.

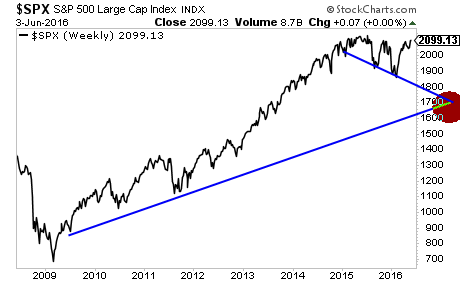

Looking at the long-term S&P 500 chart, we could easily see the market plunge to 1,600: its long-term bull market trendline.

More and more, this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 crash back in late 2007.

We did, and we’re currently preparing for a similar situation today.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.