The Relevance Of Hayek's Triangle Today

Alasdair Macleod | May 25, 2018 09:10AM ET

Most of us are aware of the inflationary pressures in the major economies, that so far are proving somewhat latent in the non-financial sector. But some central banks are on the alert as well, notably the Federal Reserve Board, which has taken the lead in trying to normalise interest rates. Others, such as the European Central Bank, the Bank of Japan and the Bank of England are yet to be convinced that price inflation is a potential problem.

Virtually no one in the central banks, government treasury departments, or independent analysts see the real inflationary danger. There is a lone exception perhaps in Dr Zhang Weiying, the top economist at Beijing University and formally in charge of China’s economic policy, who quoted Hayek’s business cycle theory to point out the dangers of excessive deficits.[i] Whether he is listened to by his colleagues, we shall doubtless find out in due course. Otherwise, a sudden acceleration of price inflation will come as a complete surprise to our financially sophisticated markets.

This article explains why the danger lies in the structure of production, which in the West at least is seriously out of whack. The follies of post-crisis central bank monetary reflation are likely to drive us rapidly into the next credit crisis as a consequence. To understand why this is so requires us to revisit the 1930s writings of an Austrian-born economist, who was tasked by the London School of Economics with explaining to advanced students the disruption to the production process from changes in consumer demand.

Friedrich von Hayek was famously reported as the economic guru of both Margaret Thatcher and Ronald Reagan. This distinction owes its origin to his market-based approach to economics, which was in stark contrast with the statist approach that was predominant in political circles at that time, and still is today. It was simple shorthand for the media writing for a mass audience.

The distinction is nonetheless correct. Instead of spending his professorial career bending with the socialist and Keynesian winds, he continued to develop and defend free-market economic theory. As a war for hearts and minds, apart from his occasional successes, it was one Hayek lost, and the consequences of the triumphs of Keynes and socialism are reflected today in systemic instability. But that is no reason to abandon the Hayekian tradition.

Hayek made a number of important contributions to economics, including an understanding of the business cycle, which he demonstrated was driven by credit expansion, and the subsequent consequences of that earlier expansion. The root of the problem, as it is today, is the way producers of goods and services adapt to changes in demand for final goods. It is a problem seemingly ignored by policy makers. Instead they believe that monetary expansion can replace savings without negative economic consequences. This is simply not true.

