The True Causes Behind The Yield Curve Inversion And Gold

Sunshine Profits | Oct 04, 2019 08:18AM ET

By now, everyone and their brother has heard about the yield curve inversion. How come it has inverted and how much should we read into it? Is it really such a reliable indicator of an upcoming recession? Let's dig into the true causes behind the inversion and find out what its meaning for the gold market.

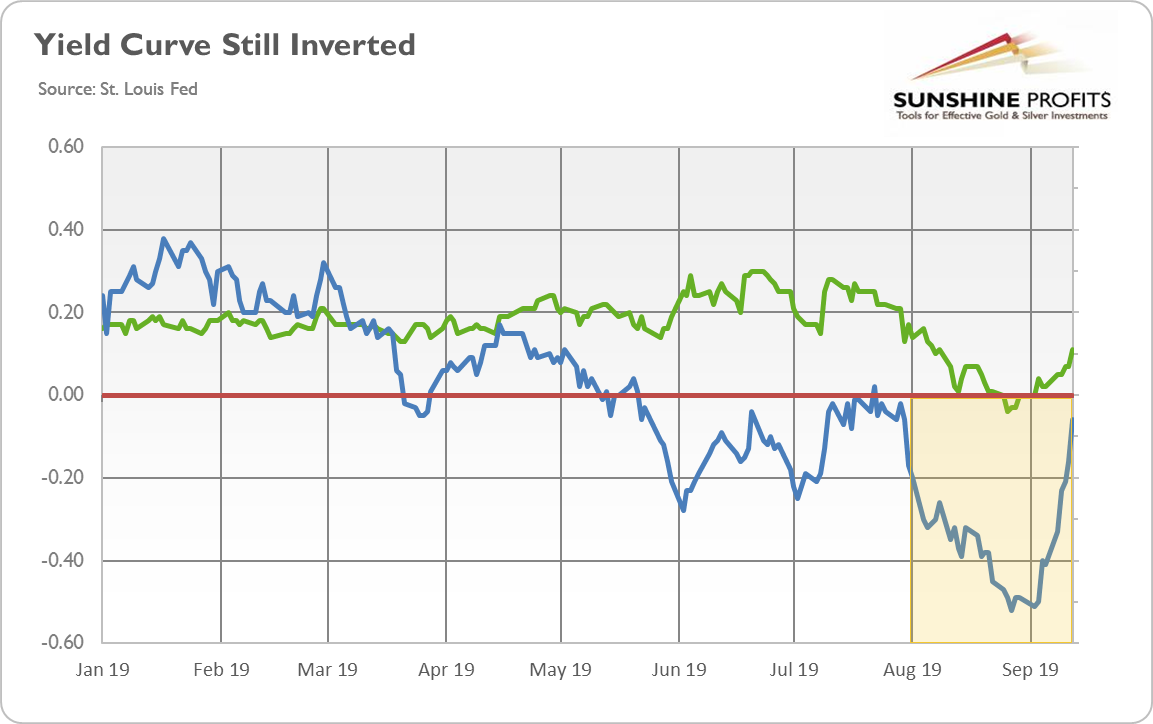

Is the yield curve inverted? Well, it depends. Although the spread between the U.S. 10-year and 3-month Treasurys has normalized somewhat in September, it remained in negative territory. Meanwhile, after a short dip below zero in August, the spread between the U.S. 10-year and 2-year Treasuries spent time in positive territory, as the chart below shows.

Chart 1: Spread between US 10-year and 3-month Treasuries (blue line, daily numbers, in %) and spread between US 10-year and 2-year Treasurys (green line, daily numbers, in %) from January 2019 to September 2019

Which spread should we trust? The literature says that the best results are obtained empirically by taking the difference between two Treasury yields whose maturities are far apart. Using the three-month Treasury rate (the overnight rate) at the short end is appropriate. When used in combination with the ten-year Treasury rate to predict U.S. recessions, it provides a reasonable combination of accuracy and robustness over long time periods. Thus, the U.S. yield curve has been inverted since mid-May, which constitutes a powerful recessionary signal. Indeed, that signal has been recently (at the turn of August and September) strengthened by the short-lived dive of the spread between 30-year Treasuries and 3-month below zero.

If history is any guide, we should expect a recession next year, possibly even before the presidential elections. Buy some gold, lots of popcorn, sit and watch - it will be fun! Now, a very important thing: this scenario is not written in stone. History does not repeat itself, it only rhymes. So please be aware that the recession may came a bit earlier or later, or it may even decide not to arrive. It would be unlikely, but we cannot exclude it. The yield curve is the most reliable recessionary indicator we have, but it's not a crystal ball, it's just an indicator, man!

To use any indicator wisely, we need to understand the broader context. We need more data and a proper background. We need to know the ultimate reasons behind the yield curve inversion. As one can see in the chart below, although the U.S. long-term interest rates that started at the end of 2015.

Chart 2: US 10-year Treasury yields (green line) and US 3-month Treasury yields (blue line) from January 2015 to September 2019.

Now, the question is whether the short-term rates climbed because of the decrease in the supply of the U.S. government bonds or due to increasing demand. Although the Fed has been engaged in some quantitative tightening, the unwinding of the U.S. central bank's balance sheet started only in October 2017 and was rather moderate. Moreover, the federal deficit has been growing since 2015, which means that the Treasury had to issue more bonds and notes to cover the gap between its revenue and spending. It means that the rise in the short-term interest rates was caused by the more intense demand.

The key issue now is what caused that increase in demand. The Austrian theory of the business cycle is helpful here. At the beginning of the cycle, there is an artificial economic boom caused by the low interest rates and credit expansion. Entrepreneurs take advantage of easy money and start many projects that wouldn't be viable at higher rates. However, the competition makes the inputs more expensive. So, as we approach the peak of the economic expansion, the input prices rises. The rising input prices squeeze profits margins, forcing entrepreneurs to seek short-term financing to complete their business projects. In order to complete the projects, they are ready to borrow money at higher and higher rates. As they demand more funds, the yields, including the Treasury yields, increase. The rising prices also incite the Fed to hike the federal funds rate in order to curb inflation, adding to upward pressure on market interest rates.

What does it all mean? Well, we are approaching the end of the boom. The next phase is a bust. Nobody knows when exactly it will come and how severe it will be. But it will arrive one day, and sooner rather than later. There shall be corporate bankruptcies then, weeping and gnashing of teeth. However, not for all the people. The bust is gold's favorite phase, so those making the golden choice will thrive.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.