The Market Is STARVED For Discoveries: Novo Resources

Sprott Money Ltd. | Oct 16, 2017 02:37PM ET

Bear markets are tough for geologists. The first item to get thrown out the 30th floor window of a mining executive’s Toronto corner office is the exploration budget. The second are the exploration geologists.

The five-year bear market ravaged the exploration space as the entire mining industry slashed costs, sold off non-core assets and repaid boatloads of debt that had been accumulated during the good times. The junior space fared even worse as top-notch management teams with solid projects (projects likely to have been drilled in a heartbeat during a bull market) were forced to beg on Bay Street for a “keep the lights on” raise, complete with a 5-year, 25% premium warrant; only to find themselves rejected.

My, my, my how things have changed.

The bear market arguably ended in the first part of 2016 after metal and share prices finally found a bottom following a very tumultuous 2015. Cash-poor juniors who spent much of the past five years with their heads in the sand, are finally coming up for air and are now able to raise money. According to EY Mining & Metals, total capital raised by the entire mining sector rose by 15% year-on-year to $71B in the 2nd quarter of 2017 (as depicted in the below chart).

EY also pointed out that mergers and acquisitions increased by 71% year-on-year in 2Q17, as shown in the below graph:

Source: EY.com

Furthermore, exploration budgets have finally picked up speed. According to S&P Global Market Intelligence, budgets for nonferrous metal exploration rose for the first time since 2012, showing a 14% increase versus the 2016 budget numbers.

snl.com

While this marked budget increase is largely attributed to the majors increasing their post-2016 budgets, the juniors that survived the downturn have also increased their budgets to an aggregate increase of 23% year-on-year. So where are the discoveries?

The short answer is discoveries take time.

The long of the short is geologists have to mobilize a camp to map and conduct geophysical (e.g. magnetics/IP) and geochemical analysis (e.g. soil/chip sampling) before they even identify drill targets. Often drilling occurs in harsh remote locations like Nunavut where the field seasons are short and you’re lucky if you get more than five months before the frost comes and then even liquor can’t keep the geologists from going home.

Then, in order to drill, the company needs permits and cash. If the story is good, getting money is the easy part, relatively speaking. CEOs and CFOs can pitch the story to tap capital markets and raise money through private placements through firms like Sprott, but the drill permits are another story.

If anyone has experienced the “efficiency” of processing paperwork with the Department of Motor Vehicles, then one has an idea of the time it can take to get a drill permit. Once the arduous process is complete and the permit is in-hand, the company is able to drill (subject to weather and the requisite liquor inventory, of course). The geologists then have to conduct an initial quick log, conduct core reconstruction and orientation (fitting it back together and working out core loss), photograph the core, saw the core in two, conduct detailed logging, sampling and bagging, before it is dispatched to the prep lab (possibly waiting until there is a worthwhile truck or helicopter load before dispatching). They then can wait up to a few months depending on the backlog of assays at the lab. And then, only then, they might receive word that a discovery has been made.

My point is this lengthy process requires patience from both the exploration geologists and the investors.

So, although financings and exploration budgets have picked up, we still have yet to see a string of discoveries that drive the fervor of excitement in junior markets, at least none that are based on drill results.

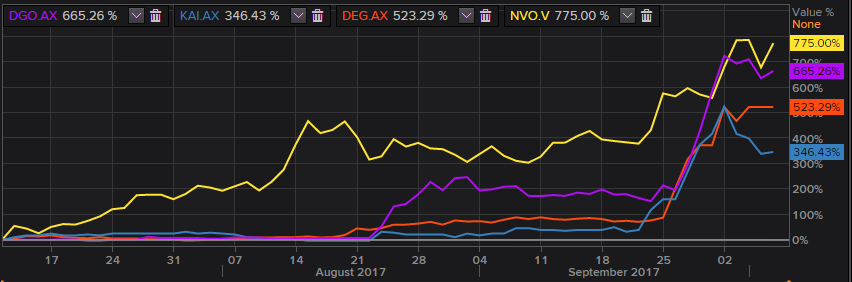

On July 12 of this year, Novo Resources Corp. (V:NVO) (OTC:NSRPF) released a video and a subsequent press release announcing the discovery of in situ gold nuggets ranging up to 4 cm long in gold-bearing conglomerates from its Purdy’s Reward project in the Pilbara district in North West Australia. As you can see in the below chart, the market immediately responded to this news as the share price jumped from CA$0.90 on July 11 th to CA$1.49 on July 12, the day of the press release. The upward trend has continued, surpassing CA$8.50 in the first week of October – shortly after Novo Resources presented a live stream at the Denver Gold Forum where on-the-ground geologists in Australia unearthed watermelon-seed-sized nuggets right in front of a stunned audience.

The average gold deposit mining grade is about 1 gram per ton – way too low to see with the naked eye. So when a company has a project with visible gold, the investment community pays attention. And so does the mining industry, seeing as a land rush ensued with numerous companies picking up concessions adjacent to Novo’s prospect and reporting conglomerate hosted gold nuggets. And boy has it paid off:

Source: Thompson Eikon; as of October 8, 2017.

The excitement surrounding this area play has become an industry talking point and somewhat of a beacon of hope in a sector that hasn’t done much since the middle of 2016 when gold peaked at $1370 in the wake of Brexit. Remarkably, based on C$8.50/share Novo Resources now has a fully diluted market capitalization of CA$1.6B and they have yet to drill one single hole.

Now that’s NOT to say they won’t make a sizeable discovery. The Pilbara Region in North West Australia had historically been explored for base metals including iron and copper, so there is a good chance the prospect of gold was overlooked. Nonetheless, the valuation is unusual for such an early stage project. Typically, an exploration company’s share price doesn’t begin to move until drilling confirms mineralization.

Whatever Novo Resources’ outcome may be, I believe the large-scale picture shows just how much the exploration space needs a new discovery. More importantly, it shows how the industry as a whole is in desperate need of pipeline development stage projects that can replenish reserves produced. If mining companies do not make new discoveries, or buy development stage assets, they in effect become companies in liquidation.

Luckily there are a handful of development stage projects that were discovered in the last bull market which have a fraction the valuation of Novo yet are already proven and ready to be put into production. Potential discoveries are always more exciting since there is technically unlimited blue sky potential, however, one can buy real proven assets on the cheap that will become producing mines. Take a look at the below, widely-used chart from Brent Cook of Exploration Insights, which shows the life cycle of a mining company from the conceptual stage through depletion:

Source: https://explorationinsights.com/

The chart underscores the ebbs and flows common in a junior’s life cycle. As previously discussed, the conceptual and pre-discovery phase takes up a substantial portion of the life cycle, followed by market fervor throughout the discovery phase. The post-discovery excitement is then likely to wane while companies conduct the onerous – albeit imperative – resource estimates, environmental impact assessments and feasibility studies. This part of the life cycle may not provide sexy press releases, but it’s necessary to bring a project from the discovery stage to the development stage, shown above as the “Orphan Period.”

We believe these development stage companies will become increasingly hard to come by as majors take them over. So while we wait for new discoveries to be made, and companies like Novo either boom or bust, we at Sprott will continue to acquire the orphans before the market has caught on.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.