Sometimes markets emphasize simple themes, rejecting even modest efforts at nuance. The current big stories are the record highs in stocks, the length of time since the last significant correction, and the "market is rigged" meme. These themes are all easily grasped and interesting media fodder. They have set the agenda.

Meanwhile, the economy seems to be providing a positive answer to early 2014 skepticism – Weather (!) or Not?

The contrast between the economic fundamentals (and impending earnings results) and the "soft" stories will be the dominant theme during the upcoming week.

Prior Theme Recap

In the last installment of WTWA before my vacation, I expected the theme to feature new Fed Chair Janet Yellen in her first press conference. Some might have questioned that forecast, since we had already heard plenty from Yellen both in confirmation hearings and in her "Humphrey-Hawkins" testimony to Congress. What could be new?

The era of Fed transparency yields ever longer statements, economic forecasts, and assurances about future guidance. There are also many speeches. The press conferences by the Fed Chair, given only when the overall forecast has been updated, require extemporaneous answers to questions from financial reporters. It can be a minefield.

In response to question about how long the Fed might delay raising rates after QE ended, she hesitated and said a considerable time. With further pushing she mentioned "six months." This sent stocks into a downward spiral, since there is an over-reaction to any hint of Fed tightening even a modest reduction in the extremely easy Fed policy. Those who have been reading this site, know better than to invest on such reactions, so we had yet another buying opportunity as the clarifications ensued. The theme actually extended over the next ten days.

This all reminded me of Ben Bernanke's first year, when he made a few comments to CNBC's Maria Bartiromo at the White House correspondents' dinner. This is a fun affair, but Bernanke learned that he was not "off the record" and the result was a market-moving story. Bernanke admitted that it was a "lapse in judgment."

This is a perfect illustration of the reason for my weekly post – planning for the week ahead. Readers are invited to play along with the "theme forecast." I spend a lot of time on it each week. It helps to prepare your game plan for the week ahead, and it is not as easy as you might think.

This Week's Theme

In the absence of much fresh news, we can expect another week of pundits on parade. I am calling this fluff versus fundamentals.

On the fluff side I expect to see the following:

- More Michael Lewis follow-up stories about rigged markets.

- More charts comparing the current bull market with prior crashes. They just keep coming – at least this one has an expiration date!

- An assortment of death crosses, complains about volume, and omens.

- Any decline in stock prices – even of a few percentage points – as evidence that the "big one" is at hand.

On the fundamental side we have the following:

-

Spring has changed the outlook. Ed Yardeni notes the rebounding economic indicators and summarizes as follows :

I have been predicting that the stock market would respond positively to rebounding economic indicators even though everyone knows that some of that strength is simply weather related rather than a sign of economic strength. Nevertheless, investors might have been concerned that the winter's weak numbers might have been fundamentally weak rather than just depressed by the big chill.

-

Stronger capital expenditures are in prospect. If you read only one thing this week, check out Cardiff Garcia's seven points about capex. His conclusion is a bit cautious, despite the strong evidence:

We still buy the economic slack argument for why this recovery has room to run, and to run faster than it did last year. But we also recognise that much of the case for an impressive capex pickup could have been made, and by some research teams was made, at the start of last year as well.

The discussion will include some early speculation about Q1 earnings reports.

I have some thoughts that I will share in the conclusion. First, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information .

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The Good

It was a big week for data including plenty of good news.

- Rail traffic growth is strong. Todd Sullivan notes that it could involve some catching up from weather effects, but the growth is quite large and unusual to see this early in the year. See Todd's post for full discussion and charts.

