U.S. Dollar Unhinges From Fed Rate Expectations

Dr. Duru | Aug 18, 2016 05:53AM ET

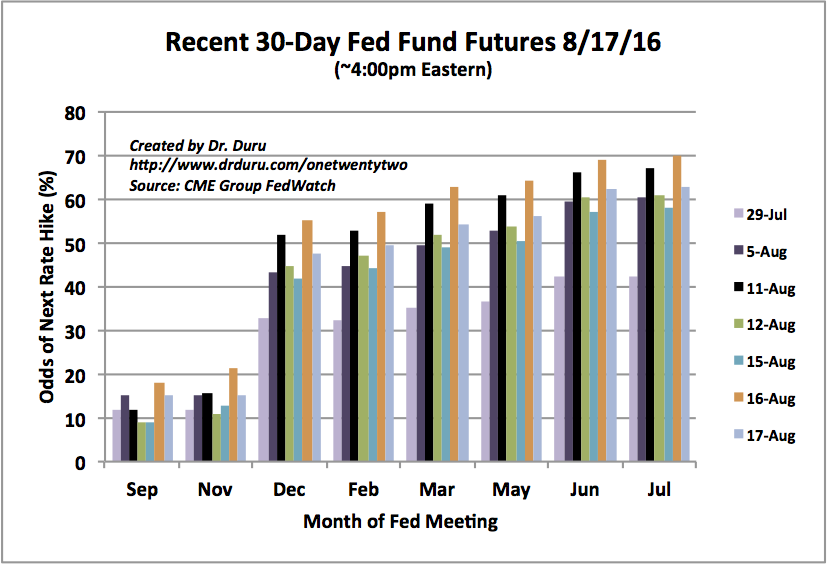

To-date, I have been using the 30-Day Fed fund futures as a valuable tool for determining likely (short-term) trading direction for the U.S. dollar index (DXY0). However, since the last Federal Reserve decision on monetary policy on July 27, 2016 , these futures have exhibited a lot of volatility and thus a lot of noise (assuming the CME’s data are correct of course).

In just the past three weeks, the 30-Day Fed fund futures have gone from predicting the Fed’s next rate cut would not happen until at least well into 2017 to predicting a December rate hike to now predicting a near even split between February and March, 2017.

The futures market has also predicted nearly everything in between. This churn renders this signal much less effective than before.

In the chart below, the odds for the next rate hike are on the vertical axis. The month of the Fed meeting is on the x-axis. The bars are colored according to the date of a particular snapshot of expectations, ordered from top to bottom in the legend and left to right in the bars of a given month from earliest date to the latest date. The first month that hits the 50% mark for a given snapshot is the month the market predicts will deliver the next Fed rate hike.

Over the last three weeks the odds for the next Fed rate hike have bounced from sometime after July, 2017 to May, 2017 to December, 2016 back to May, 2017 and now split between February and March, 2017

This back and forth has occurred amid a battery of economic data delivering rushes of responses. So perhaps the accompanying volatility in rate expectations is an understandable consequence or maybe it is a sequence of over-reactions. Instead of following along, the U.S. dollar has chosen a path of decline.

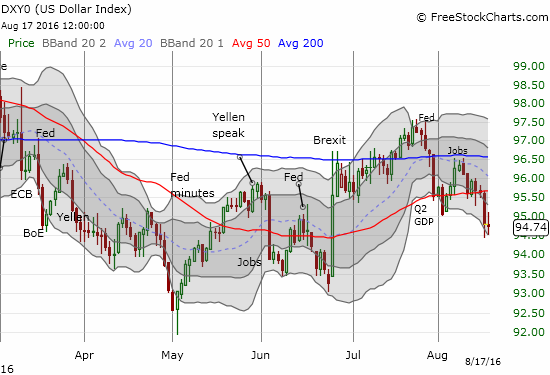

Outside of a 4-day “relief” bounce, the U.S. dollar index (DXY0) has persistently declined. So while the current odds of the next rate hike are much earlier than in the immediate wake of the last Fed meeting, the U.S. dollar index has lost 2.1%. The decline is persistent enough that the dollar’s post-Brexit gains look ready to reverse completely

.

The U.S. dollar index hits a new 2-month low as support at its 50-day moving average (DMA) gives way again. Post-Fed selling has received convincing follow-through.

With the dollar seemingly unhinging from futures expectations, I have awakened to the increasing importance of the trend. As a result, I have traded a bit more aggressively against the U.S. dollar to offset my core positions long the U.S. dollar. The main challenge is trying to hold through the resolution of this fight at 100 for USD/JPY…

The U.S. dollar is struggling to hold 100 against the Japanese yen (USD/JPY)

Be careful out there!

Full disclosure: net long the U.S. dollar

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.