Three Reasons For Extremely Low Swap Spreads

Sober Look | Nov 07, 2012 01:29AM ET

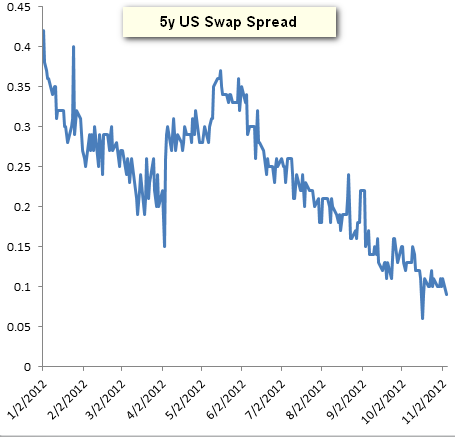

US swap spreads continue to decline, as the 5-year spread hovers below 10bp. A rate swaps is basically a stream of floating (3m LIBOR) vs. fixed payments. The level at which fixed payments are set (the swap rate) is therefore the market's projection of future LIBOR. This decline in spread is the market's expectation that future LIBOR to treasury spreads will be lower. Three factors are contributing to this decline:

1. With the ECB backstop to the eurozone sovereigns in place, the perceived risks to global banks have subsided. Improved health of the global financial system means lower cost of funding for banks, which should (loosely) translate into lower LIBOR to treasury (TED) spread in the future - thus lower swap spread.

2. As LIBOR converges to CD rates (see discussion), which have generally been lower, the market is pricing in lower overall LIBOR levels in the future (reducing swap spreads).

3. The Fed has been taking duration out of the market, first via Twist (see discussion on how Twist reduced duration) and now also with MBS purchases (see discussion). With mortgage refinancing accelerating, MBS durations decline. When fixed income investors hedge against rate risk, they usually want to pay fixed and receive floating on a rate swap. But as the need to hedge fixed income portfolios declines (because portfolios have lower durations) so does the demand to pay fixed - which reduces swap rates and spreads.

If anything, investors now want to receive fixed on rate swaps to synthetically increase their portfolio durations. An example of that may be a life insurance company that has long-term liabilities (death benefits) and needs long-term assets to avoid a duration mismatch.

Note that the bump in swap spreads during the May-June period was all driven by the eurozone, as LIBOR to Treasurys spread widened and so did swap spreads. A change to any of the three factors above (like the May-June period) could reverse this trend. For now however the ECB, the Fed, and new LIBOR regulation should keep swaps spreads low.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.