The Margin Debt Time Bomb

Chris Martenson | Sep 06, 2015 07:50AM ET

What is perhaps the greatest risk to individual investors these days?

Is it the potential for a decline in corporate earnings based on a slowing global economy? Is it that current valuation levels in both equities and fixed income instruments are much nearer historic highs than not? Is the biggest risk a US Fed that will soon raise interest rates for the first time in close to a decade?

Although all of these are specific investment risks we face in the current cycle, my contention is that the single largest risk to investors is a risk that has been present since the beginning of what we have come to know as modern financial markets. The single largest risk to investors is themselves. By that, I mean the influence of human emotion and psychology in decision making.

We Are Our Own Worst Enemies

After many years of managing through market cycles, it seems pretty clear to me that humans are uniquely wired incorrectly for long-term investment success. When asset prices double, we want those assets twice as bad. When asset prices drop in half, we want nothing to do with them. Isn’t this exactly what we saw in US residential real estate markets a decade ago? Isn’t this what we experienced with the rise in dot-com stocks in 1999 and their demise over the three following years? Human decision making shapes the rhythmic bull and bear market character of asset prices. We know the two most prominent emotions that drive markets higher and lower are those of fear and greed.

If we turn the clock back far enough in early human history, we know that humans ran in packs. Strength and protection was found in a pack or herd. It was when humans ventured away from the protection of the herd (consensus thinking) that they were physically vulnerable. The fight or flight mechanism has been an integral part of human development over time. Several thousands of years later, these learned decision making responses are simply hard to “turn off.” We find comfort in decision making within the herd. When confronted with challenge, it’s either fight or flight. These ingrained human character traits are why we often see investors buy much nearer a top and sell close to market bottoms. Decision making driven by emotion, as opposed to logic, is the single greatest impediment to long term investment success. There is an old saying in the markets: “Human decision making never changes, only the wallets do.”

Human Emotions Meet Animal Spirits

Just what does this have to do with decision making in the current environment? Remember, as investors, controlling our emotions is probably the single greatest obstacle to sound decision making. As such, we need to anticipate potential emotional triggers so we can better confront and allay our own human responses to market outcomes. There is probably no greater human emotional trigger than actual price volatility itself. If we can anticipate and understand why price volatility may occur, we hope to dampen our own emotions and objectively steer through the vagaries of market cycles.

What we are seeing in the current market environment as a catalyst for potential heightened forward market price volatility is the current level of NYSE margin debt outstanding. You may be familiar with the financial market characterization of “animal spirits.” The concept of “animal spirits” is integrally intertwined with human emotion, in this case meaningfully heightened confidence. There probably is no greater show of human confidence in the investment markets than borrowing to fund an investment. Certainly, leveraged investors expect a return above their cost of capital, with expectations usually much higher than just this simple metric. The direction and level of margin debt outstanding at any time is a reflection of these so called “animal spirits,” it is a reflection of human confidence.

The Margin Debt Time Bomb

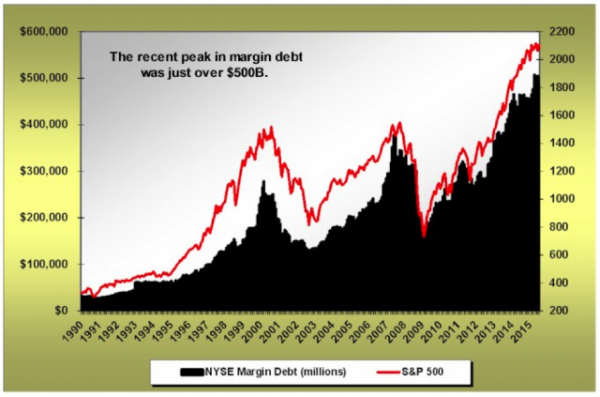

Let’s have a look at where we now stand. As of July month end, NYSE margin debt outstanding stood just below a record level of $500 billion. It hit a new all-time high right alongside the equity market itself, exactly in line with what we would expect in terms of the emotional side of human decision making.

A few observations regarding the consistent patterns of human decision making seen in the historical rhythm of margin debt are important. First, it is clear that margin debt peaks very close to the final run to cycle highs in stocks with each bull market cycle. Remember, when asset prices double, we as humans want them more than ever, but when prices are cut in half, we avoid them like the plague. At the recent peak, margin debt was up just shy of $50 billion this year after being flat in all of last year. After these near vertical historical accelerations at cycle tops, margin debt has peaked and begun to decline while stocks temporarily go on to new highs – this divergence being the tell-tale indicator equities have peaked for the cycle. Because this data comes to us with a bit of a short-term lag, it’s seen in hindsight. At July month end, the S&P traded above 2100, while margin debt balances fell just shy of $18 billion. On a very short-term basis, this divergence was established in July.

Where we go ahead will now be important. Official NYSE August margin debt levels will not be available for a number of weeks, but it’s a very good bet margin debt levels contracted again in August, perhaps noticeably. As I watched the Dow open down over 1000 points a number of Monday’s back, it was clear margin liquidation drove the open. Price insensitive selling dominated early trading in many an asset price gap down.

As we step back and reflect on “rational” decision-making, it would be much more appropriate (and profitable) if margin debt outstanding peaked near the bottom of each market cycle (low prices) and shrank near the top. As long as human decision makers susceptible to emotion are involved, that is not to be.

The final important observation germane to our current circumstances is that when market prices turn down, margin debt levels drop like a rock. Think about leverage. It works so well when the price of assets purchased using leverage rise. Yet leveraged equity can be eaten alive in a declining price environment. Forced liquidations are simply price insensitive selling. Of course, this will only occur after prices have already dropped meaningfully enough to either force margin calls, or cause margined investors to liquidate simply in order to remain solvent or limit loss. We have certainly seen a bit of this in recent weeks.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.