Oil Vs. Asian Dollars

Alhambra Investment Partners, LLC | Aug 24, 2016 01:56AM ET

Starting June 8, oil prices began falling again, reversing their more optimistic trend that had lingered since February 11 long after the usual correlation to CNY was broken. In fact, by the time WTI had peaked, CNY was already being meddled with again in clear PBOC interference. Despite being backward to what was 2015’s relationship of death, by July the oil price drop was something to behold; it was a regular, daily occurrence that escaped the mainstream’s ability to define (since it was contrary to the spring rebound narrative).

After falling below $40 (closing price) for the first time since mid-April on August 2, however, there seems no stopping the buying. As it went down in nearly a straight line it has come back up just as intensely, if not more so. What changed?

Many are claiming that it was merely a typical correction on the way to much higher oil prices as the global economy will look like what the FOMC and Janet Yellen describe. Because there is no other economic data anywhere in the world that even indicates that as a possibility (except the isolated unemployment rate and the media’s tendency to attach the word “strong” to anything even when highly inappropriate in doing so) we are left with the “dollar” – and very likely the Asian “dollar”, just not via China like last year.

Back toward the end of June, Bloomberg reported yet another increase in the negative spread for yen basis swaps into dollars; this time even more intense than the burst that ended on February 11. Starting on June 8 (first clue), the basis swap plunged from around -48 bps (which is already a very “tight” starting point”) to -68 bps at the time the article was written. That was the most “dollar” deficient since November 2011; i.e., intensification of the “dollar shortage” vis a vis Japan and yen.

We already know well the direct relationship between this angle of a “dollar” problem and JGB yields. Referring back to mid-March for the second time today, JGB yields were trading below the NIRP penalty because of this inordinately large premium in basis swaps (from the point of view of holding spare “dollars”).

The answer is the huge discount to “borrow yen”, meaning cross currency basis swaps. The negative premium was again at a record high in this trading, which means that investors only need a safe haven to park their “borrowed yen” while they pocket a huge spread on the swap. Who is making out in all this? Anyone with spare “dollars.”

In other words, if you have “dollars” you don’t care about what you do with the yen you swap into; park them in negative yielding JGB’s because the negative basis swap is so favorable to anyone with “dollars” (FX leverage) the cost of the negative yield is nothing compared to the swap premium (again, from the perspective of the “dollar” holder). The very fact that this negative basis swap persists and does so at increasing record levels demonstrates very plainly what I was writing about earlier today in diminished balance sheet capacity in money markets related to Japanese banks – FX included in those money markets.

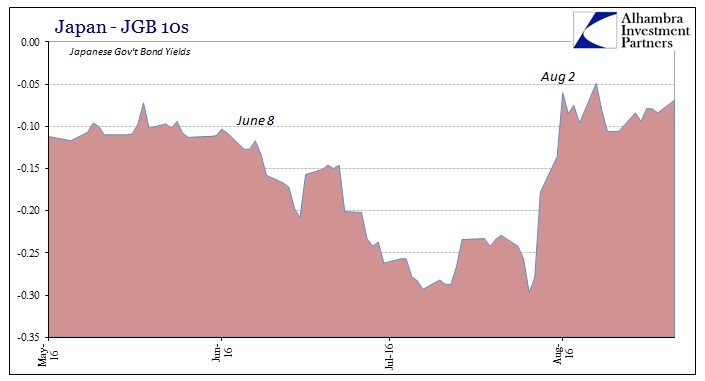

With that in mind, there is then a very good relationship between the basis swap spread (negative) and JGB yields. Around June 8, as the spread began to sink, so did yields especially in the JGB 10’s.

By the time the Bloomberg article was published, the yield was a ridiculous -20 bps and double the penalty rate of NIRP at the 10-year maturity. It would continue to get worse as by July 27 the JGB 10s were yielding a flat-out stupid -29.7 bps, cross currency basis swaps sinking toward an unbelievable -80 bps. The very next day, JGB’s sold off, with the 10-year maturity jumping to “just” -27.9 bps. On July 29, however, yields rose sharply with the 10s finishing that day at -17.8 bps.

July 28 and 29 should sound familiar as all eyes had been on the Bank of Japan ever since the “helicopter” rumors started flying earlier that month. Those days were the actual policy meeting where, to the mainstream, BoJ massively disappointed. That day, however, I wrote that, as usual, the mainstream was wrong because it was looking in the wrong place.

What BoJ is, in fact, addressing is the yen which, dating back to November (and JGB’s to early December), has been openly and significantly defying their stated goals; going so far as to disregard NIRP entirely. Therefore, what might be most telling here is that they chose not more QQE to try to tame JPY but dollar. It recognizes, I think, that NIRP was a huge mistake as it still isn’t appreciated just how much it messed up Japan’s money markets and even liquidity supply…

I don’t want to make too much in comparison to their reluctance to add to QQE, but it isn’t nothing that when the entire world expected them to act they did so where they did. It is an acknowledgement, I believe, that one of Japan’s most pressing issues is “dollar” and not just its own economic disaster. After all, Japanese companies that have been for decades upon decades financing in “dollars” have done so via Japanese banks. For the BoJ to step in for them at all confirms a great deal about what we long suspected with regard to the world’s biggest problem.

In other words, the most important aspect of BoJ policy changes announced on July 29 were not related to what it didn’t do, that which disappointed the helicopter chasers, but rather what it did; and what it did do was all about “dollars.” It was immediately effective, at least in terms of the short run:

Dollar funding costs for Japanese banks dropped considerably after the Bank of Japan last week enhanced its support for Japanese banks, a little-noticed success in the central bank’s otherwise underwhelming stimulus…

The one-year dollar/yen basis swap spread , or the cost of swapping yen for dollars for a year, dropped to around 70 basis points from around 77 basis points before the BOJ decision.

That last part is what you see in the huge selloff in JGB yields that extended to a second day on August 2. In short, the Japanese end of the Asian “dollar” had become distressingly disruptive through June and July, but much less so once BoJ singled out the “dollar” in its actual policy changes. Thus, from around June 8 until about August 2, the Japanese-connected “dollar” pressure was increasingly acute and globally disruptive (stock markets obviously notwithstanding because of their own liquidity supply and buying interests, largely myths about what central banks can’t do). Since August 2, much less so; leaving oil once again as a function of “dollars” this time in relatively better shape.

That is only the short run, however, lest anyone get carried away being impressed by BoJ finally doing something immediately effective. It hasn’t helped JPY, which I still believe was their intention. Though you could argue there has been some positive spillover in that the yen exchange rate seems stuck around 100 rather than moving sharply upward into the 90’s once more, it isn’t anything like a reversal which you have to believe was hoped for. The same goes for the negative basis swap; it may have moved less negative (less “dollar shortage”), but the spread is still near record wides.

The policy, therefore, was only marginally effective in at most the short run of arresting the “dollar” pressure of June and July (you will notice how little effect the “helicopter” rumors had in this regard, which someone could argue was the point of those curiously placed whispers in the first place, at least trying to have a large effect on the FX shortage into JPY). The overall global condition, as we know through repo and LIBOR, remains. As with so many PBOC intrusions these past few years, BoJ has bought only some time and likely not all that much, changing very little in the process.

Without the proper perspective, all these things are but a mystery that never gets solved. Oil is “dollars” and increasingly “dollars” is Japan. While that may seem like a relief given last year’s story of oil and China, it is not, in fact, a positive development.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.