Don't Ignore The Possibility Of A U.S. 2015 Rate Hike

Sober Look | Oct 26, 2015 01:08AM ET

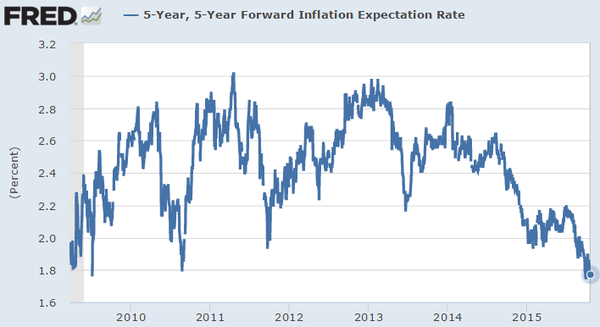

Futures-implied probability of a 2015 rate hike in the United States remains below 40%. Some market participants have all but dismissed this possibility, as they look at weak global growth as well as soft inflation and inflation expectations in the US. Some have even suggested that the next policy move by the Fed should be a rate cut into negative territory.

|

| Source: St. Louis Fed |

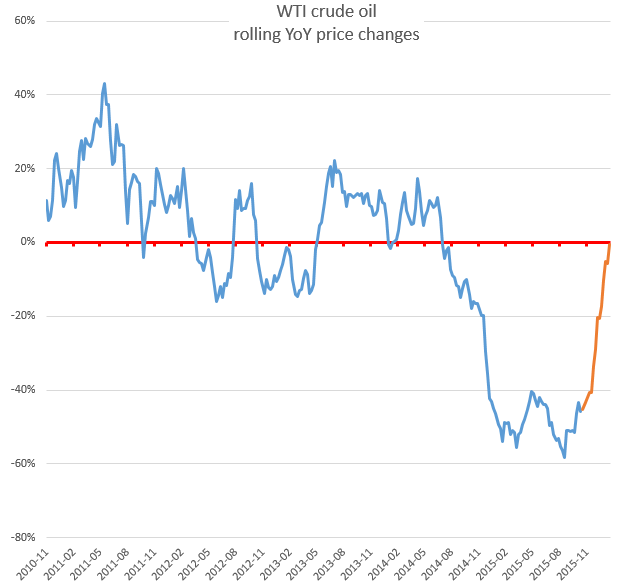

However, global growth and US inflation expectations may not necessarily be the main focus at the Fed. For example, numerous economists continue viewing the energy market crash as having only a transient impact in inflation. The logic here is that if we freeze crude oil prices at current levels (below $45/bbl), by early 2016 the year-on-year change will be around zero.

And a number of energy analysts expect crude oil prices to begin gradually rising going forward. To many forecasters, this would imply that crude oil price weakness will no longer have such a severe impact on the rate of inflation.

Of course some would say that low fuel prices have not yet fully made their way through the economy - suggesting that the disinflationary pressures will persist for some time. Similarly some argue that the full effects of the dollar rally in the first half of 2015 are yet to be fully felt.

Nevertheless, many economists view the headline inflation approaching the core measures by early 2016, with the core CPI turning higher as well. Moreover, a slew of recent US economic reports suggests that while the US economy probably slowed in the second half due to dollar strength and weakness abroad, the effect may be transient.

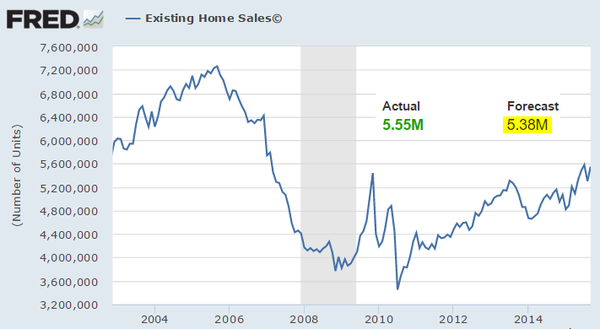

The housing market, for example, continues to recover, and consumer sentiment and spending does not seem to be impacted by the recent market volatility.

|

| Source: St. Louis Fed |

| Source: Scotiabank |

| Source: @GallupNews |

| Source: Deutsche Bank (DE:DBKGn), @MKTWeconomics |

Even US manufacturing, which has been under pressure recently, is showing signs of stabilization. The latest Markit manufacturing PMI report surprised to the upside.

| Source: Markit, Investing.com |

But what about the relatively poor payrolls report for September, which clearly missed expectations? Some economists argue that this is as much about slower hiring as it is about tight labor markets. For example (as we saw in the latest Pulte Homes quarterly report), the homebuilding industry is struggling with acute labor shortages. Of course, as the Wall Street Journal recently pointed out, the US housing correction has been so severe that a whole generation of construction workers has permanently exited the industry, creating shortages as the sector recovers. Nevertheless, when the Fed hears about labor shortages in an industry such as housing, they take notice.

| Source: WSJ |

Signs of tighter labor markets have also appeared in the latest NFIB reports on small business. When speaking with small businesses, it becomes clear that there is no shortage of applications for each opening they have. But they can't seem to find people with the right experience and/or skill set (skills gap).

| Source: NFIB |

Moreover, the broader unemployment measures continue to improve. Here is the so-called "U-6" for example, which according to some economists is about 1% away from "full employment."

| Source: St. Louis Fed |

Whatever the case, many argue that this is a precursor to acceleration in US wage growth. We haven't seen a great deal of evidence of that so far, but many economists (including those at the Fed) are convinced that it's only a matter of time.

One of the concerns the FOMC had in September was the risk of a rapidly deteriorating economy abroad, particularly in China. It has since become clear that while China's economy continues to slow, the combination of aggressive fiscal and monetary stimulus there is likely to cushion the decline.

| Source: Investing.com |

Some may remember that in September of 2013, in the wake of the so-called "taper tantrum," the Fed decided to continue with QE. The central bank, however, started tapering three months later. The "playbook" this time around could be similar.

Are global markets prepared for a December liftoff? It seems that while credit markets remain cautious, there is much less uncertainty priced into US equity markets. A relatively strong employment report next week, for example, could reignite market volatility.

| Source: BAML |

Many argue that the US economy can withstand a rate hike at this point. Indeed it can. However, given that much of the world is currently in a monetary easing mode, such a move by the Fed would result in a further rally in the US dollar. We saw the Bank of Canada strike a dovish tone recently, the PBoC is in the middle of a major easing cycle, the BoJ is in a perpetual QE, and the ECB is fully expected to expand its stimulus.

A further dollar rally would exacerbate the rout in emerging markets, potentially forcing China to resume the RMB devaluation. Disinflationary pressures in the US could worsen and the manufacturing sector would take another hit. Nevertheless, it seems that many at the Fed are willing to overlook such an outcome and begin the first rate hike cycle in nearly a decade.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.