The Two Tim Tale: A Portfolio Experiment

Tim Knight | Apr 02, 2017 12:42AM ET

I have been running an experiment with myself over the past couple of months. I really didn’t plan for this experiment. I just sort of fell into it. Now that it’s running, though, I’m quite interested to see what comes of my personal test.

The first result of this test is as follows: in the first quarter of 2017, in my regular portfolio, I lost ground. That isn’t a huge shock, since that portfolio is entirely short, is often 200% margined (or even more), and Q1 2017 had all kinds of lifetime highs on just about every major index. I had some great trades here and there, but the simple fact of the matter is that if you spent an entire quarter going short, and the market hits record highs, you are not going to make money.

However, I also traded a different portfolio. This portfolio had some huge disadvantages versus my “regular” portfolio:

(1) I didn’t start trading it until the first month of the year had already passed by;

(2) I only allowed myself one or two positions at a time – maybe three, tops;

(3) I only allowed myself to trade ETFs;

(4) I was so conservative with it, I never used more than 25% of my buying power

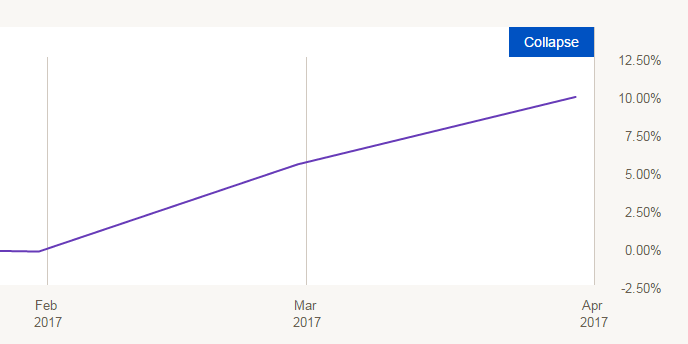

And yet, with all these drawbacks, this is what Q1 looked like for my “ETF-Only” portfolio:

That’s right – – about a 10% gain, with basically both arms tied behind my back. (The trades, incidentally, were largely reflected in my Slope Plus ramblings). Incidentally, the chart above could only be displayed based on monthly data, so don’t be fooled by the smoothness.

To be very clear, this wasn’t a “mega-bull” portfolio. On the contrary, having just examined my results, virtually all the gains came from triple-bearish symbol ERY (NYSE:ERY) and double-bearish symbol TWM (NYSE:TWM). Isn’t that wild? So this portfolio wasn’t just bearish, it was crazy bearish – – and yet it kicked my “normal” portfolio’s ass all over the football field.

I’ve been thinking a lot about this, and I think it has as much to do with psychology as trading strategy. On the trading strategy side, the principal advantage I had was the short-term nature of these trades. In my normal portfolio, my goal is for a stock to fall over a sustained period, such as weeks or even months. This market hasn’t had a decent downtrend in literally years, so this is extremely difficult. But with this ETF-only portfolio, I am totally comfortable being in a trade just for a day or two, or however long it seems profitable to remain.

Some of you may be thinking, based on the preceding paragraph, I should do binary trading. No thanks. It’s not for me. We’re all different, and different instruments and techniques work well with some and poorly with others. I tried binary trading, and I didn’t like it.

But as I say, the psychology side has a distinct difference. I’ve noticed that I don’t really have the same ax to grind with my short-term ETF trades as I do with my regular swing trades. I know I’m preaching to the choir here, but the fact is that the market doesn’t really need to break down in any meaningful way to take profits out of it, even with bearish trades. I just need to get the short-term direction right (obviously……..).

So if I’m going to build on this success, what do I seek to change? I’d say the following:

+ More Aggressive – As I mentioned above, I played it quite safe, usually keeping 75% of my portfolio in cash. Yet with a 10% return in the first quarter, I’m ready to amp that up, particularly since, as wrong-headed as it may be, I’m more confident with “house money” (the profits I’ve made).

+ Less Attention to Noise – It’s inevitable there are going to be some folks on Slope whose trading direction differs from my own. I famously blew my DUST (NYSE:DUST) trade earlier this year when I let that get to me, and the exact same thing has been happening lately with my JDST (NYSE:JDST) trade. I am bearish on the miners, but I actually trimmed back 60% of my long position since I kept reading about how miners were going to soar based on such-and-such indicator that I don’t even use. However, JDST largely recovered on Friday, and I’m wondering if I am just semi-repeating my DUST debacle by heeding someone else’s opinion besides my own. I need to stop that and focus on my own rationale, not someone else’s.

+ Risk-Based Size: One smart thing I do in my normal portfolio is base the size of the position on the amount of risk (e.g. stop-loss price). I’ve been kind of winging it with my ETF portfolio, but I think it would be wise to introduce this same discipline into both portfolios, particularly to avoid getting irresponsibly large positions, as I feared I might have been doing with JDST.

I hope to share more good news about my little personal experiment with Q2 ends.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.