The Risk Of An ETF-Driven Liquidity Crash

Lance Roberts | Oct 01, 2018 08:26AM ET

Last week, James Rickard posted an interesting article discussing the risk to the financial markets from the rise in passive indexing. To wit:

“Free riding is one of the oldest problems in economics and in society in general. Simply put, free riding describes a situation where one party takes the benefits of an economic condition without contributing anything to sustain that condition.

This is the problem of ‘active’ versus ‘passive’ investors.

The active investor contributes to markets while trying to make money in them.

A passive investor is a parasite. The passive investor simply buys an index fund, sits back and enjoys the show. Since markets mostly go up, the passive investor mostly makes money but contributes nothing to price discovery.”

Evelyn Cheng highlighted the rise of passive investing as well:

“Quantitative investing based on computer formulas and trading by machines directly are leaving the traditional stock picker in the dust and now dominating the equity markets, according to a new report from JPMorgan (NYSE:JPM).

‘While fundamental narratives explaining the price action abound, the majority of equity investors today don’t buy or sell stocks based on stock specific fundamentals,‘ Marko Kolanovic, global head of quantitative and derivatives research at JPMorgan, said in a Tuesday note to clients.

Kolanovic estimates ‘fundamental discretionary traders’ account for only about 10 percent of trading volume in stocks. Passive and quantitative investing accounts for about 60 percent, more than double the share a decade ago, he said.

‘Derivatives, quant fund flows, central bank policy and political developments have contributed to low market volatility’, Kolanovic said. Moreover, he said, ‘big data strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come.’”

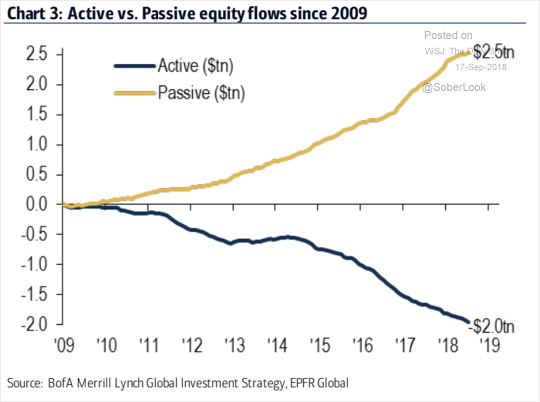

The rise in passive investing has been a byproduct of a decade-long infusion of liquidity and loose monetary policy which fostered a rise in asset prices to a valuation extreme only seen once previously in history. The following chart shows that this is exactly what is happening. Since 2009, over $2.5 trillion of equity investment has been added to passive-strategy funds, while $2.0 trillion has been withdrawn from active-strategy funds.

As James aptly notes:

“This chart reveals the most dangerous trend in investing today. Since the last financial crisis, $2.5 trillion has been added to “passive” equity strategies and $2.0 trillion has been withdrawn from “active” investment strategies. This means more investors are free riding on the research of fewer investors. When sentiment turns, the passive crowd will find there are few buyers left in the market.

When the market goes down, passive fund managers will be forced to sell stocks in order to track the index. This selling will force the market down further and force more selling by the passive managers. This dynamic will feed on itself and accelerate the market crash.”

He is correct, and makes the same point that Frank Holmes recently penned in Forbes:

“Nevertheless, the seismic shift into indexing has come with some unexpected consequences, including price distortion. New research shows that it has inflated share prices for a number of popular stocks. A lot of trading now is based not on fundamentals but on low fees. These ramifications have only intensified as active managers have increasingly been pushed to the side.”

“This isn’t just the second largest bubble of the past four decades. E-commerce is also vastly overrepresented in equity indices, meaning extraordinary amounts of money are flowing into a very small number of stocks relative to the broader market. Apple (NASDAQ:AAPL) alone is featured in almost 210 indices, according to Vincent Deluard, macro-strategist at INTL FCStone.

If there’s a rush to the exit, in other words, the selloff would cut through a significant swath of index investors unawares.”

As Frank notes, the problem with even 35% of the market being “passive” is the liquidity issues surrounding the market as a whole. With more ETF’s than individual stocks, and the number of outstanding shares traded being reduced by share buybacks, the risk of a sharp and disorderly reversal remains due to compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities, and contagion across asset markets.

The risk of a disorderly unwinding due to a lack of liquidity was highlighted by the head of the BOE, Mark Carney.

“Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.’”

In other words, the problem with passive investing is simply that it works, until it doesn’t.

You Only Think You Are Passive

As Howard Marks, mused in his ‘Liquidity’ note:

“ETF’s have become popular because they’re generally believed to be ‘better than mutual funds,’ in that they’re traded all day. Thus an ETF investor can get in or out anytime during trading hours. But do the investors in ETFs wonder about the source of their liquidity?’”

What Howard is referring to is the “Greater Fool Theory,” which surmises there is always a “greater fool” than you in the market to sell to. While the answer is “yes,” as there is always a buyer for every seller, the question is always “at what price?”

More importantly, individual investors are NOT passive even though they are investing in “passive” vehicles.

Today, more than ever, advisors are actively migrating portfolio management to the use of ETF’s for either some, if not all, of the asset allocation equation. However, they are NOT doing it “passively.”

The rise of index funds has turned everyone into “asset class pickers” instead of stock pickers. However, just because individuals are choosing to “buy baskets” of stocks, rather than individual securities, it is not a “passive” choice, but rather “active management” in a different form.

While the idea of passive indexing works while all prices are rising, the reverse is also true. The problem is that once prices begin to fall – “passive indexers” will quickly become “active sellers.” With the flood of money into “passive index” and “yield funds,” the tables are once again set for a dramatic, and damaging, ending.

It is only near peaks in extended bull markets that logic is dismissed for the seemingly easiest trend to make money. Today is no different as the chart below shows the odds are stacked against substantial market gains from current levels.

The reason that mean-reverting events have occurred throughout history, is that despite the best of intentions, individuals just simply refuse to act “rationally” by holding their investments as they watch losses mount.

This behavioral bias of investors is one of the most serious risks arising from ETFs as the concentration of too much capital in too few places. But this concentration risk is not the first time this has occurred:

- In the early 70’s it was the “Nifty Fifty” stocks,

- Then Mexican and Argentine bonds a few years after that

- “Portfolio Insurance” was the “thing” in the mid -80’s

- Dot.com anything was a great investment in 1999

- Real estate has been a boom/bust cycle roughly every other decade, but 2006 was a doozy

- Today, it’s ETF’s

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing.

Until it goes in the other direction.

The sell-off in February of this year was not particularly unusual, however, it was the uniformity of the price moves which revealed the fallacy “passive investing” as investors headed for the door all at the same time.

It should serve as a warning.

When “robot trading algorithms” begin to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.

Fortunately, while the price decline was indeed sharp, and a “rude awakening” for investors, it was just a correction within the ongoing “bullish trend.”

For now.

But nonetheless, the media has been quick to repeatedly point out the decline was the worst since 2008.

That certainly sounds bad.

The question is “which” 10% decline was it?

Regardless, it was only a glimpse at what will eventually be the “real” decline when leverage is eventually clipped. I warned of this previously :

“At some point, that reversion process will take hold. It is then investor ‘psychology’ will collide with ‘margin debt’ and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.

When the ‘herding’ into ETF’s begins to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments. Don’t believe me? It happened in 2008 as the ‘Lehman Moment’ left investors helpless watching the crash.

Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.”

Make no mistake we are sitting on a “full tank of gas.”

While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

So, what’s your plan for when the real correction ultimately begins?

“If everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail.” – John C. Bogle.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.