The Week Ahead: Is This A Tipping Point?

Jeff Miller | Jun 09, 2013 12:23AM ET

Each week I consider the upcoming calendar and the current market, predicting the main theme we should expect. This step is an important part of my trading preparation and planning. It takes more hours than you can imagine. My record is pretty good, with recent topics including Fedspeak, increased volatility, and a focus on interest rates – all very accurate.

Sometimes there is no clear theme, and I try to be honest about that. In the past I have described it as a "lull before the storm" and as "waiting for evidence." This week I see an absence of major new data. At the same time the markets are at a crucial point for both technicians and traders. That is the main reason for the recent volatility. I see the following key questions?

- Is this a potential tipping point for markets – both bonds and stocks?

- What is the real "new normal?"

PIMCO invented and popularized "new normal" and every word by their public spokesmen gets plenty of media attention. I want to highlight an alternative "normalization" viewpoint from Brad DeLong, a Berkeley econ prof. His positions mean both that he has the highest qualifications possible and that he will be ignored by most of my market colleagues because of their own biases. This is foolish. I highlight great sources from various persuasions, ranging from the very liberal to rock-ribbed conservatives and libertarians. I do leave out extremists from the conspiracy wings.

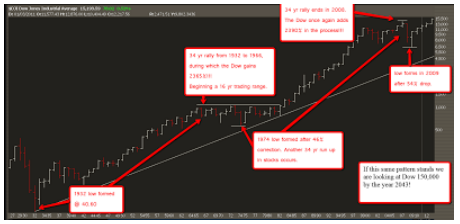

Prof. DeLong also did a great job as organizer of the recent Kauffman Conference – helpful both to me and to many others. (More on that to come). This week he wrote Michael Gouvalaris , who takes a long-term technical viewpoint. Here is his key chart:

Well! 2043 is outside of my regular forecasting range, but the concept is sound. Mike writes as follows:

"…(T)he markets will always favor the upside over the long term because of pure math. The downside risk is 100%, that is the worst case scenario. While your upside is unlimited. We just saw two separate cases of long term macro bull markets that produced over 2000% returns while the declines maxed out at around 55%. Do you see where I am going with this? Institutions adopt this mindset, they look at the 2000% upside over time after a historically oversold decline, as opposed to the downside risks in the short term. It's easy to blame the PPT, the Fed and a whole plethora of others for market rallies in the face of "headlines" and slow data. Ironically it is almost always the same ones that have gotten monetary policy, QE, fiscal policy etc, completely wrong from the very start."

Makes sense to me!

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.