The S&P 500 May Have Had a Convincing Breakout But I Am Still a Queasy Bull

Dr. Duru | Mar 14, 2012 07:38AM ET

: 73%

VIX Status: 14.7%

General (Short-term) Trading Call: Strong bullish bias – see below for more details and an explanation!

Commentary

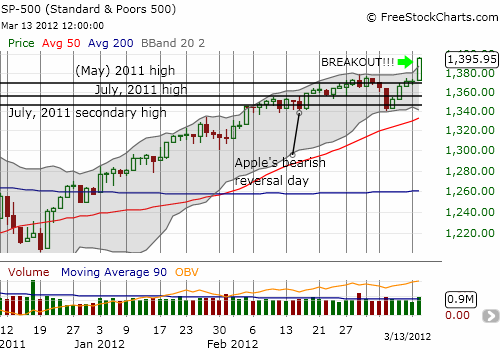

S&P 500 delivers one of its more signficant breakouts in a long time

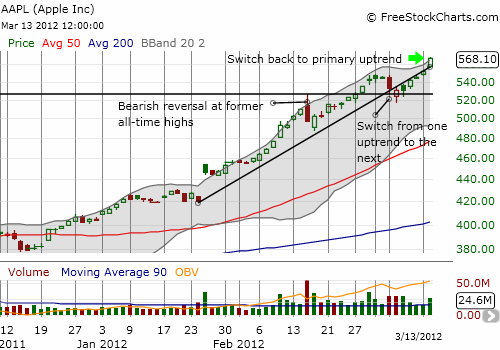

Apple (AAPL) is climbing to infinity and beyond

A picture can say a 1000 words, and a stock chart can broadcast a 1000 lessons. I started this T2108 Update with these two charts because, in my mind, they perfectly symbolize the bullish significance of yesterday’s trading. Buyers FINALLY stepped up in force to power the S&P 500 higher.

The 1.8% gain on the day featured higher than average volume, a breakout to near four-year highs, and a close at the highs of the day. The market simply cannot get more bullish than this on a single trading day. A stellar trifecta. Apple (AAPL) clearly led the way for the bulls; the main differences are the ALL-TIME highs on the winds of persistently strong buying pressure. Enjoy these pictures – I think it is rare to get such convincing breakouts.

OK. Now that I got the excitement out of my system, I can wallow in my queasiness about this setup. T2108 re-entered overbought territory after just a brief rest from Volatility ETFs Often Own All VIX Futures ” for understanding why the current crop of volatility products perform so poorly over an extended period of time.”

I expect the S&P 500 to grind its way higher and higher over the coming weeks and months, but it should feature constant shifting in and out of overbought periods rather than another extended overbought period. While the bias will be for more upside, the churn will remind us (or at least me) of the on-going downside risks.

Bears will find themselves constantly frustrated, and bulls will find constant relief. However, the historical data also suggest that this next bullish phase will NOT end as well as the first one. In fact, we should expect an outcome very similar to the extended overbought periods of 2009 and 2010. That is, at the end of this road is hiding somewhere the next calamity. This time, it will be something none of us are thinking about and/or worrying about. Yes, I just feel more comfortable thinking about what can go wrong.

To kick off this trend-following, I executed two aggressive trades: calls and shares in Caterpillar (CAT) and calls in CSX Corporation (CSX). I previously discussed the bearish implications for the divergence in performance of the two stocks. I even cautioned in a separate post that CAT may have printed an ominous breakdown. Yesterday’s bullish trading action invalidated the warning:

CAT is now poised to follow Apple's lead and break to fresh all-time highs

In this next bullish phase, I fully expect CSX to play a lot of catch-up (a slowdown in coal is hurting CSX) and for CAT to represent one of the favorite ways for big buyers to play an on-going recovery in the U.S. and global economy.

I consider these trades to be my first trial balloons of the shift in strategy. I am looking for confirmation that the S&P 500 is truly embarking on a fresh trend. This confirmation should come with a bullish follow-through day within the next week or less WITHOUT the S&P 500 completely reversing yesterday’s breakout. Breaking the lows of yesterday will call into question the breakout. I plan to stay flexible and nimble, especially since I am now traveling a bit away from my traditional comfort zone.

Finally, note that I have written about many bullish scenarios in the past few months. These areas will also be my focus on any future buying setups: commodities, housing, insider buying, and special “situations” or themes. Stay tuned for more pieces in these areas.

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.