Market Reaction To U.S. Tax Plans: EUR Pulled Pack, AUS Has Fallen

IG | Apr 27, 2017 03:24AM ET

The feeling on the trading floors around the anticipated Trump tax plans is certainly one of being underwhelmed, but then should we really have expected anything so punchy that it really moved the dial?

The “big announcement” was an outline of what had largely been leaked or highly speculated on, with measures like cutting business tax to 15% (from 35%), setting up a territorial tax system, reducing the personal tax brackets to just three (from seven) and limiting the number of tax deductions. Among other measures.

The question of how these spending initiatives will be offset is still what the cynics will be pointing to. In fact, I don’t think you need to be a cynic, just a realist, that unless we get a vote to alter the healthcare bill and create real federal savings then the tax reform announced will increase what is already a worrying trajectory for the U.S. deficit over the medium to longer-term.

By all accounts, there is set to be a new vote on healthcare either this Friday or Saturday, which perhaps looks a little more achievable of passing as the Freedom Caucus are making some positive comments here. What this new bill looks like is still the subject of debate as it hasn’t been released to the public.

It's perhaps the more centre leaning Republicans now that seem to have an issue with changes to Obamacare as they feel it won’t protect their constituents. Recall, they are politicians and still need to be re-elected, so they have to do what they feel their constituents will be least unhappy about.

The market reaction could be best described as a modest “sell the rumour, buy the fact”, at least in the U.S. bond market, which is where the best purest reaction to the tax plans has been seen. Given the timeline, the U.S. five-year Treasury is a good place to start and here we saw yield drop from 1.86% to 1.82%. USD/JPY went along for the ride, pulling back from ¥111.78 to ¥111.00, but the pair has been well bid since the 17 April.

Gold has found some buying support as yields fell and is just about holding the 27 February high of $1264. A close below $1264 would be a negative for the gold bulls, but short positions are perhaps not warranted on gold until we can see a move through $1239, which I see as the key support level here.

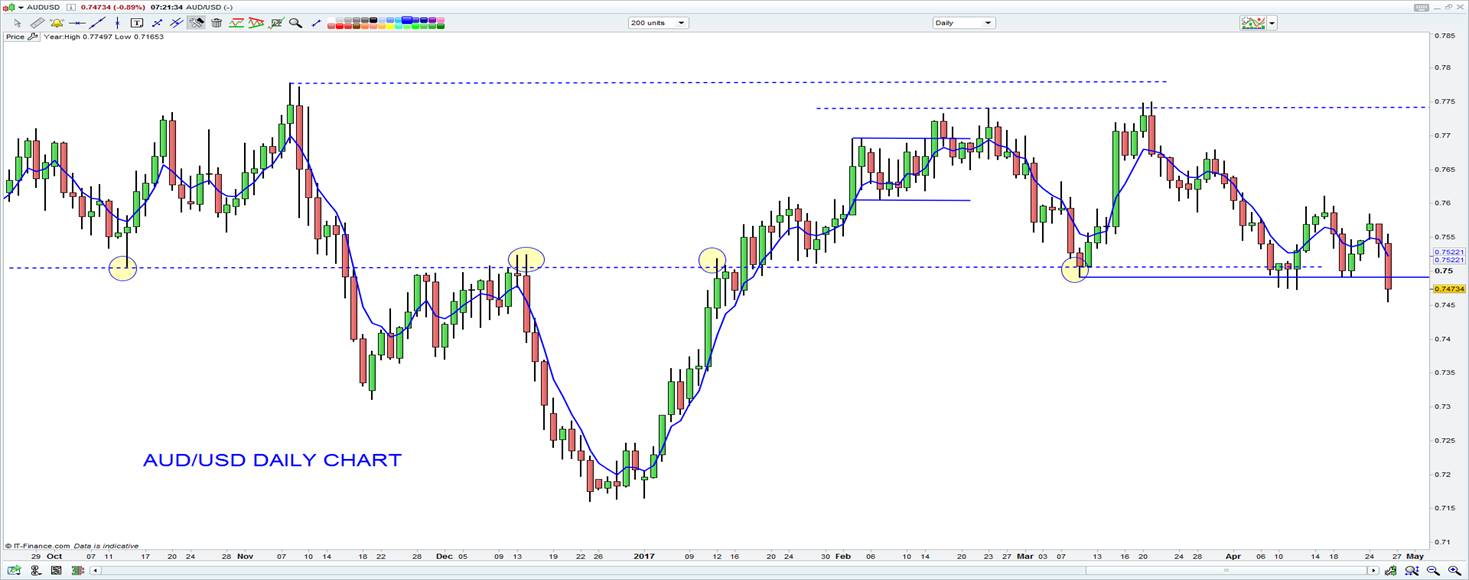

The reaction in other USD pairs has been interesting as the USD weakness (seen in USD/JPY) has not resonated in EUR/USD and AUD/USD. EUR/USD has pulled back to $1.0856, although has since reclaimed the 1.09 handle, while AUD/USD has fallen 0.8% on the session and looks destined to close below the key $0.7491. For the technical traders, $0.7491 is the neckline of the February and March double top and while there is still work to do here, a target of $0.7250 is forming.

AUD, along with the NZD, has been the weakest currency in G10 on the session and this is not a reflection of iron ore (spot iron ore +0.8%, iron ore and steel futures fell 1% and 0.8% respectively) or a reflection of the Q1 CPI print. I say this because the swaps market has increased its probability of futures rate hikes (from the RBA) by four basis points and we have seen some selling in Aussie government bonds.

Perhaps this is a position adjustment, given the market was quite long of AUD (if we focus on the weekly Commitment of Traders) report, but there is no doubt the technical picture is becoming more bearish and this should be respected. Long GBP/AUD is perhaps the better trade, although the bulls really want to see a close through the years high of a$1.7209 – it is ominously poised to do so. The daily chart (see below) is one chart that has to be one the radar and a break of 1.7209 and traders should be able to pick up a fairly quick 600 pips to the next key resistance.

In the land of equities, we see a fairly flat open today and a pause for reflection, with largely unchanged readings in the NASDAQ, Dow and S&P 500. It certainly feels like the U.S. markets have taken over from European indices as the driving force and the key detriment of sentiment once again, although local traders are paying attention to moves in China. It seems fairly clear that we have seen the highs in China’s producer price inflation and growth rate and lower levels are likely from here, although a slow gradual decline in the growth rate is expected and not a collapse.

Energy is likely to see slight downside given the S&P 500 energy sub-sector closed down 0.4%. U.S. crude has seen a fairly whippy session, having rallied 2.2% on a sizeable 3.64 million draw in oil inventories in the official Department of Energy (DoE) report, although digging below the surface we can see the refiner ‘run’ rate at 94.1%, which signals a high level of demand. Gasoline inventories increased 3.36 million barrels and along with a general pullback in risk positions the reversal in crude see’s price a touch lower than the price at 16:00 AEST yesterday and this is what is to be priced into our energy names.

BHP’s American Depository Receipt (ADR) was accurate in predicting the Aussie listing open to the cent yesterday, and today we see the ADR closing up a whole four cents. So a flat open is in play and this could be thematic of the broader materials space. The banks have been performing quite admirably of late and have been outperforming the ASX 200. Whether that changes in the next week or so is yet to be seen given ANZ, NAB and WBC are set to report 1H17 earnings, but it does feel the market is expecting some strong numbers here and a belief that perhaps we could see better days ahead for margins.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.