Australian Data In Focus

IG | Oct 27, 2016 06:25AM ET

It seemed Australian investors were in pessimistic mood yesterday selling the banks down with reasonable conviction, although our flow was quite nuanced with 60% of all opened positions on National Australia Bank Ltd (AX:NAB) buy orders (as opposed to short orders). Naturally we await NAB’s 2H16 earnings this morning with anticipation and while the immediate concern is whether they can beat the $6.39 billion expected for full-year cash earnings ($3.165 billion 2H16), the focus will also be on whether they maintain the 99c dividend, with some calls that it may fall to 89c to bring the payout ratio to more ‘sustainable levels’. The market will be disappointed if we see 2H net interest margin below 1.87%, but one should also look for signs in its revenue outlook, bad and doubtful debts, costs and capital (CET1).

Given the fairly benign lead from Wall Street, where the NASDAQ has underperformed thanks to a reasonable sell-down Apple (NASDAQ:AAPL), while financials have outperformed, we expect a fairly flat open in Australia. In the commodity space we have seen iron ore futures push up a further 1.5% (spot iron ore +1.8% to $63.07), with small gains in steel futures. Coking coal futures has seen modest losses of 0.5%.

In the oil markets we have seen some fairly punchy price action, with sizeable volatility around the weekly Department of Energy (DoE) official inventory report. Initially we saw US crude rally 2.4% to a high of $50.10 on a 553,000 crude inventory drawdown (gasoline inventories were down 1.95 million barrels), but then these crazy oil traders saw that there was a 2.26 million barrels drawdown from an area on the West Coast called PADD 5 (The Petroleum Administration for Defence Districts), which basically has little relevance to the actual oil inventory survey. So when traders added the 2.26 million barrels back to report they ultimately saw a 1.7 million inventory increase and hence we saw US crude head back toward $49.00. Investors in energy stocks shouldn’t be too concerned just yet, as the S&P 500 energy space is still in the green.

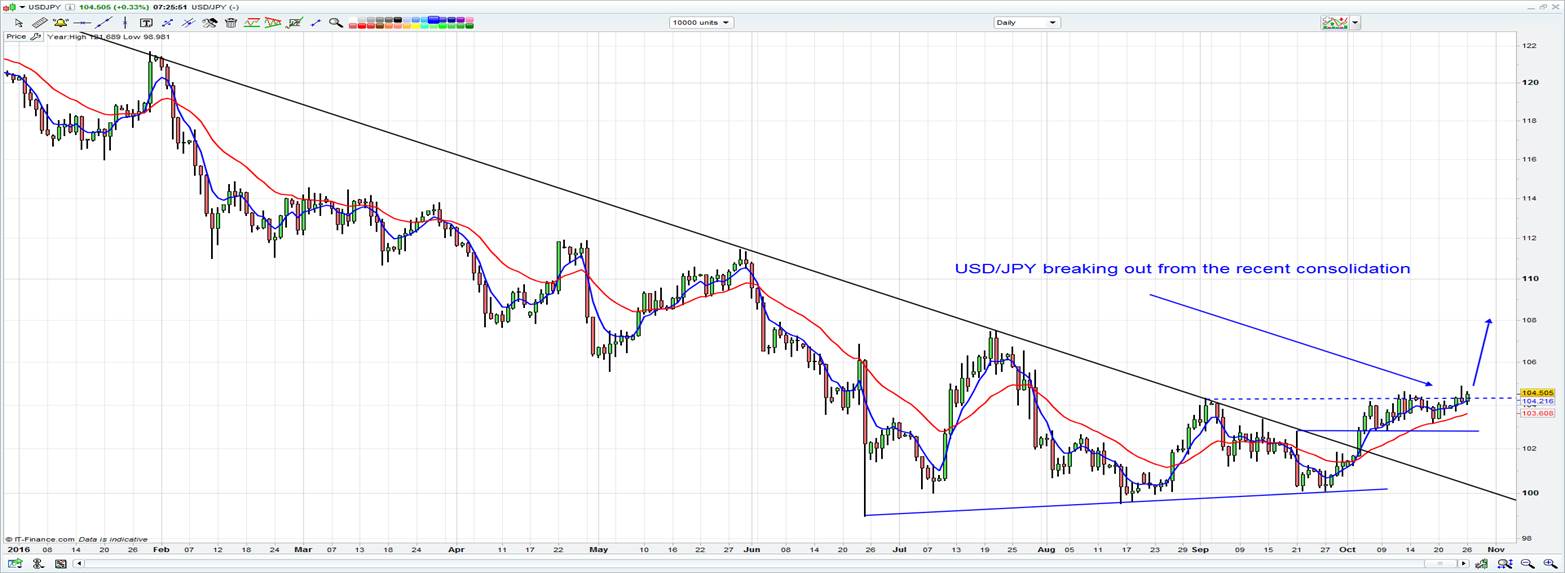

In FX land we have seen very modest selling in the USD, with EUR/USD pushing back above the $1.09 level. USD/JPY looks set to close above the key ¥104.32 level, representing the September high and after spending most of October trading in a ¥104.32 to ¥103 range it looks as though the USD bulls have grabbed the bull by the horns and taken control. USD/JPY should be on FX trader’s radars, where I feel the breakout has legs to push into ¥107, but it will be a grind as opposed to a rapid, aggressive price move. See USD/JPY chart below.

AUD/USD traded to $0.7709 after yesterday’s slightly hotter headline Q3 CPI print of 0.7% qoq, with modest losses in the front end of the Aussie bond market (the Aussie 2-year government bond has pushed up 2 basis points). If we look at market pricing we can see the prospect of a rate cut in next week’s RBA meeting has fallen to 6% (from 15% the day before), while over the coming 12 months we can see the probability of a cut has fallen from 48% to 28%. One suspects if our key terms of trade (coal and iron ore) can sustain their current levels into Q4 we could see nominal GDP push into the 4.5% to 5% region.

Interestingly, new statistics released yesterday from Domain show Sydney and Melbourne property prices hitting a new record, with the median Sydney house price reaching A$1.068 million (+2.7% qoq). The median Melbourne house price increased 3.1% to a record A$773,669. Things aren’t collapsing just yet it seems.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.