Here's What The Rate Hike Means For Bonds

Urban Carmel | Dec 14, 2016 03:20PM ET

Summary: Bond yields usually rise as the FOMC raises rates. This is one of the mostly strongly held consensus views in the market right now. A year ago, investors also thought yields were set to rise; instead they fell over the next half year. Might investors be wrong once again?

The FOMC raised its target for the federal funds rates Wednesday afternoon. We discussed the affect of rate increases on various asset classes a year ago when the FOMC enacted its first rate increase since 2006. The general conclusion was that equities, commodities and bond yields all rose in the subsequent months.

Those conclusions were mostly right. The one exception was bond yields. On the day of the rate increase in December 2015, 10-year yields in the US hit 2.33% (arrow). That was the high until November 2016, 11 months later. In the interim, yields fell 100 basis points over the next half year.

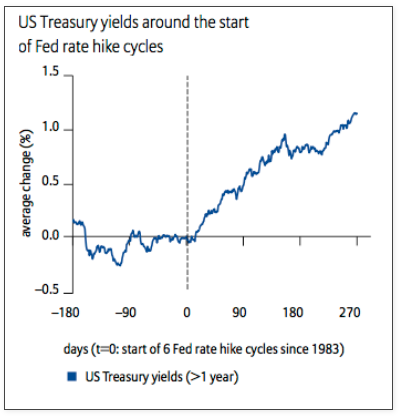

That was unexpected. Yields had risen from 1.9% in October and from 1.6% in January 2015. In the six prior rate hike cycles since 1983, yields had continued to rise after the FOMC decision (data from Allianz (DE:ALVG)).

Treasury yields have again risen strongly ahead of today's FOMC meeting, although the 10-year yield is only 10 basis points higher than a year ago. Expectations are they will continue to rise. Might investors be wrong once again?

Money flows out of bond funds have recently been one of the most extremely negative of the past 15 years (from BAML).

Overall investor bond sentiment is as bearish as it was a year ago (arrow). Over the past 10 years, similar levels of bearish bond sentiment (lower panel) have mostly coincided with a rebound in bond prices (upper panel; from NDR).

Commercial bond traders (considered the 'smart money') are taking the contrarian view. They now have the largest long position in at least 5 years (green line, lower panel). They have mostly been right, with bond prices rising subsequently (upper panel).

Bond breadth momentum, using the same formula investors use in calculating the McClellan oscillator NYMO for stocks, is also at a decade-long extreme (lower panel). Prior extremes like this have mostly been near at least a short term turning point in bond prices (upper panel; from Tom McClellan).

Fund managers surveyed by BAML now have their largest underweight position in bonds since last December. These fund managers' inflation expectations have jumped to the highest level in 12-1/2 years (upper panel). It's notable that current levels have marked at least a short-term reversal point in yields in the past (lower panel; a new post on this can be found here).

Similarly, there has been a massive increase in the percentage of these fund managers who believe the yield curve will steepen in the next year (upper panel). This is now at the highest level in 3-1/4 years. Similar cases, at either a high level or following a steep increase, have led to at least a short-term reversion lower in yields (lower panel).

The intermediate trend in yields is higher: the US 10-year yield is near the highs from July 2015, a year and half ago. The main bond ETF, TLT, has fallen about 15% in the past two months and is below falling 5-d, 20-d and 50-d moving averages. The first sign of a short-term change in trend will likely be consecutive closes above its 13-ema (green line). This has been where short rallies have failed since September (arrows).

Bond yields usually rise as the FOMC raises rates. This is one of the mostly strongly held consensus views in the market right now. A year ago, investors also thought yields were set to rise; instead they fell over the next half year. Might investors be wrong now once again? There is a good set up for investors to be surprised; what is missing is a visible sign in bond prices.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.