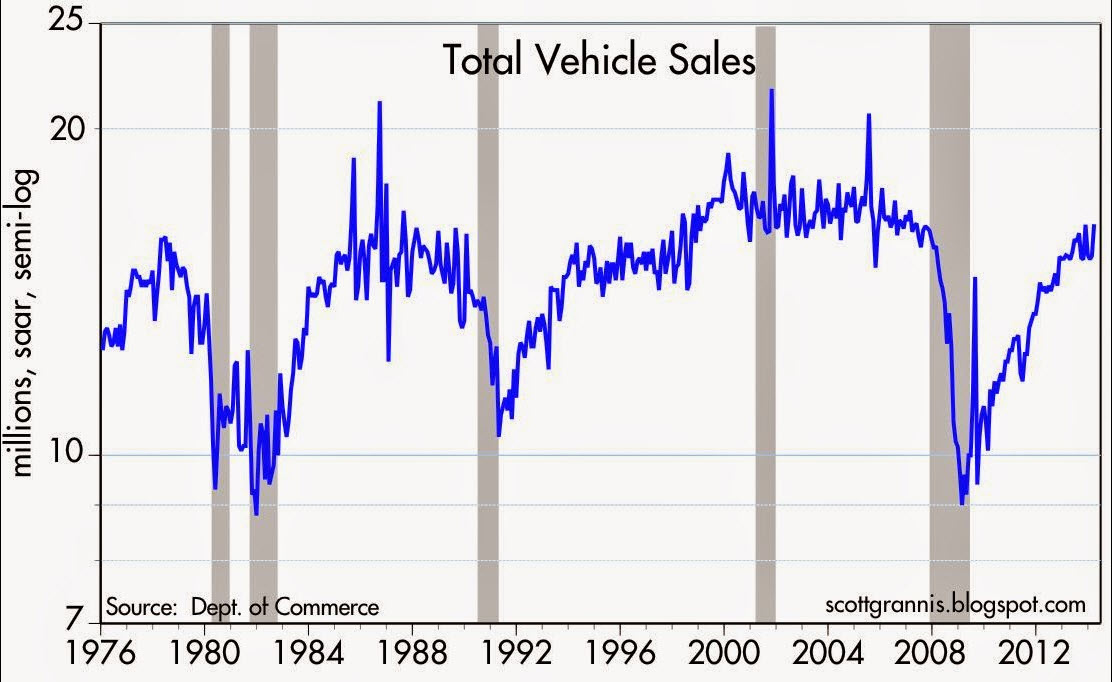

- Auto sales are strong, bouncing back more than expected and 81% over the recession lows. Ford F-150 sales, a good indicator for small business and construction, had the highest March total in seven years. See the Scott Grannis has a full discussion along with this chart:

- High frequency indicators were positive. New Deal Democrat covers a wide array of consumption, sentiment and monetary measures in his "spring rebound" account.

- ISM manufacturing and service reports showed expansion. The levels were not exceptionally strong, but internals showed strength in new orders and employment. (See manufacturing ).

-

Employment news. I am scoring the employment story as positive, even though the indicators – initial claims, ADP private employment, and payroll employment – were all slightly worse than the published expectations. These are all noisy series, so a few thousand less than the consensus guess does not mean much. The results all confirmed the more recent job trends, which were clearly better than the preceding "soft patch." Most importantly, the market treated the results as positive, and that my working definition of good is "market-friendly." For now, good news is good. Here are some highlights:

- Private job growth has been very solid – enough by itself to reduce the overall unemployment rate;

- Labor force participation has improved without increasing the unemployment rate;

- Hours worked has also improved, suggesting more job gains ahead;

- Improvement in full-time jobs.

There were a couple of negative aspects to the report:

- The hourly wage down-ticked by one cent. We need to see wage improvement;

- The overall level of employment is still disappointing, especially for this point in a recovery;

- Far too many people are still under-employed.

The Fed has acknowledged the complexity of the employment news, abandoning the unemployment rate guideline for a more complex picture. Dwaine Van Vuuren has created the "Yellen Dashboard." This will rapidly become the best place to see a summary of what the Fed is considering. Here is the current look, suggesting a tightening in 2016:

The Bad

There was also some bad news.

- Technical indicators are more negative. I always enjoy the market updates from Charles Kirk (small membership fee required), especially his weekly chart show. His objective and flexible approach changes with the evidence and helps traders see what to watch for. Charles notes an uncertain situation with the failure of some bullish setups and a threat to the uptrend. This one-sentence summary cannot do justice to his explanation, so take a look. (Also compare with Felix's insights for traders, below).

