The Spell Is Broken: Netflix Is More Like A Traditional TV Network

David Trainer | Apr 20, 2016 03:25AM ET

Shares of Netflix (NASDAQ:NFLX: $98/share) plunged 12% after-hours on Monday after its earnings report revealed weaker than expected subscriber growth. Most notably, domestic subscriber growth continued to slow.

More shockingly, at 2.5 million the company’s projections for its second quarter net subscribers additions are far below expectations (4 million). We think this news should break the spell that has kept investors blind of the poor economics and competitive position of Netflix.

This stock remains highly overvalued. Even if valued at a premium to its much more profitable traditional media peers, the best investors can hope for the stock is $58/share. We think $30/share is the more likely eventuality.

The Spell Is Broken: Raising Prices Hurts Customer Growth

It is a simple law of business that any discretionary product appeals to fewer consumers when it becomes more expensive. How many customers do you think McDonald’s Corporation (NYSE:MCD) would lose if it raised prices by 11% across the board? It would be a lot, and Netflix is no different.

In our original Danger Zone call on Netflix in November of 2013, we predicted that Netflix would have to raise prices in order to have any hope of generating cash flow and that raising prices would undermine customer growth. Our November 2013 report provides historical precedence for how price hikes affect the company’s customer growth: Netflix “shed almost 1 million subscribers in 2011 when it announced a new $16 price for streaming and DVD rental services, up from the previous amount of $10. Customers in this space have many choices, and they will quickly and easily flock to a lower price option whenever needed.”

Investors should not be surprised that Netflix lowered guidance for subscriber growth for Q2 after announcing that many long-time users will face price increases starting in May. Netflix raised the price for new subscribers from $7.99 to $9.99/month two years ago, and now long-time users are being “un-grandfathered” and will have to pay the new, higher rate. These users have many more options for streaming video than they did in 2011.

The Spell Is Broken: Netflix Cannot Afford To Produce Original Content And Keep A Big Content Library

For years, Netflix had one significant advantage over its streaming competitors: its massive library of movies and TV shows. As Netflix has pushed more and more into original content recently, it can no longer afford that massive catalog of licensed content. Over the past two and a half years, its content library has shrunk by 32% .

Figure 1: Content Obligations Growing Slower Than Revenue

Figure 1 shows a data series we’ve graphed in multiple previous articles on Netflix. Before we discussed the massive increase in the company’s content obligations. Now, it’s notable that those obligations have increased slower than revenue in two out of the past three years (2013 and 2015).

We also predicted that Netflix would have to move into producing more original content in order to justify charging customers more. We doubt few investors believed the company could ever generate enough cash flow to justify its valuation by charging consumers to see re-runs.

Unfortunately for Netflix, the more it shrinks its content library and raises its price, the less there is to distinguish it from the multitude of other streaming services flooding the market.

The Spell Is Broken: Netflix Is More Like A TV Network

Investors should think of Netflix less like a high-flying tech company and more like a traditional video content provider, like CBS Corporation (NYSE:CBS) or Viacom B Inc (NASDAQ:VIAB). Both those companies have roughly double the revenue of Netflix, but CBS’s enterprise value is 24% lower, and Viacom’s is 40% lower.

At its core, Netflix is merely a content delivery platform — and one of many. From Amazon (NASDAQ:AMZN) video services to CBS All Access to HBO Go, Outerwall’s Red Box (OUTR) and Dish Network’s Sling TV etc. There is no shortage of competition in this space, and none of them stand out as offering anything that is really unique. Netflix is attempting to separate itself by creating original content only available to Netflix subscribers, but it is not the only player in that game.

The first mover advantage in streaming video for Netflix has eroded rapidly. It no longer looks like a singular entity in the on-demand video space. Instead, it’s one of many players in an increasingly crowded field searching for eyeballs. It’s still the leader, but where’s the competitive advantage needed for pricing power?

