The S&P 500 Continues A Strong Run Toward Overbought Conditions

Dr. Duru | Oct 09, 2015 03:18AM ET

T2108 Status: 65.0% (near 6-month high)

T2107 Status: 29.4% (6-week high)

VIX Status: 17.4

General (Short-term) Trading Call: Neutral (target of 1996 on the S&P 500 has already occurred ahead of overbought conditions. See “From the Edge of A Breakout to the Ledge of A Breakdown ” for more details).

Active T2108 periods: Day #5 over 20%, Day #4 over 30%, Day #4 over 40%, Day #2 over 50%, Day #1 over 60% (ending 113 days under 60%), Day #319 under 70%.

Commentary

The bullish tidings continue.

T2108 continued its startlingly fast run-up toward overbought conditions with a close at 65.0%. T2108 is on pace to hit overbought conditions on Friday, October 9, 2015. If not then, next week looks like a slam dunk. T2108 was last at current levels when the S&P 500 (SPY) was still making new all-time highs back in April. Today, Thursday, the S&P 500 managed to push through resistance at its 50DMA and is challenging the intraday high from September. This high neatly divided two oversold periods.

The S&P 500 breaks out above its 50DMA for the first time in two months

At its lows, the volatility index, the VIX, finally erased all the angst that began in August. I will wait until it touches the 15.35 pivot point before “declaring” another victory for fading volatility.

All that August angst has all but faded into a distant memory

ProShares Ultra VIX Short-Term Futures (UVXY) again looks ready to resume its long-term downtrend after confirming a 50DMA breakdown

Trading from here is more difficult because the S&P 500 has a lot of resistance to fight. It cleared the 50DMA with no problem. By the time the index hits its 200DMA, T2108 will certainly be knee-deep in overbought conditions. That milestone will be a signal for shorting, perhaps aggressively depending on other technical conditions, like how the market responds to earnings season. If the S&P 500 manages to even break through 200DMA resistance while overbought, then it will be time to assess the prospects for one of those overbought run-up rallies. One step at a time of course.

In the meantime, the 50DMA breakout essentially confirms the drama at commodities giant Glencore (LONDON:GLEN) is already forgotten, so perhaps some financial messiness from there could still spark trouble in another few months).

So, the trading call stays at neutral with bullish and bearish bets getting fair consideration. Note well: given the strong upward press, the bulls and buyers sure seem to have taken full control back from sellers and bears.

How about caveats? On Wednesday, I noted a stall in Caterpillar (NYSE:CAT). CAT already seems ready to bounce back. Ditto for the Australian dollar (FXA) which is pressing upward and onward against all major currencies. This is a strong comeback for risk-taking. At the time of writing, the Australian dollar is breaking out against both the Japanese yen (FXY) and the U.S. dollar (UUP). I have put on hold further accumulation of my bets against the Australian dollar and am starting to wrap my head around the potential BULLISH implications of this on-going rally.

The Australian dollar has broken out against the Japanese yen…

…and against the U.S. dollar, the Australian dollar has punched out an even MORE convincing move.

With those major caveats on hold for now, I noticed caveats in the form of laggards in big-cap tech.

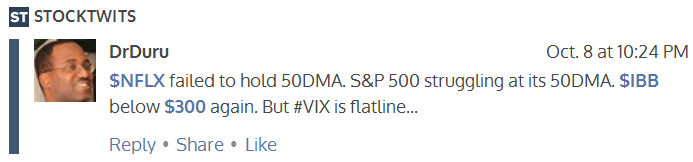

First, Netflix (NASDAQ:NFLX) was down 3% at one point during the day. It looked like a sure 50DMA breakdown…

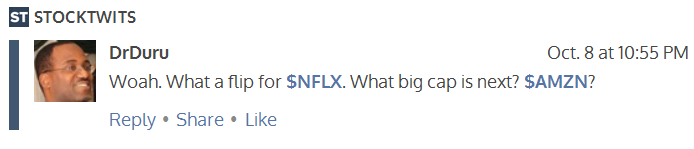

Then, suddenly, NFLX soared vertically and closed the day not only above its 50DMA but well above its upper-Bollinger Band (BB)! I cannot even remember the last time I saw something like this in a large stock. The only news out on the day was a $1 price increase for a Netflix subscription. I could not find a related NFLX press release but this ABC news article suffices: “Netflix Raising US Price for Most Popular Video Plan by $1 ”

While I did not participate in any of the NFLX action, I DID quickly flip Amazon.com (NASDAQ:AMZN) call options on the day (I am still very bullish on AMZN trades).

An abrupt and sharp intraday turnaround for Netflix (NFLX)

Amazon.com (AMZN) eventually followed suit and bounced off 50DMA support

Not much of a caveat of course, especially since NFLX’s move now forces me back into the bullish camp on the stock. My lone caveat on the day comes from Apple (NASDAQ:AAPL). The stock tried to come back but fell short.

Apple (AAPL) bounces off its lower-Bollinger Band but still closes in the red.

The AAPL caveat is not just about the negative close. It is even more about AAPL’s languishing behavior. The stock failed twice last month to break though 50DMA resistance and end the downtrend from its previous all-time high. Such a move would have lead the market. Instead, AAPL is lagging. It is hard to imagine the market leaving AAPL too far behind, so the current divergence is interesting to watch.

Finally, the major risk-on move underway is delivering large gains to many beaten up stocks. This alone could be a caveat as I strongly suspect stocks like Joy Global (NYSE:JOY) are catching bids as “catch-up” stocks.

I should have loaded up on more of these kinds of plays during the oversold period. “Cheap” is good for playing catch-up, especially when sellers have apparently exhausted themselves. At that point, the stock can only go up. These kinds of plays are not for the faint of heart and require a lot of patience and diligence to avoid

chasing just as the buying fervor turns into a rush to lock in juicy profits.

Joy Global’s long-standing pain accelerated starting in July. The current rally is JOY’s strongest in a very long time.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

The charts above are the my LATEST updates independent of the date of this given T2108 post.

Full disclosure: long SVXY shares, long SSO shares, short CAT, short AUD/JPY, short TWTR put options, long RIO call options, long BHP put and call options, long USD/CAD, long EEM put options

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.