The Retail Sector Margin Squeeze

Zacks Investment Research | Nov 19, 2021 05:15AM ET

Most of the large retailers have been able to work through the supply-chain challenges and keep their shelves fully stoked. What this suggests is that when it comes to supply-chain management, size does matter.

That said, all of the big retailers had to spend more to keep shelves stocked, with freight expenses a major drag on margins and outlook. We saw this with Target AMZN had to deal with these issues. Both Walmart and Target exited Q3 with above-normal inventory on hand, as a way to handle the holidays efficiently.

We will discuss more details about Walmart and Target a little later, but let’s recap the Retail sector’s Q3 earnings season scorecard.

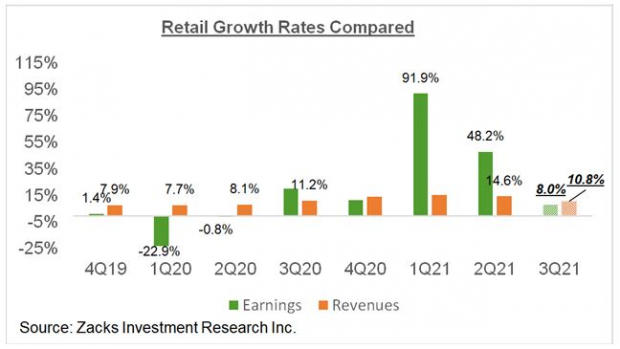

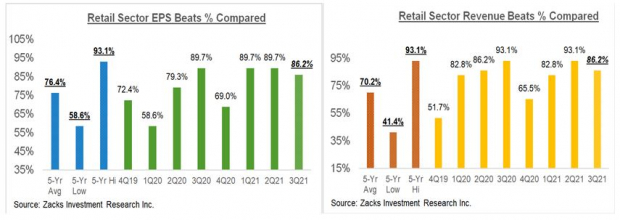

With results from 29 of the 35 retailers in the S&P 500 index already out, total earnings for these companies that have reported are up +8% on +10.8% higher revenues, with 86.2% beating EPS and revenue estimates. Net margins for this group are down 14 basis points from the year-earlier level, as a result of the aforementioned headwinds. This would follow the 150 basis point expansion in the preceding reporting cycle (2021 Q2).

For the S&P 500 index as a whole, Q3 net margins are up 230 basis points. The chart below put the Retail sector’s Q3 earnings and revenue growth rates in a historical context.

The comparison charts below put the sector’s Q3 EPS and revenue beats percentages in a historical context.

While the proportion of these companies beating Q3 EPS and revenue estimates is below what we had seen in the preceding period, the beats percentages are nevertheless tracking historical averages.

Getting back to the Walmart report, the stock was modestly down following the release even as it did an impressive job of navigating the supply-chain issue. Walmart’s U.S. comps were up +9.9% in Q3, with Walmart U.S. up +9.2% and Sam’s Club up +13.9%. Walmart’s Q3 gross margin of 25.3% was down 20 bps from the year-earlier level. Walmart exited Q3 with +11% more in inventory relative to the year-earlier level.

Walmart shares have lagged the broader market and Target this year, with the market concerned about the retail giant’s margins outlook in the face of inflationary and supply-chain issues. The stock is down -0.9% this year vs. +26.4% gain for the S&P 500 index and Target’s +42.4% gain.

The market loves Target’s digital offering that seamlessly integrates the online into the company’s brick-and-mortar footprint. Target enjoyed strong growth, with comps up +12.7%, though gross margins came in weaker than expected on the back of higher freight and supply-chain expenses. Target exited the quarter with +18% more inventory than the year-earlier, effectively guaranteeing stocked shelves during holidays.

Q3 Earnings Season Scorecard

Including all the results that came out through Friday, November 19th, we now have Q3 results from 475 S&P 500 members or 95% of the index’s total membership. Total earnings (or aggregate net income) for these companies are up +41.9% from the same period last year on +17.7% higher revenues, with 79.7% beating EPS estimates and 74.5% beating revenue estimates.

The proportion of these companies beating both EPS and revenue estimates is 62.7%, the blended beats percentage.

Earnings and revenue growth has come down in the ongoing Q3 earnings season from the first-half’s break-neck speed, but it is still very high.

You can see this in the comparison charts below that shows the Q3 earnings and revenue growth for the 475 S&P 500 members that have reported results through Friday, November 19th.

The unfavorable comparison to the first half of the year isn’t only with respect to the growth rates, as the proportion of these companies beating EPS and revenue estimates is also tracking below what we had seen from this same group of companies earlier in the year, as you can see in the charts below.

The decelerated growth pace notwithstanding, aggregate Q3 earnings for the S&P 500 index are on track to reach a new all-time quarterly record, surpassing the record set in the preceding quarter. You can see this in the chart below that shows the 2021 Q3 aggregate total at $477.8 billion.

The one notable disconcerting development this earnings season is on the revisions front, with estimates for the current period (2021 Q4) modestly turning down in recent days after inching up at the start of the reporting cycle.

This is in contrast to the persistent positive revisions trend that we have been seeing since the Summer of 2020. While the magnitude of negative revisions to Q4 estimates is fairly modest in the aggregate, it is relatively more pronounced for the Retail and Transportation sectors.

Estimates for full-year 2022 are still going up, though the revisions trend has notably plateaued since the start of October. In fact, had it not been for the positive revisions to estimates for the Energy sector, estimates for the index as a whole would have actually come down since the start of Q3.

The chart below shows how aggregate estimates for full-year 2022 have evolved since the start of the year.

Since the start of October, aggregate estimates have come down for 10 of the 16 Zacks sectors and gone up for four. The four sectors experiencing positive estimate revisions since the start of October include Energy, Autos, Basic Materials and Medical.

Positive revisions to Energy sector earnings estimates have been the most pronounced and have helped offset negative revisions to a host of other sectors. The Energy sector is expected to have the highest earnings in 2022 since 2012.

Expectations for Q3 & Beyond

Looking at the quarter as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total Q3 earnings for the S&P 500 index are expected to be up +40.3% from the same period last year on +17.2% higher revenues.

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

The chart below shows the comparable picture on an annual basis.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Breaking Down the Outlook for Margins

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.