The Force Awakened, Then Yawned

Blaine Rollins | Dec 20, 2015 01:48AM ET

The Force Awakened, Then Yawned

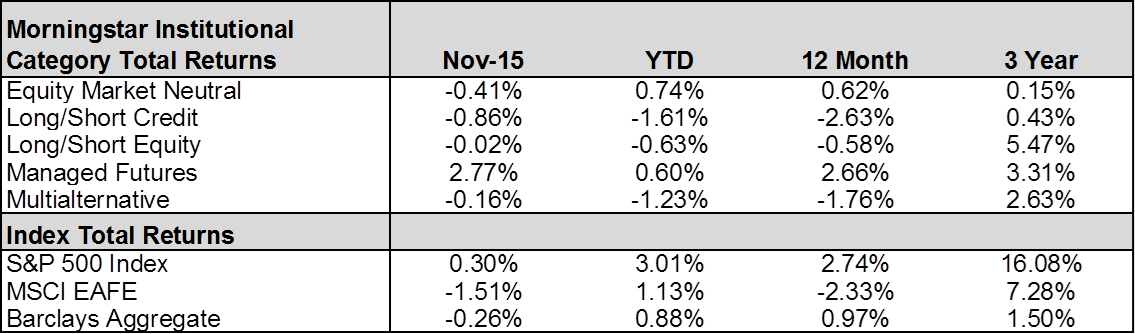

The books are about to close on 2015, a year replete with macro scares, volatility spikes and risk-on rallies. Despite all of the ups and downs, we find many asset classes and strategies ending the year about where they started. Through December 16th, global equities are hovering near zero, with the MSCI World Index down 0.57%, the S&P 500 up 2.75% and the MSCI EAFE Index down 2.18%. Bonds have been flat, with the SPDR Barclays (L:BARC) Aggregate Bond (N:BNDS) Index up a mere 0.42%, and most alternative strategies likewise generating uninspiring returns. The Morningstar Long/Short Equity category has returned -1.67%, Managed Futures +0.20%, Market Neutral -0.13%, Multicurrency -0.62%, and Multialternative funds are off by 2.4%. Of course, there have been some big losers, with commodities in general, and energy in particular, having an extremely difficult time, but most diversified portfolios are likely near their January 1 levels.

So what’s the point? A lot has been written in recent years about the low-return environment facing investors now that the tailwind of falling interest rates is finally behind us. Investors of all stripes, from pension plans to individual investors, are struggling with this reality. And when returns are hard to come by and investors are disappointed, the natural reaction is to act. We feel the need to do something, anything – change the asset allocation, fire a manager, go passive, chase the few things that did work (buy high) and dump those that didn’t (sell low). But succeeding in the challenging game of investing is often about being patient, protecting capital when the expected payoff-to-risk is poor (as seems to be the case at present), and taking risk when the payoff is attractive, that is, when there is a “fat pitch.” Control what you can control – like volatility – through thoughtful portfolio construction; reduce the chance of a big loss that can take years to recover from, and know that by reducing volatility, the mathematics of compounding improve.

Equity markets were flat to down during November, leading to a flat month for the long/short equity category. Managed futures funds were the big winners, as many longer-term trends continued, including a more than 10% drop in WTI crude oil and another strong month for the US dollar. Long/short credit was the month’s worst performer, as high yield credit suffered losses during the month. Longer term, long/short equity remains the top performer, which is to be expected given the strong market tailwind over the last three years.

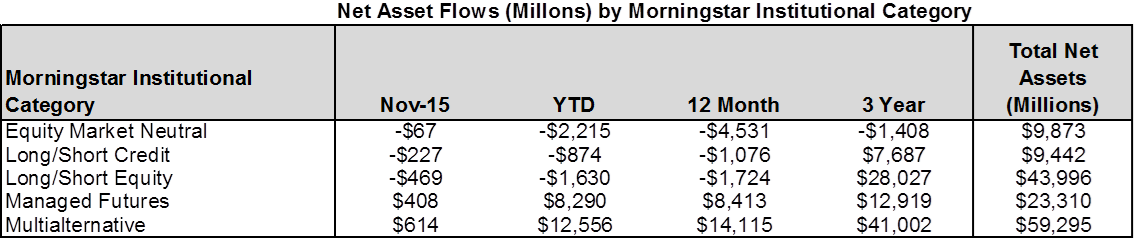

Assets continued to flow into managed futures and multialternative funds during November, while long/short equity continued to shed assets. Looking deeper into the flows data can be an interesting exercise, and we think long/short equity is exemplifying the main driver of flows – performance. While showing net outflows of nearly half a billion dollars, flows have been dispersed. The outflows have been concentrated among the worst performing funds this year, which also happened to include many of the category’s largest funds. On the other side, there have been significant inflows into funds with the best performance this year. While this seems natural, and can certainly be warranted depending on the reason for the under/outperformance, in aggregate this behavior actually tends to hurt long-term investor performance, as we and others have discussed before.