- Investors emphasizing low risk in retirement savings. Putting aside the wisdom of the individual choice, this is a drag on markets. Gallup has poll results showing the emphasis on caution. We should note the sharp contrast with some of the trading-style sentiment polls.

- Earnings warnings are at near-record levels. According to MarketWatch , there have been negative pre-announcements from 93 out of 111 companies. Here is the key chart:

- China's growth is slowing. Ed Yardeni has the update on the China PMI data – positive, but lower than expected or hoped for. Here is the key chart:

The Ugly

Middle East peace talks. Some believe that the White House has pulled the plug on Secretary Kerry. (See the CFR story ). Whatever the reason, the lack of progress is disappointing.

Humor

We all deserve some laughs. Here is an amusing contrast.

Congressman James P. Moran (D. VA) explains that members of Congress are underpaid at $174,000 per year with assorted benefits and perks. He explains that it is expensive to live in DC. Moran is retiring this year. (Rollcall )

Former Fed Chair Ben Bernanke is raking in the speaking fees. He scored over $250K on his first gig , beating his full-year salary working for the Fed. This seems to be just a starting point. Given the frequency of Bernanke testimony and speeches, I wonder what additional information he has to offer? What sort of incentive structure does this create?

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here .

Recent Expert Commentary on Recession Odds and Market Trends

unveiled a new system .

Doug Short : An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (2 ½ years after their recession call), you should be reading this carefully.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured "C Score." One of his conclusions is whether a month is "recession eligible." His analysis shows that none of the next nine months could qualify. I respect this because Bob (whose career has been with banks and private clients) has been far more accurate than the high-profile punditry.

Yellen Dashboard " as noted above!

Putting it all together, it is time for another look at the "Big Four" indicators monitored by the NBER when defining recessions. As you look at the chart, remember that a recession starts at a business cycle peak. First we need to see a potential peak, and then there must be a significant decline. Doug Short updates this regularly , providing the best concurrent evidence on the economy:

The Week Ahead

This is a light week for data. The "A List" includes the following:

- Initial jobless claims (Th). Best concurrent read on the most important subject.

- FOMC minutes (W). After the Yellen press conference and subsequent FedSpeak, what more can we learn? Expect plenty of attention anyway, with a search for nuance.

- Michigan sentiment (F). This gauge of both spending and employment remains at a crucial level.

The "B List" includes:

- JOLTS report (T). This misunderstood release is like a "liquidity report" for the job market. Watch the quit rate. It has been high and growing, which is good.

- PPI (F). Inflation data are still not very interesting.

We will also have some FedSpeak, speeches by assorted foreign leaders and politicians, and some lesser data releases. Tuesday marks the "official" start of earnings season with the Alcoa Inc (NYSE:AA) report. In recent years that has been less of a bellwether, so I expect the earnings story to start in earnest next week.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has shifted into neutral leading us to sell stock positions as more ETFs were sent to the penalty box. This is not a bearish sign, but an indication of extreme uncertainty. By Thursday Felix was completely out of stocks and was 1/3 invested in bonds (via the iShares Barclays 20+ Year Treasury ETF (ARCA:TLT). Those who want to follow Felix more closely can tune it at Scutify.com , where he makes a daily appearance.

Compare this with Charles Kirk's outlook, summarized above.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. The current "actionable investment advice" is summarized here .

This is still an important time for long-term investors. We all know that market corrections of 15% or so occur regularly without any special provocation. Recent years have been the exception. Over the last several weeks I have emphasized the need to maintain perspective, using market declines to add to positions.

It helps if you have been actively rebalancing your portfolio and trimming winners. Then you have some cash. Some readers have asked me to write more on this topic, so I have placed it on the agenda. For now, let me do a quick summary.

- Review your holdings regularly. (For me, that means at least weekly, but it is my job. Quarterly is probably enough for most people, perhaps with some price alerts). Make sure that your original reasons for the investment are still valid. Revise your fair value and price target estimates.

- Do not fall in love with a position. If hanging on to a disappointing holding, make sure your reasons are sound.