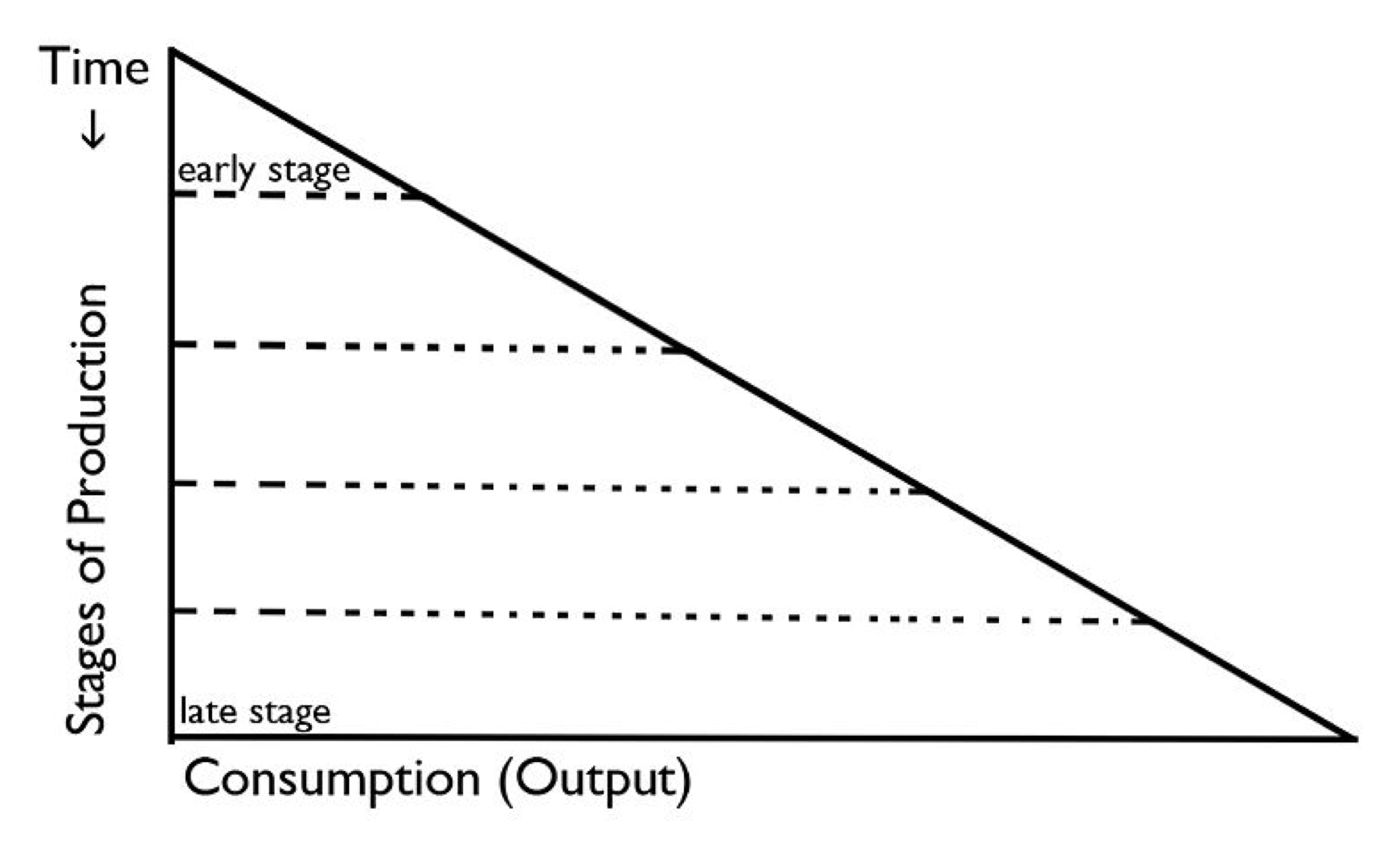

Hayek illustrated the mechanism of production and the effects of capital flows in a capitalistic economy in the form of a triangle, which showed the steps in production from its early stages towards the final product in time sequence. Using this simplistic illustration he explained the effects of fluctuations of consumer demand on production. The following illustration is of Hayek’s triangle.

The triangle’s sides represent an inverted vertical axis of time, and a horizontal axis of output, the output being consumer goods. The dotted lines represent the various stages of production, typically from the gathering of raw materials and the processing of products through intermediate stages of processing, until the final products are ready for sale to consumers. The assumptions are ones of equilibrium, that is to say there is no change from technology, the distribution of stages of production are even, the quantity of money in the economy is fixed, and lastly there are no alterations in consumer choice.

This highly artificial construction is intended to isolate the factors that determine the relationship between production and consumption, a vital subject otherwise concealed from us by the noise from all the other extraneous factors.

At this point, we must dismiss the common assumption behind GDP, that it is only output that matters. The error has a long history, and goes back even to Adam Smith, who wrote,

“The value of goods circulated between the different dealers never can exceed the value of those circulated between dealers and consumers; whatever is bought by the dealer being ultimately destined to be sold to the consumers."[ii]

In the sense of the sum of added values, this is obviously true. But what matters in our context is payments, payments in the production chain and payment for the final product. The payments between the various stages of production can be many multiples of the final payment, a fact which is hidden from us by the GDP statistic. Indeed, it is only partly revealed to us by the business-to-business activities that occur in production as captured by the US Bureau of Economic Analysis’s gross output statistic.[iii]

Hayek took his triangle to the next stage, and that was to consider the relationship of money flows between intermediate processes, compared with payment for the final consumption output. The intermediate steps are given payment values. The working assumption is that they increase at an even rate as they progress towards the final product, which is likely to be the case because if the returns on one intermediate process is out of line with the others, capital flows can be expected to correct the disparity.

The following illustration shows two examples, and we shall consider the first one initially, where the output of consumer goods is 40 monetary units.[iv]

The sum of intermediate transactions in the production process at 80 monetary units is double the value of the final output of consumer goods. Crucially, the relationship between the money spent by consumers on final goods and the sum total of the payments of the intermediate stages of production depends on the level of savings. This is because money not spent on current output is invested in production, assuming there is no change in the quantity of money.

In a sound-money economy, the relationship between savings and consumption can be expected to be relatively stable, and overall shifts likely to be small. But if consumers as a whole increase their savings, spending on the output of consumer goods will obviously fall, and the amount of money available for investment in production will rise. Apart from fluctuations in cash balances, which for our purposes we can ignore, there is nowhere else for it to go.

This means that producers of intermediate products will have to seek ways to improve production processes in order to supply the final goods at reduced prices. If our triangle’s base is to be reduced, as in the second case in the graphic above, the production process must be extended to make use of the extra investment provided by the increase in savings. Obviously, the relationship between the intermediate production steps and the final product will then change, with an increase in the total value of intermediate transactions. In the first case, the value of the intermediate products was twice that of final output, and in the second, three times. [Note that all values in the second case are shown to one decimal point]

The introduction of more roundabout intermediate steps will tend to increase the time element of production as well. This is because it takes time to plan the changes, acquire premises, assemble skilled labour and acquire the means of production which are not basic tools.