A Lesson Worth Remembering as You Consider Liquid Alternatives

Just because a ’40 Act mutual fund is daily liquid doesn’t mean a fund’s holdings are, as Third Avenue’s shareholders just found out. Given our focus on the liquid alternatives space, we clearly believe that many hedge fund-like strategies can be run seamlessly within the mutual fund structure, but we acknowledge that that isn’t always the case. The strategy’s characteristics must be considered when selecting the right vehicle in which to package it, and this is true for private equity, hedge funds and mutual funds, whether long-only or alternative in nature. Through the diligence process, investors need to ask the difficult “what if” questions, and avoid strategies/managers who downplay liquidity concerns without hard data to support their claims.

SEC Proposal Could Shake Up Managed Futures and Other Leveraged Funds

A new SEC proposal could cause difficulties for some ’40 Act managed futures funds, as well as other types of leveraged funds and ETFs. The SEC is proposing derived leverage limits of either 150% or 300%, depending on the types of assets held by the funds. Click here for the supporting whitepaper. The comment period for the proposal is 90 days and we’re guessing it should produce some interesting conversation, especially from our more outspoken peers with a dog in the fight.

Alternatives in the News

Pershing Square (N:SQ) Not Seeing Significant Outflows

Looks like Pershing Square’s client service team deserves a decent bonus this year!

“If the year finishes with our portfolio holdings at or around current values, 2015 will be the worst performance year in Pershing Square’s history, even worse than 2008 during the financial crisis,” Ackman wrote in a 17-page letter that was seen by Reuters.

Investors in funds operated by Pershing Square Capital Management have asked for only a minimal amount of money back recently, Ackman wrote in the letter, saying that the firm, founded in 2004, was not forced to sell out of positions in order to meet redemption requests.

Ackman emphasized his firm’s low redemption levels. “Our net redemptions were nominal at $39 million or 0.2 percent of capital for the third quarter, and $13 million or 0.1 percent in the fourth quarter,” he said in the letter.

The firm’s Pershing Square Holdings fund dropped 19.7 percent during the first 11 months of the year, marking a sharp contrast with last year’s 40 percent gain when Ackman ranked as one of the $3 trillion hedge fund industry’s biggest stars.

( )

Yet Another Fund Returning Client Capital

Bluecrest (L:BABS) is returning outside investor capital to focus on their much stronger performing internal fund. Hmmm…

BlueCrest International was down by 0.17 per cent at the start of this month, following a 0.1 per cent gain in 2014 and a loss of 1.56 per cent in 2013, net of fees.

One person familiar with the BSMA internal fund, which does not charge the same “2 and 20” fees as its public equivalent, said that it was up by “about 60 per cent” over three years, placing it among the best performing hedge funds in the world over that period. BlueCrest declined to comment.

This lacklustre performance of BlueCrest International coincided with many of its clients redeeming their money over the past three years. The hedge fund’s total assets shrank from $35bn to about $8bn before it returned all outside money this month.

( )

Education

Leverage Under the Microscope

As noted above, leverage has become a focus for the SEC with regards to ’40 Act mutual funds and ETFs. We started perusing their proposal and there is a lot of interesting information and thought contained within it. While we haven’t yet made it through the entire 420 page document, from what we have read, it seems possible to draw some conclusions as to what the SEC’s aims are.

The crux of the proposal is to limit mutual funds and ETFs to an exposure-based limit of 150%, or 300% on a risk-based test. The 300% limit will be based on incremental derivative exposure being used to limit overall portfolio value-at-risk (“VaR”), rather than to simply add exposure. They point out that some managed futures funds are unlikely to pass this test, as currently structured:

“Managed futures funds, and other funds that use derivatives primarily to obtain market exposure (rather than to reduce the fund’s exposure to market risk) and whose physical holdings consist mainly of cash and cash equivalents, would not satisfy the VaR test.”

(Page 147 )

Overall, we are withholding judgment on the specifics of the proposal, as it will undoubtedly evolve and the timeline to enact changes is still quite uncertain. However, we have a few thoughts on its potential impact:

- Unless an exemption is made (which is discussed in the proposal), the leveraged ETF and leveraged mutual fund business could be nearly eliminated.

- Managed futures funds are likely to be the most impacted by the proposal, as many run at multiples of the 150% limit.

- Other strategies, such as multi-strategy, risk parity, and even some long/short equity funds may be impacted, though they may be in a better position to make adjustments in order to meet the proposed guidelines.

- One potentially unintended consequence, as strategies are modified to fit within the guidelines, is that funds may move to riskier assets from less risky, since the 150% limit does not take risk into consideration (surely a point that will be commented on). This could increase risk in two dimensions. First, because of margin requirements, funds may be forced into more risky assets, possibly shrinking interest rate futures and increasing equity futures positions, for example. Second, by moving away from lower risk assets to riskier assets, these funds may also become less diversified, which again, may increase risk.

- Until this proposed rule is solidified, planning for the future just became a lot more difficult for any fund company utilizing derivatives in the ’40 Act space.

To answer the obvious question that our clients will have upon reading this, none of the ’40 Act funds that we currently run will be directly impacted by this proposal if it is to take effect in its current form. However, we will be monitoring this closely, as it has the potential to have an enormous impact on the future of liquid alternatives.

Blasphemy of the Month

While the rest of the world has been anticipating the awakening of the Force, we’ve been eagerly awaiting the December 23 release of The Big Short!

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.