- Sell if your price target is hit.

- Rebalance by trimming if a stock appreciates massively, but remains below the price target.

Because we have been selling in our "long stock" program, we have prepared to buy on dips. We are following the rules that I have recommended for you. Barron's notes that "value stocks" are doing fine.

In our Enhanced Yield program we hardly noticed Friday's selling. Positions declined by less than 0.2%, despite declining stocks and increased volatility on our short calls.

Each week I highlight some of the best advice I see. Here are some highlights.

Bonds beat stocks in Q1. Bespoke has the story with some great charts. This was a surprise for many, including me, but I acknowledge all evidence, and we will continue to monitor this story. I expect the bond to stock rotation to continue.

Morgan Housel has thoughtful comments about expectations and volatility. He writes as follows:

Markets crash all the time. You should, at minimum, expect stocks to fall at least 10% once a year, 20% once every few years, 30% or more once or twice a decade, and 50% or more once or twice during your lifetime. Those who don't understand this will eventually learn it the hard way.

I have frequently written that no one can time the smaller fluctuations. Those who claim success have a standing bearish prediction, claiming success when it works but ignoring years like 2013. I recommend that investors accept the moderate declines as a cost of doing business and try to avoid the bigger moves by using the indicators I report each week. This combination would have caught all of the major declines.

Eric Parnell highlights some risks for those over-emphasizing the dividend growth stocks. Investors perceive an extra measure of safety from dividends and the group has performed well. It is a part of the quest for yield that I have documented, and it has become a crowded trade. It is fine to have a long-term focus on investing, but you should still look for value. Here is one of Eric's charts:

Robert Shiller suggests that most people would benefit from using an investment advisor. (See the WSJ article). Most people misquote and misuse Prof. Shiller by concluding that they should currently be out of the stock market because of his CAPE ratio. In fact, he personally holds an aggressive stock position (for his age) and has consistently recommended that others should hold significant stock positions. He notes that most people do not have the training to pick stocks.

To this advice, I add that most people do not have the discipline to buy and sell at the right times. Every week I hear about people who bailed out of the market in 2009 and never got back in. You can be a do it yourselfer, but you need to ignore most of the pundits, popular web sites that promote fear, and focus on hard data.

If you are missing the stock rally, you have plenty of company. This is one of the problems where we can help. It is possible to get reasonable returns while controlling risk. Check out our recent recommendations in our new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love and use feedback).

And a special thought (and chart) for young investors……from Sam Ro of Business Insider: Study the effect of saving early and consistently!

Final Thought

There are three important themes.

-

Last week was rich in data and the story confirms the gradual economic progress from the last few years. We seem to have an annual interruption from one cause or another. Each soft patch stimulates another round of recession worries.

In fact, there has been no sign of a recession for years. As long as we are not close to a business cycle peak, supported by aggressive worldwide central bank policy, we remain in the middle innings of an economic expansion. It is longer than the average because the decline was so great and the recovery is so slow.It is a blunder to force the current market into a model of some prior year or the average of past recoveries.

- The stress tests deserved more media attention. The featured story was that Citibank (NYSE:C) had to revise their plan. The big story is that we are doing something more aggressive than in 2008, and that most banks are passing the test. Here is a summary from the WSJ .

- The Michael Lewis "market is rigged" story is interesting, but a distraction for investors. I lost count of the number of interviews, starting with 60 Minutes on Sunday night and extending to PBS on Friday. I suppose it will catch the Sunday morning shows as well.

The most interesting aspect of the story so far is the willingness of the punditry to opine before they have read the book! In some cases, those commenting admit this. In other cases it is obvious that they are just guessing. When a story is breaking, no one wants to take a few hours to collect any evidence.

I am a Michael Lewis fan and I plan to write a review, just as I did on The Big Short. I have almost finished the book. There are some important worrisome themes to consider, mostly neglected by the reviews so far. I will focus on the implications for long-term investors.

For now, let me just say that the several years of a "rigged" market have been kind to the thoughtful, informed, and disciplined investor. More to come…..