The Week Ahead: Will Washington Gridlock Scuttle Stocks?

Jeff Miller | Sep 22, 2013 05:47AM ET

The weeks of uncertainty continue, as we ask whether political gridlock threatens the economy and the markets.

Last week I predicted a week of focus on the Fed, including more clarity on the change in leadership and a new direction for policy. It was a pretty easy call (for a change) and those stories dominated both the news and the markets.

Despite a busy economic calendar this week will focus on Washington and the inability to compromise on important decisions. There are two key questions:

- Can a government shutdown be avoided?

- Will the U.S. default on its debt, by failing to raise the debt ceiling?

Background

Here is a summary of the complex situation.

- Congress has not passed an actual budget for four years. Spending authority comes via "continuing resolutions (CR)" which extend current authority.

- If there is no CR before 10/1, the authority for Federal spending will end, causing a government "shutdown."

- In a shutdown, essential workers are still required to report for duty. Their pay will be delayed. Other government offices will close down, with rather substantial costs for stopping and starting up again. See the Clinton/Gingrich era shutdown , which has many parallels to the current situation.

- The US has a rather strange policy of setting a debt ceiling, even though the obligated spending has created a deficit for many years. Historically the Congress has authorized payments of previously authorize obligations. Whichever party does not have the Presidency often objects, with symbolic votes against the debt ceiling increase. For example, when President Obama was a Senator, he cast such a vote in opposition to raising the debt ceiling, knowing that it would not be decisive.

- In recent years, the conservative wing of the GOP has been willing to engage in brinksmanship to achieve their policy objectives. (See Don Marron on the risks ).

- The current objective is withholding funds for ObamaCare.

Current Situation

The two themes – the CR and the debt ceiling -- have become linked. Originally Speaker Boehner wanted to avoid a potential shutdown, preferring to use the debt ceiling as leverage. Under pressure from the Tea Party wing of the party, the House passed a CR that eliminated funding for ObamaCare. They expect Senate colleagues to use the filibuster and procedural objections to support the House decision.

GOP Senate choices are not that effective. Sen. Cruz is willing to lead the objectors, but to do so he must weekly calendar from Investing.com . For best results you need to select the date range from the calendar displayed on the site. You will be rewarded with a comprehensive list of data and events from all over the world. It takes a little practice, but it is worth it.

In contrast, I highlight a smaller group of events. My theme is an expert guess about what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios. Each week I consider the upcoming calendar and the current market, predicting the main theme we should expect. This step is an important part of my trading preparation and planning. It takes more hours than you can imagine.

My record is pretty good. If you review the list of titles it looks like a history of market concerns. Wrong! The thing to note is that I highlighted each topic the week before it grabbed the attention. I find it useful to reflect on the key theme for the week ahead, and I hope you will as well.

This is unlike my other articles at "A Dash" where I develop a focused, logical argument with supporting data on a single theme. Here I am simply sharing my conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am putting the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The Good

Last week was a good week, despite the market reaction on Friday.

- Larry Summers withdraws from consideration to be the Fed Chair. (Remember that our definition of "good" is "market-friendly"). I explained the market effect, the political background, and the challenge for the new chair in this post.

- The FOMC maintains current policy. For insight on what was behind the Fed decision you have hundreds of choices, many highly political or exasperated reactions from losing traders (See Ryan Avent (the "RA" in The Economist pieces) has an excellent discussion of the various constraints and pressures on the Fed.

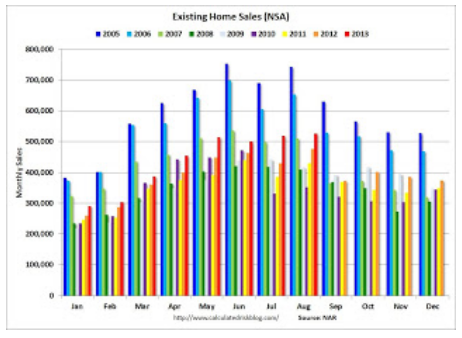

- Existing home sales beat expectations. Calculated Risk is our authority on all things housing. Bill McBride notes that the impact of higher mortgage rates would not yet have been seen in this report. Here is his typically helpful chart:

Sea container counts

are higher. Washington Post ).

FOMC members spoke out

on Wednesday's decision, making it clear that QE purchases might well be reduced as soon as October. Market reaction included politics and expiration effects, but partly revised thinking about QE as well.

