The Week In The Eurozone: Less Rigor, But Reforms Must Be Accelerated

BNP Paribas | May 31, 2013 07:28AM ET

The European Commission published its “Country-specific recommendations”, one of the last steps before the conclusion of the European Semester. Heads of state will indeed adopt the Commission’s recommendations formulated this week at the June 27 summit in Brussels. The recommendations apply to all EU member states, except those benefiting from European assistance and macroeconomic adjustment programs (Greece, Ireland, Portugal and Cyprus), which are already monitored closely by the Troika. The recommendations are based on the Commission’s examination of the stability and convergence programmes (fiscal policies) and national reform programs (other economic policies) for each country.

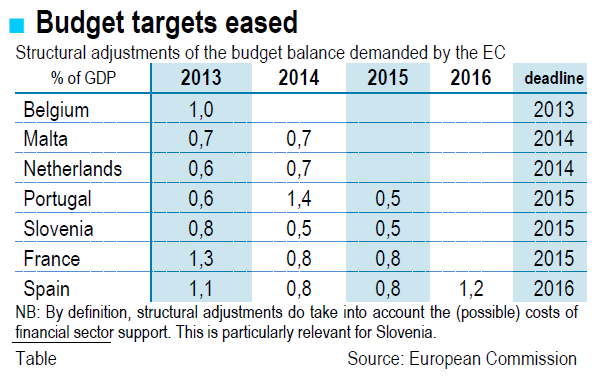

In recent weeks, several member states announced they would be given more time to bring their public deficits below 3% of GDP. The European Commission seized this occasion to further clarify its position, as well as the reasons and conditions for granting extensions. Member states were granted longer deadlines if they had actually made the structural efforts demanded by the Commission over the past three years, but sluggish economic activity had kept their deficits excessively high. As expected, Portugal and the Netherlands were given an extra year while France, Slovenia and Spain will benefit from a 2-year extension. In addition to extending deadlines, the Commission specified the size of fiscal efforts expected from each country in the years ahead. Depending on the year and country, fiscal efforts range from 0.5 to 1.4 points of GDP per year on a structural basis. At this pace, the consolidation efforts demanded by member states undergoing excessive deficit procedures are far from negligible: clearly fiscal policy will continue to have a significant impact on activity in the years ahead. Nonetheless, the Commission managed to avoid the vicious circle that had been forcing governments to increase consolidation efforts as part of emergency measures launched mid year. It is in this manner that the Commission’s shift in position will help ease budgetary constraints.

0n the whole, 12 of the 17 eurozone member states will still face excessive deficit procedures by the end of the European Semester. With Italy’s deficit trimmed to 3% of GDP in 2012 and estimated at 2.9% in 2013, the Commission agreed to recommend ending the country’s excessive deficit procedure. Even so, the risk of budget overruns this year increased recently after the new government decided to suspend payment of the first tranche of the primary residence tax. Belgium, in contrast, is clearly being singled out even though its deficit would have reached 3.1% of GDP without the cost of rescuing Dexia (0.8 percentage points of GDP): the EC has recommended that the Council launch a new phase of disciplinary procedures after observing that the Belgian authorities had not taken sufficient measures over the past three years. Nonetheless, it stopped short of requesting financial sanctions, even though it could have at this stage. The European Commission also seems to have given up on starting procedures against Slovenia given its excessive macroeconomic imbalances. It seemed to be preparing to do so in early April, and is still asking the country to urgently launch an independent valuation of its banking system.

Lastly, the European Commission insisted that the budgetary breathing room granted to certain member states must be used to accelerate structural reforms. From this perspective, France’s case is emblematic, and chairman Barroso clearly stated that the recommendations addressed to him on the subject were extremely restrictive. A series of very tight demands were made (pension reform before year-end 2013, reduced labour costs, notably employer charges, opening of regulated professions, notably jurists, and reform of the unemployment insurance system), which François Hollande hardly appreciated. He pointed out that although the Commission sets targets, the French government is sovereign when it comes to the means used.

France is faced with the same issue as countries under assistance: the best way to prepare public opinion and Parliament to accept a series of reforms, is to avoid giving the impression that they are being forced on the country from the outside. Granted, nothing in current European governance officially ties advancements in excessive deficit procedures to energy and labour market reforms. That said, the recommendations for France, as well as for all other countries, were all taken from the “catalogue of best practices” which all heads of state have supported when they sit in the European Council.

BY Frédérique CERISIER

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.