2000 And 2017: There’s A Whole Lot Of 'Rhyming' Going On

Pacific Park Financial Inc. | Sep 14, 2017 12:05AM ET

This week, CNBC’s Kelly Evans interviewed one of the most well-respected billionaire hedge fund managers in history, Julian Robertson. The co-founder of Tiger Management discussed global central bank collusion to depress interest rates and the subsequent creation of a bubble. “A bubble in the stock market?” the journalist clarified. Robertson replied, “Yes, ma’am.”

Billionaires from the investing world do not sport perfect track records. Nevertheless, when the .0001% speak, investors should take notice.

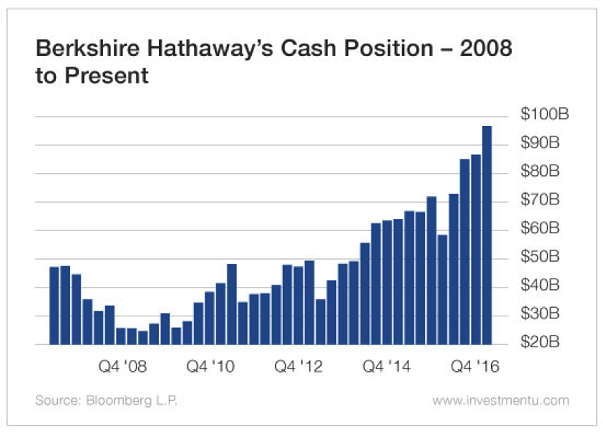

Within the past few months, the list of billionaire bull market dissenters has continued to grow. George Soros has been selling stocks throughout the summer in favor of gold. Jeffrey Gundlach suggested that investors begin “moving toward the exits.” Howard Marks warned that buying into concepts regardless of price (e.g., ‘FAANG,’ Canadian real estate, etc.) is the “…absolute hallmark of a bubble.” And while Warren Buffett (NYSE:BRKa) preaches the virtues of buy-n-hold, his active raising of cash aligns with his desire to sell higher when others are greedy.

Most rear-view mirror thinkers concur that the dot-com collapse of 2000 represented stock market insanity. In fact, after the NASDAQ 100 lost 80% of its value and the S&P 500 plummeted 50% from its peak, people acknowledged having suffered through the bursting of a stock market ‘bubble.’

Leading into the turn-of-the-century, however, few spoke about extreme valuations in terms of eventual disaster. On the contrary. The New Economy represented a supercharged shift in technology that ‘justified’ ridiculous prices for questionable profits and modest sales.

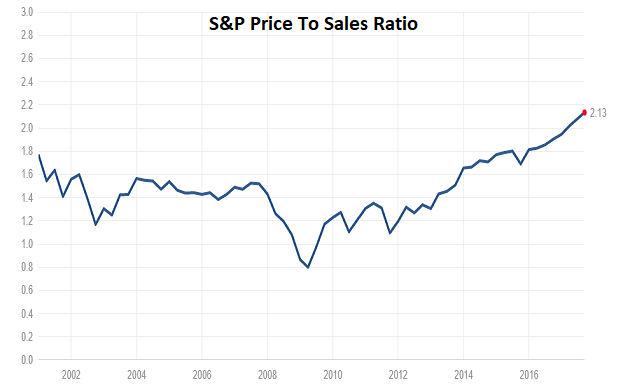

Here in September of 2017, the masses are once again disregarding the dozen or more traditional metrics of extraordinary overvaluation, justifying them on a simplistic ultra-low-rate criterion. Although most of those metrics (e.g., market cap-to GDP, earnings, book, Q ratio, etc.) may still place 2000 as the most overblown balloon in history, the fact that 2017 comes in second place should hardly serve as solace. Indeed, to the extent revenue matters, investors currently pay the highest S&P 500 price-to-sales ratio and highest median price-to-sales ratio in history.

Well, what about unabashed euphoria? Aren’t 2017 investors less bullish than they were back in 2000? On the surface, perhaps. However, cash allocations have rarely been lower (per the American Association of Individual Investors) and stock allocations have rarely been higher.

With respect to the latter, household allocation to equity as a percentage of financial assets hit a record of 64% during dot-com mania. At the end of March (2017) it was roughly 53%, though estimates place more recent data (Q2 June) at 55%.

Is the current stock market exposure as a percentage of financial assets as out of whack as it was back in 2000? No. And from a wildly bullish perspective, stocks might have plenty of room for growth. On the flip side, abnormally large percentages in the 21st century have already preceded two bear market maulings of 50%-plus. Why is it encouraging to see the development of a third blister, even if the inflammation can become more inflamed prior to infection?

“But Gary,” you protest. “In 2000, interest rates were so much higher.” Yes. Want to know what else was higher in 2000? Productivity, gross domestic product (GDP), the labor force participation rate as well as the home ownership rate. Want to know what was lower? Household debt, government debt and corporate debt.

In other words, the 2000 tech stock bubble and the 2017 all-asset bubble (stocks, bonds, real estate) have dissimilar origins, with today’s frothiness emanating from globally coordinated central bank monetary policy. Yet they both share excesses in total household equity exposure as well as sparsity in cash allocation.

Meanwhile, according to Gallup, investor optimism in 2017 has hit 2000 illogical extremes. Sixty-eight percent of folks now say that they are optimistic about the stock market’s performance during the next year. The 68% data point ties the record for the question (1/2000). Additionally, the full Wells Fargo/Gallup Investor and Retirement Optimism Index, which incorporates a variety of economic factors, hit its highest level (138) since September of 2000.

In truth, sentiment indicators often poll different segments of the population. For example, the American Association of Individual Investors (AAII) survey that polls retail investors weekly is not flashing warning signs on excessive enthusiasm. (Note: Their cash allocation levels are telling a different story.)

On the flip side, Investors Intelligence and the Association of Active Investment Managers (NAAIM) poll the professional ranks. Both have seen spreads between bullishness and bearishness exceed levels once associated with the year 2000. Not a whole lot of bears, you might say.

In aggregate, 2000 and 2017 share similarities in valuation extremes, an absence of pessimism, low cash levels and high household equity allocations. They also share business cycle lengths that many would describe as ‘long in the tooth.’ As the 3rd longest expansion in history, perhaps the current expansion is closer to completion than tax-cut infused acceleration.

Do I believe that stocks will collapse by the same amount in the exact same manner? No. Like a hurricane or an earthquake, bear market wealth destruction differs in magnitude, length and side effects. And much like a hurricane or earthquake, the question is not ‘if,’ but ‘when.’

History rarely repeats itself in precisely the same manner. Yet it rhymes. Oh how it rhymes!

It follows that counting on the Federal Reserve to limit your portfolio pain in the next bear may not be the most sensible approach.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.