Fear Is Back: China And US Fed Dilemmas

IG | Aug 19, 2015 01:43AM ET

The fear is back

Market fear is growing. Uncertainty is creeping into markets, as well as the economies on both sides of the Pacific, with China driving the fear from west side, the US from the east side.

The disconnect in trading across asset classes is also growing; bond markets, currency markets, and equities markets are clearly not aligned in their belief of futures market movements and events.

And that alone is a risk event waiting to happen, as they will align when one is proven right – and this will happen sharpish!

The China dilemma

- The market’s assessment of Chinese growth is dwindling; expectations of a GDP print of ‘around 7%’ are being downgraded consistently.

- Housing data shows year-on-year prices are falling 3.4% and the divergence between top-tier and low-tier cities is widening.

- The wealth effect is also starting to see signs of slowing, and not because of the June-July equity collapse, but because auto-sales, housing demand and industrial production outputs are seeing sustained slowdowns. This will keep the PBoC on its toes. It has a plethora of leavers to pull, but will it catch the slowdown in time, and will it actually filter into the real economy?

- Trade balance and exports in the past six months have been taking a sustained hit, with Europe and Japan seeing consistent double digit declines, while exports to the US have been jumping in and out of double digit declines over the same period. The moves highlight why China is furiously moving from an export nation to a consumption nation. However, transitioning a nation of China’s size will create volatility and economy fractures.

The short-term effects of all this are coming to a head at once. Copper made a new six-year low and is likely to cross below US $5000 a tonne in the next few days – this would mean high-end producers will be treading water, and even making a loss for every tonne they pull out.

Nickel, aluminium and zinc are welded in bear markets, and with the China demand story under pressure, they will remain so in the foreseeable near-future.

The US Fed dilemma

- The China story does feed into Fed musings, as the yuan devaluation creates a massive headache for USD earners and the export of US goods.

- We are exactly a month (for those in Asia) until we find out if ‘lift-off’ begins in September. The markets conviction for a September move is almost perfectly hedged.

- The interbank price for a September lift-off sits at 43% chance (it was 54% previous to the yuan devaluation).

- EUR/USD, the most traded currency pair on the planet, is trading in one of the tightest ranges seen in years. The weekly price is ranging between $1.09 and $1.11 and the RSI is holding at around 50 – USD/JPY is trading the same pattern. Currency markets are not normally this neutral, and this highlights the risk of what could happen on the morning of 19 September.

- The bond market does see risk and is the market pricing with the highest chance of lift-off. Swaps between corporate and sovereign bonds are widening by the day and hit 2008 levels this week. Risk is also being seen in the front-end of the yield curve of the sovereign bonds market with yields increasing – clear fear trading.

- US equities, however, are grind higher (or more sideway). The S&P has tested the 200-moving average five times in the past months, and defended that level each time. The VIX remains at a complacency level of 13. This positioning in itself is a risk, earnings season in the US was benign, and the impact of a rising USD from a bottom-up perspective is now being seen in earnings actuals. Equity complacency is something that reverses very quickly.

In conclusion, commodities are being dumped, currencies are directionless, bond spreads are widening, yet equities are still seeing upside.

This is the same disconnect seen in 2008 and in 2011 during the GFC and the Euro Crisis. The difference is that the Fed is holding the keys to future movements – if the risks are too great to raise rates, it may hold off.

How the market reacts to either option (lift-off or holding on to the status quo) is undefinable and the markets are demonstrating this. Therefore, one market that will likely see upside on either outcome is the VIX, as fear spills into trading.

Ahead of the Australian open

The ASX is well and truly caught up in macro-fear currently. Since the April high of 5999, the ASX has lost 11.6%, with the banks being the biggest contributor to this decline – all have lost more than 15% in that time. The fact that more regulation and capital is expected to be announced in FY16, coupled with fears of being ex-growth and leveraged to a market that is also likely to be ex-growth in Australian housing, it’s hard to make a case for the ASX to recover 65%, or even 50% by year-end.

I find it interesting that the last two weeks of trade have not seen the XVI (the Australian VIX index) back at the July highs. If the sustained selling continues, it should pass the July high as put protection ramps up.

So far, earnings season has been better-than-estimated. However, with the likes of Woodside (ASX:WPL), BHP (NYSE:BHP) and South32 (ASX:S32) yet to report, earnings season may still disappoint.

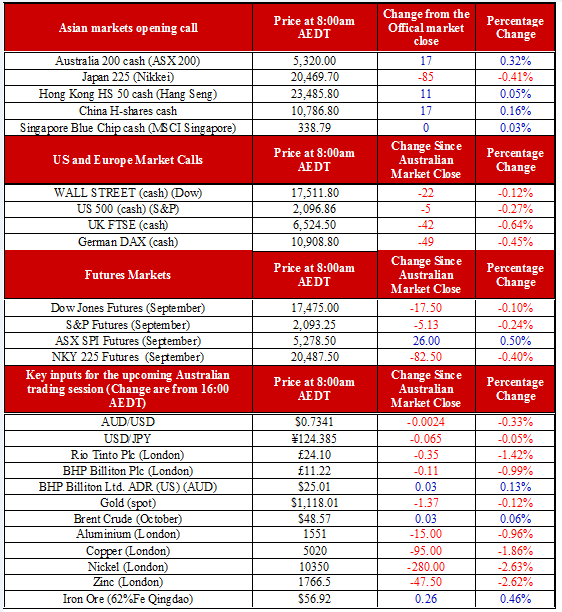

We are calling the ASX up 17 points to 5320, which would mean bucking overnight leads. The ASX is oversold, however, the macro back drop and the commodities markets are currently making it hard to be positive.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.