It follows that a healthy level of savings leads to a higher degree of specialisation in the production process. We have seen this in Germany, which since WW2 developed both a high level of savings and the mittelstand, a large core of high quality intermediate producers. It was also notably true of post-war Japan, though her diverse activities were grouped into large corporations. Equally, where government policy has had the effect of discouraging saving, production became less efficient, notably in countries such as Britain and the United States.

Hayek’s task was to make the mechanism of production more understandable than resorting to complex tables or high-level mathematics. By removing all the variables that serve only to confuse theoretical analysis and by using a triangle to illustrate the effects of a change in savings he was able to illustrate how a change in savings affects the structure of production.

Some of the variables removed are unimportant, such as the ownership of the intermediate stages of production. In a particular industry some or all of them may be embodied in one firm, but so long as there is competition in the market for capital, it does not matter. We have also glossed over the evolution of modern economies since the 1930s, when Hayek first proposed his triangle. But these and all the other factors do not undermine the basic premise, that a change in the level of savings has a material and predictable effect on the production chain. All that is required is to understand it.

There is, however, one change to the workings of the triangle worth mentioning, though it does not invalidate it. Hayek’s assumption appeared to be that the level of savings was driven by consumers deferring their consumption, and it was (and still is) generally accepted that this is the case. However, the current writer has established that in a capitalist economy savings are demanded for investment by businesses, rather than investment opportunities demanded by savers. This insight explains the long-standing correlation between interest rates and the general price level, because current prices were always the basis for economic calculation in the mind of the businessman. That relationship existed for at least 200 years before the mid- to late-1970s.[v]

Following the 1970s the general price level increased every year despite fluctuations in interest rates, breaking the established correlation. The explanation is associated with the ending of the gold standard in 1971 and the adoption of a pure fiat monetary system. However, there does not appear to be any reason for this change to have invalidated Hayek’s explanation of the trade cycle.

Pure fiat money has, however, fundamentally altered the financial system. From the mid-1980s onwards the purchase of consumer goods increasingly relied on credit, and genuine savings by consumers have diminished in their role as the principal source for industrial investment. Furthermore, investment of these diminished savings has increasingly been channelled through equity participation and bonds instead of bonds and term bank loans, which were assumed in Hayek’s calculations. Central banks have displaced capitalistic markets through monetary policy, driving demand for investment through managed interest rates instead of allowing rates to be set by the balance of business investment demand and savers saving.

The effect on prices

In our discussion of Hayek’s triangle, we have barely mentioned the role of prices. In his static model, there are only two destinations for the earnings and profits of an economic society, consumption and savings. It follows that if the society as a whole decides to increase its savings, it will be at the expense of direct consumption.

Several things will then happen. Demand for consumption goods will fall, putting pressure on retailers’ margins. At the same time, the greater supply of savings, other things being equal, will reduce interest rates. The reduction of interest rates makes investment that previously was unprofitable viable, thereby increasing the capital value of investments in intermediate production. Therefore, the profits of retailers will be reduced relative to the profits of earlier intermediate production, the most benefit going to the earliest stages.

The fall in consumer demand and the rise in savings thus encourages through lower interest rates investment in more roundabout means of production, and the shifts in profitability over the whole production process are revealed by Hayek’s triangle. Until the production process adjusts, there will be a temporary fall in sales volumes, followed in time by an increase in production, so that the supply of goods after a short period of time becomes profitable at lower prices. The evidence is seen in how businesses in savings-driven economies consistently outperform their rivals elsewhere, despite changes in currency exchange rates.

Modern conditions are very different from the world of the 1930s, with monetary inflation being the principle source of funds for industrial investment. Limited savings in some countries, such as America and Great Britain, have been corralled into pension funds, while the typical consumer lives off credit cards. We need to examine how this affects prices in the context of Hayek’s triangle.

In fact, at this stage it will be easier to dispense with Hayek’s triangle, now that we have established some basic truths. We now know that the availability of funds for investment in production tends, other things being equal, to increase the number of intermediate steps. In the case of a matching decrease in consumption, we know this is the mechanism to reduce prices of final products and still remain profitable. Now we must consider the contemporary case, where there is no offsetting reduction in consumption.

Let us assume there is an increase in base money and bank credit. An increase in the total quantity of money is generally encouraged by a central bank by suppressing interest rates. This has the effect of increasing the investment value of the capital goods in the intermediate steps in production, encouraging manufacturers to extend their intermediate production steps as described above. The basis of maintaining profitability has changed from a need to respond to lower consumer demand, to one of simply maximising available returns given lower borrowing costs.

