This 12.8% Yield Is Too Good To Be True (But This 13% Payout Isn’t!)

Contrarian Outlook | Jun 12, 2019 06:58AM ET

Most dividend investors understandably love the idea of 10%+ yields. It sure makes retirement easy!

Earn $50,000 per year in dividends alone on a $500K portfolio, or $100,000 annually on a million? Spend your lavish payouts without ever tapping principal? What’s not to like!

Plus, the recent stock market pullback has benefited investors like us because we can snag more dividends for our dollar. Yields are higher overall, and that’s a good thing.

But this strategy is a bit more complicated than simply finding 10% yields and buying them. We must smartly select the stocks that are going to pay our 10%+ dividends securely without tapping their own share prices to pay us. Here’s how.

Avoid the 89% of “Loser” Double-Digit Payers

As I write to you there are 53 stocks (trading on major US exchanges with market caps above $500 million) that yield 10% or more. A Father’s Day basket of these dividends is going to be a mixed bag, however. While some of these stocks will shower you with quarterly (or even monthly) payouts with price appreciation to boot, others will lose some or all of your cash in price depreciation.

Of our 53 candidates, 47 have not delivered 50% total returns over the past five years. And this is the minimum we ask of a 10% payer–dish us our dividend and don’t lose our initial capital!

Granted this “back of the envelope” study is a bit harsh. We’re missing a few elite 10% payers that “graduated” to lower yields thanks to good stock performances (stock price up, yield down for new cash). Still, the important lesson here is that 10% payout success is challenging. Though not impossible, as we’ll see shortly.

Of these 53 high paying underperformers we have 32 “biggest losers.” These stocks have actually lost their investors’ money over the past five years. In other words, they have delivered their big dividends yet lost as much (or more) in price. Not good!

And remember, the S&P 500 returned 61% over the time period. So, while we can expect our steadier strategy may underperform during roaring bull markets, we would expect a business to at least beat your comfortable but no-yielding mattress as a total return vehicle.

Exceptions? Of course–here’s one.

A Safe $6 Stock That Yields 13%

New York Mortgage Trust (NASDAQ:NYMT) is a low-priced stock with a big dividend. (It pays a $0.20 quarterly dividend on its $6 share price.) For many income investors, this would be enough analysis to justify a purchase!

As we saw earlier, this level of “basic dividend thinking” would get you in trouble 89% of the time. But NYMT is the rare 13% payer that backs up its dividend with actual profits.

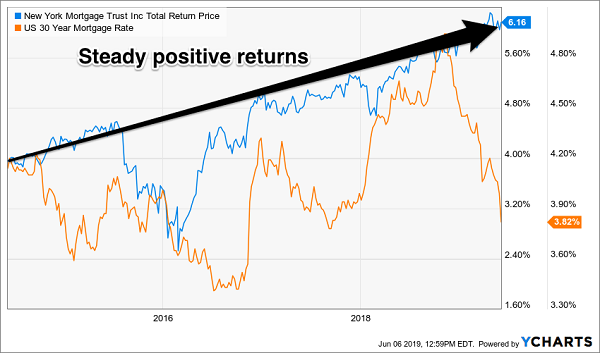

The firm buys mortgage loans and other mortgage-related securities. Its best quality is its “well-hedged” earnings, which make money regardless of whether mortgage rates are going up or down. NYMT’s steady 56% total returns (entirely from dividends) over the last five years are impressive amidst the backdrop of the mortgage rate rollercoaster:

NYMT’s Steady Dividend-Powered Returns

Most mortgage-focused real estate investment trusts (mREITs) such as industry darling Annaly Capital (NYSE:NLY) say they are hedged, but they’re not. it wasn’t actually ready for falling rates :

Unlike NYMT, Annaly Was Not Ready for Lower Rates

This dividend cut was a bit ironic because “old school” Annaly (from the ‘00s) would have profited greatly from falling rates. Traditionally, the mREIT has held fixed-rate securities, which rise in price when rates fall. Alas, Annaly attempted to hedge itself against the rising rates and bet too heavily on that unfulfilled outcome.

While we’re trolling the 10%+ minefield, here are two more paper tigers to avoid.

2 More Stocks Yielding Up to 12.8% to Sell Now

Fellow mREIT ARMOUR Residential REIT (NYSE:ARR) is taking a rare multi-year break from cutting its dividend. The stock, in theory, pays 12.6% today. But its big yields never seem to last. Over the past five years, ARR has chopped its dividend in half and its stock price has followed:

Price Follows Dividend, for Better or Worse!

When we add back dividends paid, shareholders are nearly back to breakeven over the period. Their cumulative total “return” is minus 3%.

Lest you think mREITs are the only dogs, let’s pick on business development company (BDC) FS KKR Capital (NYSE:FSK). The firm extends loans to small companies. In return, Uncle Sam gives the firm (and all BDCs) a legal pass on its tax bill provided it pays most of its income out to shareholders.

Hence the big 12.8% headline yield on FSK.

Really, BDCs have a sweet setup. Problem is, their setup may be a little too sweet for the small niche they are all trying to serve. What’s to stop a small company from shopping around for their capital and getting a better deal elsewhere?

That’s the industry problem and one reason why very few BDCs deliver their dividends without “tapping” their investors’ pockets over the long haul. In some cases, they fund their payouts partly from the income they derive from their loans (which is good) and partly by selling investors’ assets (which of course is bad).

Unfortunately, FSK’s bad has handily outweighed its good in recent years. The company has lost more in price than it’s paid out in dividends, for a negative total return!

The Biggest BDC Loser: FSK

As I showed you above, smart REITs like NYMT are your “dividend lifeboats” when the markets get rough. That’s because their massive cash payouts give you more of your profits in cash, rather than the “buy and hope” here today, gone tomorrow paper gains.

And by focusing on REITs with steady cash flow, you can make sure your nest egg stays intact—and grows for the future.

The only problem with these stocks? They tend to only pay their dividends quarterly! I prefer my payouts every single month. Don’t you?

If you share my affinity for monthly dividends, then check out my best “monthly payer” buys.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.