This 10.6% Dividend Is the Best Way to Play the Tech Bounce

Contrarian Outlook | Jul 31, 2023 05:46AM ET

It’s no secret that stocks—especially tech stocks—have soared this year. And today I’m going to show you a contrarian dividend play I see as the perfect way to take advantage.

And before you ask, no, we’re not too late here, even though it may look like we are, in light of the NASDAQ’s 40% rise in half a year.

The key to unlocking tech-driven gains is not buying overbought darlings like Meta (META), Alphabet (NASDAQ:GOOGL), Apple (NASDAQ:AAPL) and Amazon.com (NASDAQ:AMZN). Instead we’re buying through a closed-end fund (CEF) yielding an outsized 10.6% and trading at a 15.7% discount to net asset value (NAV, or the value of its underlying portfolio).

That discount is key: in effect, it’s like buying these tech stocks at 15.8% off—when they were much cheaper than they are now. But I know what you’re likely thinking: isn’t that still too rich, given tech’s big gains this year? What if there’s a market correction?

Let’s address those worries now, then we’ll talk more about the CEF I want to show you today—and name another CEF that holds top tech names but should be avoided.

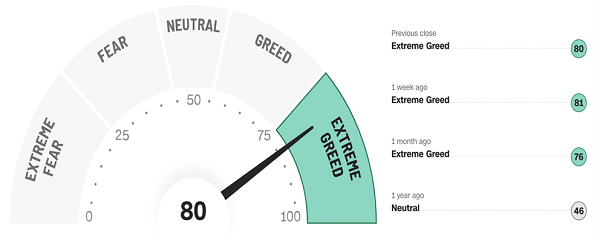

Truth is, bubble worries are for real. Take a look at the CNN Fear & Greed indicator, a decent marker of where the mainstream crowd’s heads are at. It’s been at Extreme Greed for months now.

Source: CNN.com

Add to that the one most reliable recession indicators there is—the inverted yield curve (meaning the yield on shorter-term Treasuries rises higher than the yield on longer-term ones). The curve has inverted before all recessions in modern American history.

It’s never had a false positive—and the yield curve, shown below through the relationship between the yield on the 10-year Treasury and the three-month Treasury, has been inverted for months.

Is This Indicator Right?

Either we live in unprecedented times, or the market is set for a pullback.

No one can tell the future, of course. But what I can tell you is there’s a strong chance we’re living in weird circumstances and this reliable indicator is wrong.

The Pandemic Effect

Since 2020, the world has been in a level of disarray we haven’t seen since the Industrial Revolution. Never before has all of humanity effectively agreed to shut down economic activity for an extended period. The effects of that are, of course, unpredictable.

No One Got This Right

In mid-2020, no one was worried about inflation because people still weren’t buying many goods and services due to fear of COVID. And when inflation started ticking up in 2021, inflation hawks warned it would get worse and last for years.

Last year it looked like they were right, so stocks plummeted. Inflation hawks, however, have since been proven wrong, as the chart above shows; now, at 2.97%, inflation is close to the 2% inflation target the Fed always eyes.

That also means the Fed’s rate hikes are unlikely to go much further. The latest one, which caused rates to reach their highest level in over 20 years, didn’t cause the market much worry, just like all the other hikes this year.

All of this suggests we’re in bubble territory, but we’re not, for three reasons:

- Stocks are still below their all-time highs.

- On a five-year compounded annual growth rate basis, stocks have gone up about 9.5%, which is actually less than their 10-year compounded annual growth rate (10%).

- The Federal Reserve no longer expects a recession.

The first two points make our current market by definition not a bubble. But the Fed no longer seeing a recession is a particularly critical shift.

First, this is important because the Fed did see one in 2021 and 2022, which was why they aggressively raised rates. With higher rates the Fed can, paradoxically, stop a recession faster than it can if rates are lower. The need to keep raising rates was clear—at least to the Fed, in a kind of “just in case” way.

There’s a lot to criticize Jerome Powell about, but whatever mistakes the Fed made, they’ve learned from. Now their economists, who saw a high probability of recession in the near term just a few months ago, see zero indication of a recession in the near term.

That means the Fed’s rate hikes will likely end soon, and expectations will be allowed to go up. And while this could end up in a bubble, it will likely take years to get to that level. We are closer to 1994 than 1999 here; if easy money and a tech bubble cause the next tech-stock crash, we likely have a long time before it comes to pass.

One Tech Fund to Play This Tech Bounce—and One to Avoid

So what do we do as investors? I would recommend an unconventional approach: buy a CEF called the BBlackRock Science and Technology Trust II (NYSE:BSTZ), and avoid the Columbia Seligman Premium Technology Growth Trust (STK). Both are having strong years, but they’re still underperforming tech as a whole, suggesting additional value here.

STK and BSTZ Climb—but Still Lag the Tech Sector

While both are big yielders, BSTZ’s 10.6% payout dwarfs STK’s 6.1% while also growing its dividend. STK, however, has a stagnant payout that hasn’t budged in years. (The spikes in the charts below represent one-time special payouts from each fund.)

BSTZ’s 10.6% Payout Grows; STK’s Goes Nowhere

Finally, both are tech funds that have seen renewed interest from income investors who love how they transform ownership in companies like NVIDIA (NASDAQ:NVDA) into a steady income stream. But the love hasn’t been equally distributed: STK now trades at a 6.7% premium while BSTZ’s 15.8% discount has stayed stubbornly large for months.

With BSTZ out-earning its dividend by double this year, and with the fund’s history of growing payouts, its safe dividend and big returns this year are a compelling package for income investors, so why aren’t they buying in?

Because demand for CEFs remains weak, despite their strong performance, as risk-averse income investors wait for confirmation that the Fed won’t keep raising rates. With the Fed no longer seeing a recession, they should now know the Fed likely won’t do that, and the end is very near. It may take a long time for them to figure it out, believe it and act on it.

But that’s okay: it just means we have time to beat them to the punch, buy BSTZ, collect its 10.6% income stream and resell it at a premium down the road.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.