The Week Ahead: An Avalanche of Data

Jeff Miller | Jan 31, 2012 02:05AM ET

[Note to readers -- sorry for the delay. As everyone knows, I always plan for the week ahead and I usually write about it. Sometimes I have a recreational weekend, so the writing is delayed. I did some covered writes on dividend stocks today, but that will not be a surprise for regular readers. I suspect that there will be more opportunities this week.]

In a sharp change from recent times, this week will be all about US economic data. With recession worries still prominent, each release will be subject to special scrutiny. This will be especially true of Friday's employment situation report.

There will be continuing earnings news, although we have passed the peak of the season. The Greek default story has legs. Despite the headline potential from these sources, I see signs that there is less focus on Europe, and more attention (worry?) about the US economy.

I'll have some further thoughts in the conclusion, but first, let us do our regular review of last week's news.

Last Week's Data

In last week's report I observed that there was a change in tone. We saw more of the same this week. In the absence of specific bad news from Europe, the market "wants to move higher." All of a sudden there is more attention paid to specific stock news, and a general upward trend. I'll consider this important development further in the conclusion.

The Good

There was some very good news this week.

- GDP was up at an annualized rate of 2.8%. This looks really great. The best chart of this shows the components, and (no surprise) good take with this chart:

He offers this explanation:

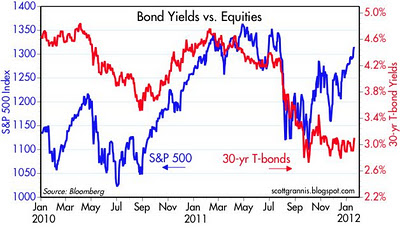

In my view, this disconnect reflects a buildup of tension in the market—something is likely to break pretty soon. Bond yields have been depressed because risk-averse investors have been seeking shelter from a potential Eurozone collapse that might trigger another global recession/depression/deflation. But equity prices have been rising because in the meantime, while the world waits for the Eurozone to implode (and we've been waiting for at least 18 months now), the U.S. economy continues to improve. Bonds are the doomsday trade, while equities are more realistic about what's happening right now.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.