Thematic ETFs Are Finally Gaining Some Much-Needed Respect

David Fabian | Sep 27, 2017 12:38AM ET

Thematic funds have long been one of the more dubious areas of the ETF industry. In a broad sense, this genre is all about taking an investment concept with potentially long-term, cyclical implications and finding a group of stocks that fit the criteria. It’s more about investing in a story rather than identifying companies based on strict fundamentals or sector prowess.

Want to invest in the trend of weight loss, clean energy, or social media growth? There are now multiple funds to choose from in each category.

Thinking that you want your portfolio positioned according to your political, religious, or ethical beliefs? I can easily point you in the right direction with several options to choose from.

It’s been an industry-wide trend that most ETFs released along these lines are quickly relegated to near-obscurity. They are often launched with minimal backing, little daily trading volume, and the uncertainty that comes with holding just a handful of stocks in a narrow vertical. Most come with significantly higher fees than a broad-based index from the likes of Vanguard or Blackrock (NYSE:BLK) as well.

Nevertheless, with ETFs becoming more mainstream and investors adopting them in droves, the comfort level of thematic trends has increased in recent years. Primarily among funds that are experiencing top-tier growth in their performance metrics to drive substantial asset flows. Money chasing performance is perhaps the oldest principle of investment psychology.

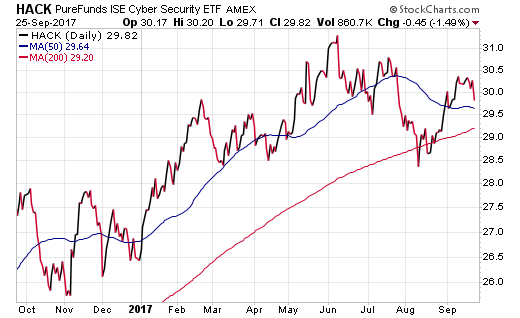

One of the original success stories of thematic funds can be attributed to the PureFunds ISE Cyber Security (NYSE:HACK), which grew from relative anonymity to over $1.1 billion in assets. This growth was attributable to multiple high-profile internet security lapses that allowed investors to visualize the development opportunity for companies within this industry.

More recently, the trend of artificial intelligence and technical automation has prompted tremendous inflows into the ROBO Global Robotics and Automation (NASDAQ:ROBO). The fund has grown by over a billion dollars in total assets through the first three quarters of 2017. It currently stands at over $1.3 billion under management and is showing no signs of slowing down.

ROBO has gained +34% on a year-to-date basis, but more importantly, its story resonates with what many investors believe to be a long-term opportunity. This vehicle allows transparent access to a group of stocks that would be difficult for many to identify and purchase on their own. Its 0.95% expense ratio, while high by ETF standards, has not been a meaningful deterrent overall.

Another top performer this year is the Global X Lithium (NYSE:LIT), which has added $460 million in fresh assets on the back of a +52% total return so far in 2017. LIT seeks to capitalize on the trend of battery technology and owns stocks such as Tesla Motors Inc (NASDAQ:TSLA) in its concentrated portfolio.

There are even actively managed opportunities in this space as well. The ARK Innovation (NYSE:ARKK) is one of the top-performing equity ETFs of 2017 with a gain of +69%. This fund owns a diverse array of stocks selected by the portfolio manager for qualities they believe will lead to long-term alpha and global innovation. TSLA is one of their largest holdings, in addition to Amazon.com Inc (NASDAQ:AMZN) and the Bitcoin Investment Trust (OTC:GBTC).

The Bottom Line

The broader adoption of thematic ETFs may be seen by some as evidence of a frothy market bereft of conventional growth plays. They certainly aren’t suitable for every type of investor. Nevertheless, a more optimistic viewpoint is that these funds are finally gaining acceptance and respect for their unique portfolio dynamics.

They will be likely used as smaller tactical holdings rather than larger core positions, which suits their risk profile and general style. Investors considering thematic ETFs would also be wise to understand that these funds will experience periods of outperformance and underperformance over various cycles.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.