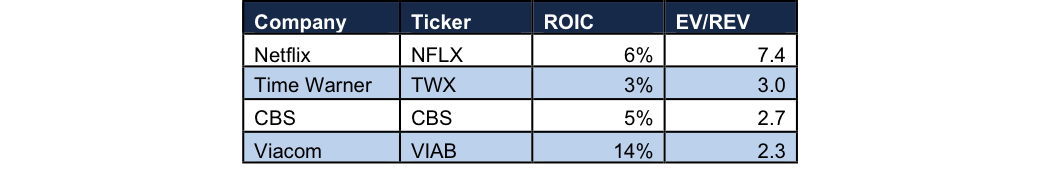

Figure 2 shows the striking valuation gap between Netflix and TV networks such as CBS, Viacom, and HBO parent Time Warner. Despite having a similar return on invested capital (ROIC), Netflix is valued with an Enterprise Value/Revenue ratio between 2-3 times higher.

Figure 2: Netflix Is Much More Expensive Than TV Networks

One could argue that NFLX deserves a premium over these other stocks due to its international growth opportunities and popularity among younger viewers. Still, it’s hard to justify the massive premium at 7.4.

Assuming a generous 4x multiple to 2015 revenue, NFLX is worth $58 share. We suggest the 4x multiple only for the sake of argument and do not believe the stock deserves a premium valuation to companies that actually generate significant free cash flow and have sustainable competitive advantages.

Valuation Still Makes No Sense

Even with the post-earnings drop, Netflix has unreasonable profit growth expectations baked into its stock price. In order to justify a $98/share valuation, Netflix must grow after-tax profit (22% compounded annually for 18 years. In this scenario, Netflix would need to maintain an average ROIC of 32%, far higher than we’ve ever seen from a media company.

A more realistic ROIC target would be for Netflix to hit 14%, the same as Viacom, within the next decade. If the company can do that and grow NOPAT by 16% compounded annually for 10 years, the stock is worth $30/share. Even those expectations could be a serious challenge for a company that burned $1.6 billion in cash during its last fiscal year.

This stock has a lot of downside risk. As the market grows more aware of the competition Netflix faces, it will become harder to sustain its sky-high valuation. Investors would be smart to take their profits while they can.

Time Is Running Out: Companies Cannot Lose Money Forever

It is hard to see how Netflix can differentiate itself enough from the competition to charge the higher prices it needs to generate the profits already embedded in its $98 stock price. In fact, we wonder if Netflix can make any money and continue to maintain its new, lower customer growth goals.

Per Figure 3, Netflix’s cumulative free cash flow burn since 2003 is over $3.5 billion. If they have not been able to make money so far, what makes investors believe they will make more money in the future in an increasingly competitive market? For how long, will the market tolerate these losses in the face of slower growth and more competition?

The bottom line here is that the Netflix business model is incapable of delivering the combination of revenue growth and cash flow implied by its valuation.

Figure 3: Netflix Burned $1.6 Billion in Cash in 2015

Original content creation is expensive and risky. Most big networks and movie studies are owned by larger media conglomerates. The strong cash flows and deep pockets of media conglomerates enable them to absorb losses when original content risks don’t pan out (e.g. Disney’s John Carter). Netflix continues to burn cash, and it will be forced to keep leveraging its balance sheet or diluting existing investors to fund operations.

So far, Netflix has been able to pay employees with stock and take on more debt to fund its operations. These funding sources could put the company at risk if the market turns against it. Netflix has $1.3 billion in employee stock option liabilities. If the stock price starts to fall, all of a sudden those employees are making a lot less money, and Netflix could find itself with the same struggle to retain talent that crushed LinkedIn (NYSE:LNKD) and Twitter Inc (NYSE:TWTR) recently.

We saw the market turn on Netflix today just from disappointing guidance numbers for subscribers. We expect to see further disappointment on the subscriber growth front as Netflix tries to balance raising prices and fending off competition. The company becomes more competitively boxed in every day. Amazon (AMZN) recently announced it will offer its streaming video service as a standalone option for $8.99/month, $1 less than Netflix.

As Amazon joins with Hulu to pressure Netflix on the low-cost side, HBO remains an imposing threat on the premium side. Netflix content chief Ted Sarandos has said the company’s goal “is to become HBO faster than HBO can become us.”

The difference? Netflix has 80 million subscribers, HBO has nearly 140 million. Netflix wants to go head to head in original streaming content against a network with more subscribers, more resources, and a much longer history of creating the original programming that keeps subscribers coming back for more.

A recent survey found that 41% of Netflix subscribers say they won’t accept any price increase. That number is undoubtedly higher than the reality, but it speaks to the increasing price sensitivity and the difficulty Netflix will have in trying to raise prices and continue growing subscribers at the breakneck rate the market expects.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.