The Ugly

Nukes – three stories:

Senior Israeli minister: Iran is on course to develop a nuclear bomb in 6 months-- (The Washington Post )

The Indicator Snapshot

It is important to keep the current news in perspective. I am always searching for the best indicators for our weekly snapshot. I make changes when the evidence warrants. At the moment, my weekly snapshot includes these important summary indicators:

- For financial risk, theSt. Louis Financial Stress Index.

- An updated analysis of recession probability from key sources.

- For market trends, the key measures from our "Felix" ETF model.

Financial Risk

The SLFSI reports with a one-week lag. This means that the reported values do not include last week's market action. The SLFSI has recently edged a bit higher, reflecting increased market volatility. It remains at historically low levels, well out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a "warning range" that deserves respect. We this article . For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

This week brings a full schedule of data releases.

The "A List" includes the following:

- New home sales (W). Housing remains crucial to the recovery. Will higher mortgage rates matter?

- Initial jobless claims (Th). This is the most responsive and also the most encourage of the employment indicators.

- Personal income and spending (F). Important concurrent measure of economic health.

- Michigan sentiment (F). A good concurrent read on employment and spending. The preliminary reading for September was very weak.

- Consumer confidence (T). Usually correlates with the Michigan survey. Will the political shenanigans matter?

The "B List" includes the following:

- Durable goods (W). Rebound from weak prior month?

- PCE prices (F). The Fed's favorite inflation gauge. Expected to be stable.

- Case-Shiller home prices (T). Slower moving than other sources, but confirming strong increases.

I am not very interested in the final GDP report for Q2.

The official announcement of the Yellen nomination as Fed Chair could come any day. German Chancellor Angela Merkel is expected to win reelection on Sunday.

Expect plenty of rhetoric from politicians and the omnipresent "countdown clock."

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix shifted back into stocks as several sectors emerged from the penalty box. Like many human traders, Felix was caught leaning the wrong way on the changes in Syria and was neutral during the Fed surprise. We are now fully invested for trading accounts in positions ranging from emerging markets, to interest-sensitive names, and energy themes.

Insight for Investors

A big challenge for investors is to make the best use of available information. The problem is too much data with no clear method for finding real experts. This was one of the reasons I started my blog, and it guides my selection of sources.

It is blindingly obvious when you think about it, but why not consider the financial incentives of your source? When a salesman calls or comes to your door, you know what to expect. Why not use the same level of skepticism online?

I look for sources who are completely aligned with their clients or readers. This explains why I have frequently highlighted the work of Barry Ritholtz and Josh Brown. This week they He explains that process is more important than outcome:

"Wall Street appears to be selling outcome, but that's illusory. What they are really selling is potential results. They are luring investors in by selling the possibility of out-performance, and not the actual out-performance itself…. When you consider the alternative — evaluating process — most investors (including many pros) simply lack the skill set to proceed. It has a degree of subjectivity; it relies on statistical analysis that is often counter-intuitive. And perhaps most difficult of all, it requires the abdication of traditional investing myths."

I urge everyone to read the entire post, but here is a thought: What if you chased what worked last year? You would own bonds and gold…. It is stronger and more successful to find methods that work in the long run and then remain loyal.

new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love feedback).

Final Thought

The gridlock scenario continues the theme I have highlighted over the last month – uncertainty and perceived risk. The market hates uncertainty. No sooner is one subject clarified – Syria, Fed Chair, QE – than another appears. When will it end?

My framework is to consider important issues in two ways – the likely actual outcome and the public perceptions and expectations. In this way I can remain grounded in the eventual reality while considering the important short-term reactions. While I am better at analyzing the former, the market often reacts more to the news flow.

Here are my current working hypotheses:

- The US will (once again) avert a default on debt, perhaps through a combination of extraordinary measures to buy a little more time, and pressure from business interests on Republicans.

- There may well be a shutdown. Since most people do not think much about government services until they need them, this seems harmless enough -- in the abstract.

- A shutdown will not last long, especially in the modern social networking era. A few missed checks and delayed passports will stimulate the will to compromise.

- Participants can reach agreement after proving that they have done everything possible to fight for their constituent interests.

The big question for the markets relates to the effect on confidence. This was devastating in 2011, even when default was averted. Will investors look at a government shutdown as a precursor to defaulting on the debt? The linkage of these issues, the complexity of the process, and the unusual tactics may create a dangerous situation where perception becomes reality.

Or will investors learn from 2011, seeing a familiar pattern?

No one can answer this question in advance. Agile traders can use this outline as a guide. Investors may choose to ignore the entire process.

If it were not so sad and dangerous, it would be funny. In the words of Will Rogers, "I don't make jokes. I just watch the government and report the facts."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.