Budget Deficit Headwind For US Bond Market

IG | Feb 13, 2018 01:59AM ET

The headlines in overnight have centered predominantly on Donald Trump’s budget and infrastructure plans, although not to be left out of the mix there is talk Theresa May could signal an agreement around Northern Ireland and the customs border later this week.

Certainly, the economic forecasts disclosed as part of the Trump budget have been a talking point, where we won’t actually see a balanced budget for 10 years. The assumptions used to calculate the headline budget deficit of $873 billion in 2018 (revised higher from $440 billion) and $984 billion ($526 billion) are also a point of conjecture given they assume the 10-Year Treasury yield will average 2.6% in 2018 and 3.1% in 2019, while US CPI should average 2.1% and 2% in these years respectively. The fact the 10-year Treasury sits unchanged on the day at 2.85% shows a market that is unnerved by these numbers, specifically as we had largely known them anyhow and one questions if the plan here actually eventuates as proposed.

That said, the deficit is only going to be headwind for the US bond market and promote upside in long-end yields. It is a growing concern and on current projections clearly something has to change, especially if the future costs to roll the maturing debt over is becoming ever more costly. It is a worry for the USD too in the years ahead and while FX traders are not selling USD’s on deficit concerns today, it will be an ever-growing headwind in the years ahead.

The recent driver of USDs is seemingly the yield curve, where we saw the difference between 10-year and 2-Year Treasury’s widen seven basis points last week and it’s not surprising that the USD Index rallied 1.4% in appreciation, helped by a touch of positioning adjustment given speculative holdings of EUR longs fell 5% (to 140,823 contracts) last week. Today, we see the USD index tracking 0.3% lower, with small gains seen in the NOK (+0.5%) and AUD (+0.4%), helped by strength in commodity markets, with CME copper pushing up 1.8%, although Brent and WTI crude have closed flat, giving up earlier strength.

There has been no real economic data to drive, although there has been some interest in the New York Federal Reserve January Survey of Consumer Expectations, where median inflation expectations moved 0.1% lower for both the one- and three-year horizon. The market is still assessing potential portfolio risks around this week’s US CPI print and retail sales (both are due on Thursday at 00:30 aedt), while further out we get January FOMC minutes (22 February at 06:00 aedt) and Jay Powell’s Congressional Testimony (28 February to 1 March).

Staying on the economic data theme and locally today NAB business conditions and confidence are released at 11:30 aedt, although the report is unlikely to spur too much life in the AUD or the interest rate markets, with 15.5bp (or a 62% chance of a hike) priced into the December Aussie 30-Day bill futures contract. The lift in sentiment won’t disappoint the bulls either, especially those holding exposures to emerging markets and specifically, I am keen to see if it is time to look at the MSCI Emerging Markets (NYSE:EEM) ETF more favorable again with price pushing up 1.5%.

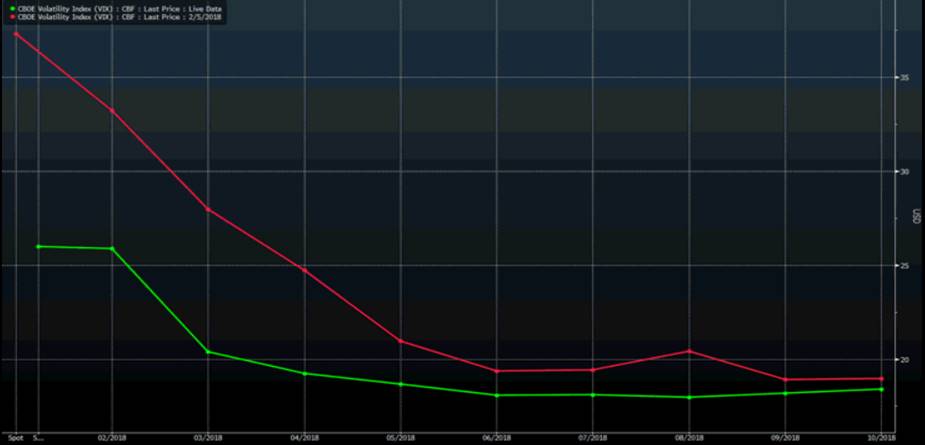

We can also see traders have partially closed out of longs in VIX futures, after last week’s monster re-positioning, from what was a sizable net short position of 59,357 contracts (in VIX futures) to sit at a record net long position of 85,818 – we live in interesting times. Either way, we have seen some volatility (vol) sellers, with the VIX futures curve flattening out (see below), although it is still elevated. We have also seen high yield corporate credit working with spreads four basis points tighter, which will please equity investors after last week’s blow out, where spreads widening some 40bp through the week. US equities have also found solid buyers here and whether it’s a dead cat bounce or the start of a more promising rally is obviously yet to be seen, but we currently see the S&P 500 +1.5% and the Dow Jones +1.9%, while small caps are underperforming a touch with the Russell 2000 +1.2%.

Much ink has now been spilt over the fact that the S&P 500 rallied so strongly (on two occasions) off the 200-day moving average and we have finally seen the US equity index moving back above its 5-day average, printing the first closing higher high since 26 January, but there is still much work to do and specifically the 50% retracement if the recent correction seen at 2704 is a level the bulls will want to see the index close above -sellers seen into here could be quite telling. However, for today we can see strong moves higher in energy, materials, tech and financials and that bodes well for equity appreciation in Asia.

One small consideration locally is that S&P 500 Futures were finding buyers through Asia yesterday, so when the ASX 200 closed at 16:10 aedt, S&P 500 futures were already +0.6%. So some of the moves were partially priced in and if we look at S&P 500, if we want to be pedantic, we can look at the change in S&P 500 futures from 16:10 aedt to the current time and see the index up a further 1.0% - therefore, we still see a stronger open locally, and this is true of Aussie SPI Futures which are sitting up 31 points from 16:10 aedt, so this should support the ASX 200 for a gain of 0.5% on the open this morning. Based purely on their respective ADRs (American Depository Receipts) (NYSE:BHP) should open +0.9% higher, while (NYSE:CBA) should lift by some 0.3%.

A big day of the reporting calendar with Cochlear Ltd (AX:COH) and Transurban Group (AX:TCL) getting the lion’s share of trader’s attention. The micro-focus comes at a time when the market internals are showing an ever increasingly pessimistic stance, with just 8% of the ASX 200 trading above their 20-day moving average and 51% above their longer-term 200-day average and this will garner some focus this morning with the 200-day moving average on the ASX 200 sitting at 5845 and likely to be tested. We can also see over a quarter of the market closing at 4-week lows.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.