Good Data From Japan Shows JPY May Have Potential To Outperform In 2018

IG | Dec 27, 2017 02:10AM ET

As we gear up to tackle what is left of the working week, this scene is set for a largely unchanged open, that is, at least at an index level.

So while this may be true at an index level, if we look within the various sub-sectors we should see some life, where there have been some interesting moves to focus on and specifically in the commodity complex. So if one is holding a long position in Brent, US crude, heating oil, copper, Aluminum or silver, or exposed to these commodities through equity then your Christmas has just been extended a little longer. Certainly, energy is attracting interest on the floors, with US crude testing $60, and sitting up 3% from Friday’s ASX 200 close and so this move needs to be discounted into Aussie oil names. Headlines that an explosion at a pipeline in Libya has been the catalyst, with the impact said to be affecting production by 70,000 to 100,000 barrels a day. So, the supply/demand equation continues to favour on-going support for the barrel and further plays into one of the big macro dynamics for 2018. That being a slow, yet steady rise in inflation and price pressures.

With US markets open overnight we can see a couple of Aussie stocks ADR’s trading and this gives us some sort of guide for the ASX 200 open, with BHP tracking +0.8% and building on its +16% year-to-date performance and it should be indicative that materials and energy will be an outperformer in a broader market with limited participation. CBA, on the other hand, looks set for a soggy open with the ADR -0.4% and following the moves seen in the S&P 500 financials sector, which is currently lower by 0.4%. The Aussie SPI futures don’t give us any indication, as the futures market shut up show at 16:30 aedt on Friday and hasn’t been open through overnight US trade.

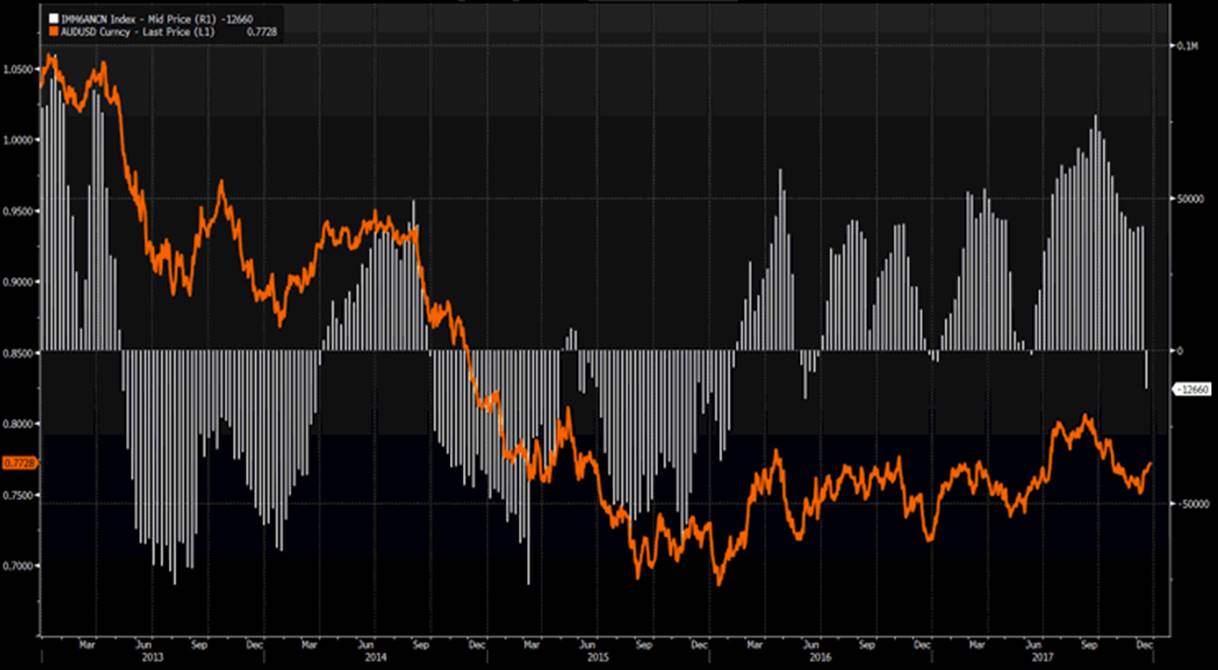

Once again, if you want big punchy moves and that is your thing then Bitcoin is the place to be and since Friday we can see price moving in a huge 5357 point range. A few have questioned the future direction of the crypto space, and we are certainly seeing a decent battle underway to re-establish some sort of bullish trend again, however, I think a decent closing break of 16,174 should help the bulls case and would suggest a solid platform for a move higher. Outside of Bitcoin, and the commodity markets it’s been a quiet and lifeless trade and of course, this will not surprise. We have seen The Nasdaq 100 lower by 0.4%, while the S&P 500 is lower by 0.1% and held back by tech, although volumes through this market are 46% below the 30-day average. FX markets have also found no real traction either, with AUD/USD trading in a range of $0.7732 to $0.7700 over the last couple of days, while perhaps it is worthy of note that speculative positioning in AUD/USD is now held net short, which aside from a brief period in June is the first time speculative FX funds have held a bearish bias on AUD since June 2016. See the white histogram showing the net position.

USD/JPY has tracked a 33-point range in this time and again this shouldn’t shock and the daily chart shows gridlock, where price looks very comfortable indeed and missing a short-term catalyst. That said, the set-up does suggest something is brewing and a big move is certainly due in early 2018. US fixed income has seen small buyers with the United States 10-Year Treasury down one basis points to 2.47%.

If we take a step back and look at global economic data points, we have seen US core PCE (personal consumption expenditures) pushing up to 1.5% on Friday, while US durable goods orders rose 1.3% and aggregating all this together it suggests the tracking rate for US Q4 GDP is running closer to 3.5%. November personal income and spending gained 0.3% and 0.6% respectively. This is important as the savings rate has fallen 30bp to 2.9% and this now sits at the lowest since 2007. We also saw the December University of Michigan sentiment survey out, where we saw the 1-year inflation read down a touch from the initial read to currently sit at 2.7%, although keep in mind this sat at 2.5% in November.

The US data can be complemented by data from Japan yesterday, where nationwide November core CPI moved to 0.9%, the highest since 2015. The more forward-looking Tokyo core CPI read (it tracks December inflation) has pushed up to +0.8%, versus the consensus at 0.7%. Household spending gained 1.7%, while the labour market shows further inspiring factors with its jobless rate ticking down to an incredible 2.7%, with the jobs-to-applicant ratio running at 1.56 times. Good things are happening in Japan and while the BoJ continues to maintain a view that it will not alter monetary policy and allow an overheating on the economy, there are some reasons to think the JPY has genuine potential to outperform in 2018.

With limited economic data to push markets around this week, today really is about position squaring ahead of the new calendar year. I do think the commodity trade is one we need to watch and while liquidity is obviously an issue, this is an asset class that is hot at the moment and could really dictate inflationary trends in 2018, where inflation, volatility and the USD hold the key to the capital markets.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.