Search For Yield Continues (But Not All Assets Created Equal)

Callum Thomas | Jun 28, 2017 12:43AM ET

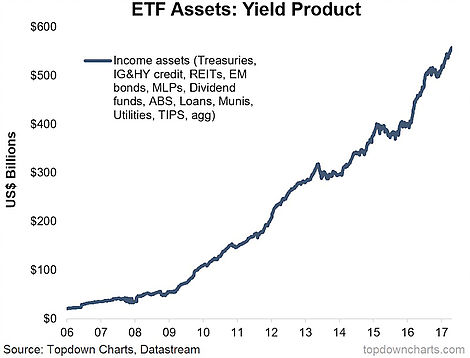

If the amount of AUM in yield and income related ETFs is anything to go by, it would seem that the search for yield is alive and well. By our count the amount of ETF AUM in yield products has surged to over half a trillion dollars. And it's worth highlighting as you check out the chart below that not all yield is created equal. Indeed the lust for investment income has seen a lot of investors stretching into assets with increasing liquidity risk, credit risk, commodity risk, interest rate risk, and even equity market risk.

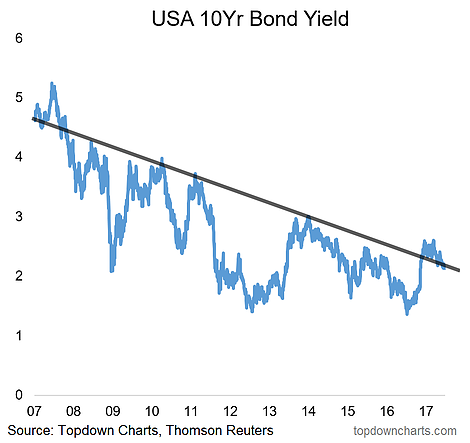

With demographic drivers and still-low cash rates around the world the income asset bubble could go on for a while yet. Particularly as US bond yields look to be rolling over. Indeed, bond yields are going to be a key risk driver for income assets, and for now they are sort of in limbo at a point where a trend change from down to up has yet to really take hold.

The impact of balance sheet normalization or QT [Quantitative Tightening] could cause shockwaves through yield products when it comes. Thus it's worth remembering the point that income assets aren't always low risk assets...

Things that make you go (a)UMmmm... AUM [Assets Under Management] in income or yield focused ETFs has surged to over half a trillion dollars.

The US 10-Year Government bond yield looks like it is attempting to continue back on its downtrend after a brief breakout last year. The outlook for bond yields depends on the global economy, as previously noted.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.