The Trump Rally Is Just Getting Started

Chris Vermeulen | Feb 15, 2017 10:51AM ET

Have you ever been presented with an opportunity and missed out on it? Well, here is an opportunity you don't want to miss.

Based on my unique “Cycle Analytical” work combined with my “Proprietary Predictive Analytics Model”, I see new highs to be made in the U.S. stock market. Applying my metrics, I find that the markets are neither overbought nor overextended. Indeed, the market remains in a clear bullish trend and the next leg is very sustainable.

Technically Speaking, it's back to buying the dip.

The S&P 500, Dow Jones and Nasdaq closed at all-time highs on Friday, February 10, 2017. The Trump rally is just getting started according to Bloomberg.

Investors should expect that the global markets will continue their bull-market run throughout the first half of 2017 rather than forming a top, which leads to a bear market. “Extremes" have lost their’ meaning at this point. The Federal Reserve has given the green light to major banks in the U.S. to raise dividends and buy back shares. The huge thrust in momentum has now returned to the four U.S. stock indexes.

Nicholas Teo of KGI Securities said that: "Ever since his [Trump's] victory in November, global stock markets have been steered by actions events rhetoric emanating from the new commander-in-chief”.

Plenty Of Cash

The trigger events show the willingness of the markets to give the Trump Administration a lot more 'slack' as we engage into 2017. Billions of dollars are continuing to flow into the U.S. real estate market from Chinese nationals. They are using their offshore cash reserves to make payments on the properties they have speculated on in the U.S. There are also big-money speculators who have the sophistication needed to circumvent China’s capital controls.

BlackRock (NYSE:BLK) estimates that there is a whopping $50 trillion in cash“sitting on the sidelines”. This money has come from global central banks, financial firm reserves and consumer savings accounts. Blackstone (NYSE:BX) is keeping nearly one-third of its assets in cash. Fund managers have increased their reserves to levels that equal the highest since 2001. This means that there is a lot of liquiditywith nowhere to go, but up.

We are still in the early days of the new Trump Administration and everything seems to be going his way. President Trump’s proposed economic policies are being well received by U.S. businesses, especially Wall Street banks. His plans are certainly positive – such as deregulation, defunding of various useless federal agencies, simplification of the tax code and lowering taxes. Many people, including some of the best money managers in the world are at a loss as to where to put their money.

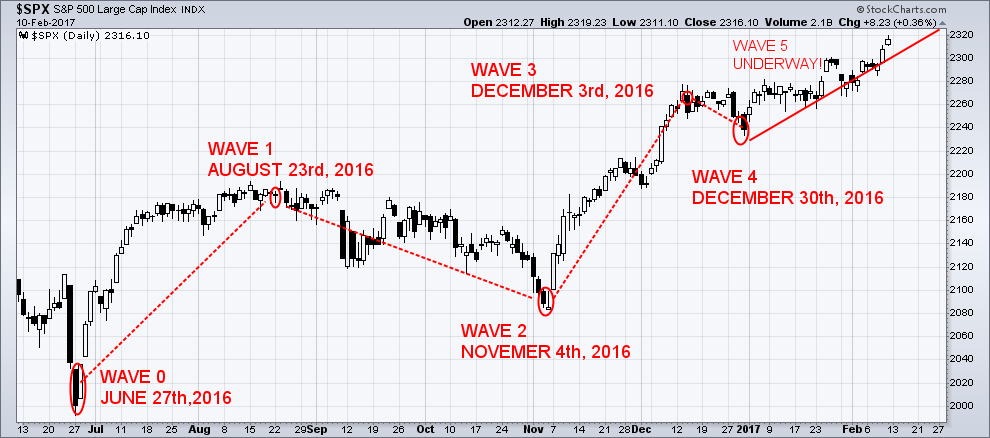

The Elliott Wave Principle is a description of how groups of people behave. It shows that mass psychology swings from pessimism to optimism, creating specific and measurable patterns. In the chart below, repeating patterns in prices are displayed showing where we are located at any given time. In those repeating patterns, I can predict where we are going next.

Wave 5

Wave 5 is the last leg in the primary direction of the dominant trend. Wave 5 advance is caused by a small group of traders. Prices will make a new high above the top of wave 3.

How To Make Money

Momentum traders are truly a unique group of individuals. Unlike other traders or analysts who dissect a company's financial statements or chart patterns, a momentum trader is only concerned with stocks in the news. These stocks will be the high percentage and volume movers of the day/week.

On February 8, 2017, we closed out our NUGT trade for a 112% profit that we entered on December 16, 2016,

America Is Happy Again

A recent Gallup poll reported that American’s confidence in the U.S. economy remained strong in January of 2017. Gallup's U.S. Economic Confidence Index averaged +11, which is the highest monthly average reached in Gallup's nine-year trend.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.