Dovish FOMC Could Retest GBP/USD 2015 Highs

Littlefish FX | Jul 29, 2015 08:12AM ET

The Fed will announce the decision of its July FOMC meeting this evening accompanied by a statement on the decision, though no scheduled press conference from Fed Chair Yellen. With trading volumes reduced into the summer months, the details of today’s statement will likely set the tone for USD trading between now and the September meeting and as such, will be keenly scrutinized by trades.

Given the comments we had from Fed Chair Yellen recently in her semi-annual testimonies regarding the Fed’s commitment and desire to raise rates sooner rather than later, market participants have been cautiously optimistic going into this meeting that the accompanying statement will provide further hawkish support from the Fed.

So what further hawkish support might we get from this statement? It is possible that the Fed could give a further indication as to the proximity of a rate increase similar to the comments we had recently from BOE Governor Mark Carney regarding a UK rate hike, and indication without being too specific. Currently, implied probability shows only a 17% chance of a rate increase at the September meeting, and only a 34% chance of a hike at the October meeting, so clearly any indication of a lift-off date looking near would be welcomed by USD bulls.

However, going into this meeting, it feels as though the risks are skewed more to the downside. The Fed have reiterated their commitment to raising rates, but also to their data dependent stance on a lift-off. Looking at the recent data, we have had some improvements, CPI came in with a small beat, NFPs have rebounded to register a big win, unemployment rate declined, and housing data has looked stronger, besides the big miss we saw in New Home Sales. ISM Non-Manufacturing missed, as did Retail Sales, and just yesterday, we saw a big miss in Consumer Confidence. In comments made during her testimonies, Yellen cited increased consumer confidence as supportive of a rate-increase, so I wonder how recent consumer data will affect the statement we get today.

Similarly, in the last statement, the Fed noted that the downward pressure on inflation due to energy price volatility was likely transitory and that “energy risks appear to have stabilized;” however, since that statement, we have seen further declines in energy prices, surely dampening the Fed’s view that these negative impacts will be soon to clear? Again, the same story with commodity prices and the negative impact of non-energy imports; with commodity prices having also deteriorated further, it will be interesting to see how the Fed views current conditions and whether they allow the Fed to be “reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

GBP/USD has been fairly pressured pressured in the last month and could see some sharp upside relief if dollar bulls are disappointed. The pair is likely to be supported, given the BOE’s increased hawkishness surrounding rate hikes, with market participants expecting further support from next week’s meeting, following yesterday’s positive GDP release.

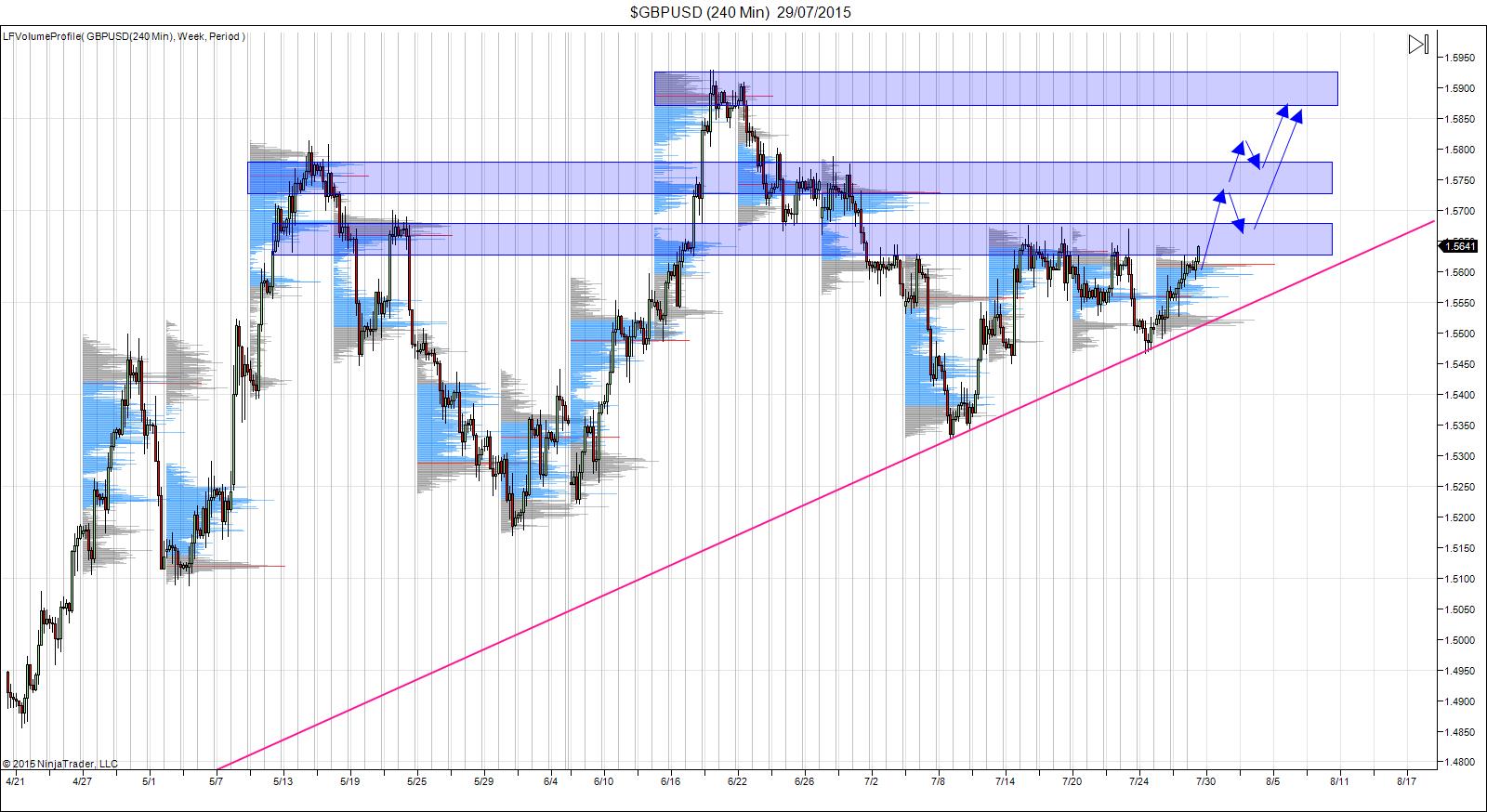

A dovish FOMC would open up a retest of the 2015 highs in GBP/USD. Having held the ascending trend line from the yearly low, GBP currently is challenging initial resistance. Following this evening’s statement release, I will be looking for any pull back into the overhead resistance areas for entering longs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.