While interest rates are suppressed, the effect is to increase demand for the resources of intermediate production. These include raw materials, labour, factory and office space, and the purchase of complex tools. The assumptions a businessman makes in his calculations will always be based on current conditions and he will not try to make an economic assessment. Instead, he proceeds in the belief that unless he takes the profitable opportunity presented by the availability of cheap money for investment, his competitors most certainly will.

Meanwhile, credit is readily available for consumer purchases, which will tend to continue to increase as that credit is drawn down. The effect, in terms of Hayek’s triangle, is that investment in more complex intermediate steps in production turn out to be superfluous, a fact which is only revealed when interest rates rise. The relevance of this important point should not be lost on the financial community today, now that some central banks, particularly the American Fed, are trying to “normalise” interest rates.

Monetary policy aside, we now need to look at the mechanism whereby rates may rise to the point where the imbalances in Hayek’s triangle begin to unravel. At the consumer level, prices initially rise in the financial centres and spread outwards from there, eventually affecting prices even in remote rural areas. That is easy to understand. Less obvious are the price increases that flow from raw materials and commodities through Hayek’s triangle to consumption goods.

A notable flaw in monetary policy is the encouragement it gives to all businesses to pursue the same business strategy at the same time. For this reason, lower interest rates and monetary inflation sooner or later creates a surge in demand for production goods, most significantly for raw materials, followed by shortages of available resources for the early stages of intermediate production. For this reason, the most significant price rises are in commodities, followed by bottlenecks in the extended (earliest) production process. The factors of production, including employable labour, begin to be in short supply and must be bid for competitively.

For a time, some of the price consequences can be softened by importing cheaper factors of production and consumer goods from abroad. But given that all the major economies have closely aligned their monetary policies, this is only a short-term solution at best, and more worryingly means that national problems in the production chain are in fact global.

So, we can see there are two distinct sources of price inflation: the first and most obvious is the fuel for maintaining consumer demand, the second a hidden tsunami from the malinvestments[vi] that have been created in the production structure by the falsification of business calculation through the suppression of interest rates.

For these reasons, the acceleration of price inflation usually takes central banks by surprise. They spot the first but are seemingly unaware of the second. They erroneously believe they can manage price inflation by tracking the relationship between consumer prices and interest rates. They are oblivious to the far greater danger emanating from the malinvestments created by their own earlier monetary policies.

Central banks have become adept at managing the ever-increasing systemic risks contained in the financial system, but they fail to appreciate the price risk emanating from the distortion of the production process. Inevitably, they are caught unawares when price inflation suddenly begins to get out of control, and reluctantly they are forced to raise interest rates.

Sooner or later, higher interest rates expose the malinvestments in the structure of production. In the early stages, having committed to business models which would be unprofitable without the suppression of interest rates, there is a tendency for extended factors of intermediate production to struggle on, so an initial rise in interest rates will have little overall effect. However, the height of interest rates that leads to a wholesale crisis in the production process crucially depends on the degree of malinvestments in the system, including the legacy of debt accumulated from previous credit cycles. We can only guess what it will be this time round, but the chart that follows gives an idea of what it is likely to be, should the crisis be triggered in the American economy.

A trend of declining interest rate peaks has triggered successive credit crises since the early 1980s. These are followed by officially recognised periods of recession, as indicated on the chart. The question posed is at what level of the Fed Funds Rate will the next crisis be triggered? Bearing in mind the almost 100% increase in outstanding corporate bond debt since the last credit crisis, when the FFR was raised to 5% and Lehman collapsed, we can only guess it will be an FFR between 2.5% and 3.5%.

Relating this small increase to Hayek’s triangle, we can envisage a significant growth of malinvestments must have taken place over the last ten years. In fact, the crisis of 2008 was strictly financial, so the malinvestments go back at least to the beginning of the millennium.

We know that central bank policy has explicitly been to stop the liquidation of debt at least since the late 1980s, and the series of declining interest rate peaks is associated with this debt build-up. And just as in previous instances, once the FFR has been raised to its trigger point, there is nothing the Fed can do to stop the crisis developing.

Other central banks appear to be even less prepared. The ECB and the BoJ are still supressing interest rates, while actively propping up their bond markets. The Bank of England is similarly oblivious to the danger posed by wholly inappropriate production structures.

In conclusion, we can see through an understanding of Hayek’s triangle where a supplementary and more violent form of price inflation could quickly arise. It matters not in which country the credit crisis is triggered, because as soon as one goes, the rest will follow. But as well as interest rates rising, the earliest signal a credit crisis is on its way will be sustained rises in industrial commodity prices. Note that crude oil has already more than doubled in price over the last two years.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.