The Gold Market, Through A Glass Darkly

Darryl Robert Schoon | Dec 11, 2012 02:44AM ET

No matter what confidence game is being run, confidence is the necessary prerequisite. This is why confidence indicators are so closely monitored by central bankers. If consumers and businesses lack confidence, they will not partake of the central banker’s credit; a necessary step in the indebting of otherwise willing victims.

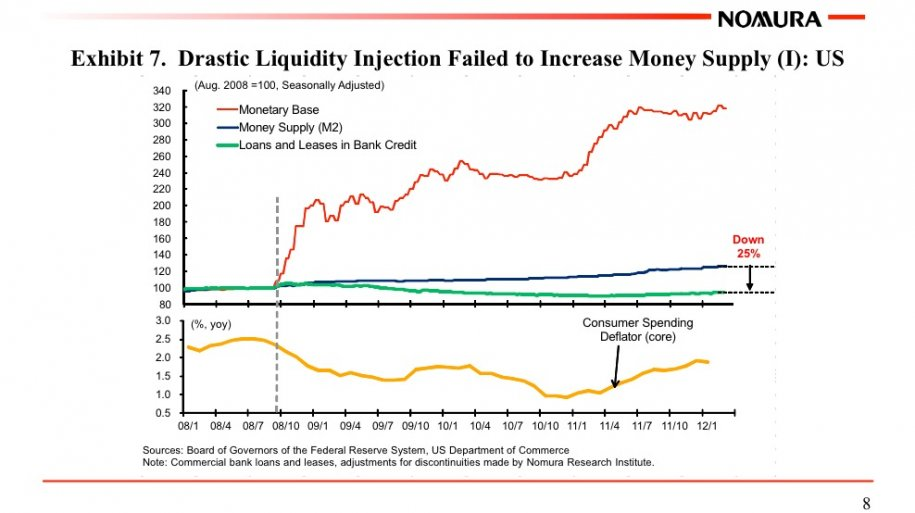

The credit trap is at the core of the bankers’ ponzi-scheme of credit and debt; and although today’s markets are awash with liquidity, bankers are increasingly loath to lend and customers are increasingly reluctant to borrow.

Central bankers are well aware of the precarious health of their illicit franchise. Credit and debt-based economies must constantly expand to pay constantly compounding debts; but now, instead of expanding, economies around the world are slowing and contracting.

This is why central bankers are concerned with a rising price of gold. After gold exploded upwards in 1980 during a virulent episode of inflation, the price of gold was understood to be an indicator of monetary distress.

The more distressed the bankers’ prey

They’re far less likely to borrow today

After gold’s explosive ascent in 1980, central bankers began seriously ‘manage’ the price of gold. A lower price of gold would indicate not only an abatement of monetary problems but investors would be less inclined to trade their paper banknotes for the safety of gold when they could more profitably leverage their paper banknotes in the bankers’ paper markets.

Since the early 1980s, supplies of newly mined gold have constantly fallen short of market demand for gold; but notwithstanding supply and demand fundamentals, gold prices nonetheless fell for 20 straight years. In 1980, the average price of gold was $615. By 2001, it was only $271. Clearly, the free market price of gold was being distorted by ‘outside’ forces.

This anomaly in the supply and demand dynamic that exists in free markets is explained by the research of Frank Veneroso, a little-known but very influential analyst. In my book, The Collapse and the Better World to Come , I explain why I’m so optimistic about what is about to happen.

Buy gold, buy silver, have faith.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.