These 3 Funds Are Headed For A Crash. Do You Own Them?

Contrarian Outlook | Feb 14, 2019 05:38AM ET

The 2019 rebound has done a lot to revive most people’s portfolios. But there’s a new trap you need to dodge as the market ticks up: the risk you’ll stumble into an overbought stock (or fund).

But don’t take that to mean stocks are pricey—far from it! The S&P 500 is barely up from the start of 2018 and still far from its all-time highs, which is ridiculous when you consider last year’s near-20% earnings growth.

So it’s pretty easy to see that stocks are still ripe for buying.

But there is one sector I am worried about—and it brings me to the first of 3 closed-end funds (CEFs) I want to warn you about today.

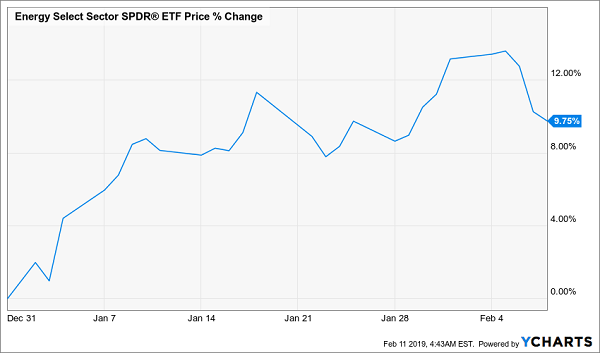

I’m talking about energy stocks, which have been on a tear so far this year, as you can see from the performance of the benchmark Energy Select Sector SPDR ETF (NYSE:XLE):

Energy Gets Ahead of Itself

Trouble is, that growth isn’t supported by earnings! In fact, profits in the sector have actually fallen nearly 6%, according to FactSet. And the CEF I’m going to tell you about now has actually run up even more than XLE, despite massively underperforming the market.

That would be the Tortoise Energy Independence Closed Fund (NYSE:NDP), which has soared a shocking 37% since the start of 2019. Investors holding this fund probably feel pretty smug about that gain, but they shouldn’t. While NDP’s market price is up big, its NAV (or the value of its underlying portfolio) is up just 7.1%, a fair amount behind XLE’s gain.

Snapshot of an Overbought Fund

The main reason for NDP’s meteoric rise is classic yield chasing: many are enticed by this fund’s astronomical 18.7% yield. But that is a mirage; not only has NDP cut its dividend massively throughout its history, but it is currently under-earning its dividend, which means yet another cut is coming soon.

The fund is also down on a total-return basis (so even when taking dividends into account!) since its inception, no thanks to the 2014 oil crash. But even before that, its returns were less than impressive:

A Perennial Money Loser

For this reason, NDP is my No. 1 must-sell CEF right now.

But it’s not the only one to run away from. The PIMCO Global StocksPLUS & Income Fund (NYSE:PGP) is a complex bond-and-derivatives fund whose market price has also run far ahead of its NAV, and not by a little, either! PGP has soared 24.5% in 2019, while its NAV is only up 4.5%:

PGP Steps Onto the Precipice

As a result, PGP’s premium to NAV is now an absurd 56%, which means it’s positioned for a crash anytime now.

If this sounds familiar, it should. I’ve written about PGP’s huge premium many times before, a short-term trade in June . Investors who followed that advice bagged a 39% annualized return in less than three months.

Now we’re at a crest in the wave, so if you have PGP in your portfolio, this is the time to ditch it.

One more fund we need to be wary of: the Virtus Global Dividend and Income Fund Inc (NYSE:ZTR), which did something unusual just over a year ago: it traded at a premium for the first time ever.

A Suddenly Costly Fund

Although that premium disappeared during the recent market crashes, ZTR investors don’t care. They’re buying at a 5.1% premium for no good reason, since ZTR both underperforms its peers and the Vanguard Total World Stock (NYSE:VT) over the long haul.

Trailing the Market

Since ZTR’s NAV is up a measly 4.2% in 2019, while its market price is up a shocking 18.6%, it is clearly overbought—which means it’s time to walk away.

Here’s a SAFE 8.5% Cash Dividend for 2019

I don’t know why anyone would play around with looming disasters like ZTR, PGP, and NDP when the CEF market continues to throw us bargain after bargain.

In fact, I’ve got 18 of the very best deals in the space waiting for you now! As a group, these 18 retirement lifesavers throw off an incredible 8.5% dividend!

So a $500,000 investment in the “average” fund in this elite “18 pack” would hand you $42,500 in dividend income this year alone.

These funds are the 18 buy recommendations in my CEF Insider service’s portfolio—and I’m ready to GIVE you instant access to all of them right now when you today, with no risk and no commitment whatsoever .

And remember, that 8.5% dividend is just an average. One of these blockbuster funds yields an amazing 10.7% Another? 11.7%!

That’s not all, either, because you also get …

My 5 “Best Buys” for 8% Dividends and 20%+ GAINS in 2019

When you start your trial , you also receive a FREE Special Report revealing my top 5 CEF buys for 2019. These CEFs truly are the best of the best: your go-to picks for reliable income and blockbuster upside: I’m forecasting 20%+ price gains in 2019 alone, thanks to the ridiculous discounts they’re trading at right now.

History is also on our side here, because these 5 powerful funds have a long record of market-beating returns, like pick No. 1, which has absolutely dominated since it came on the scene:

Imagine Holding This Triple-Digit Winner

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.