The Flash Crash Of 2015

Wall Street Daily | Aug 28, 2015 05:15AM ET

Monday morning, August 24, found me sitting aboard a ferry called the Jessica W, furiously reading the news and checking stock quotes on my phone.

I was returning from a relaxing vacation on Block Island, which is located about 12 miles off the coast of Rhode Island. I couldn’t believe it – I was traveling during one of the most chaotic financial market events in years.

My friends sat in amazement as I summarized the astonishing events unfolding that morning.

A global stock market rout had set the stage for panic selling in the United States. Equity index futures and pre-market trading had suggested the day would be ugly, and the U.S. stock market open at 9:30 a.m. was extremely disorderly.

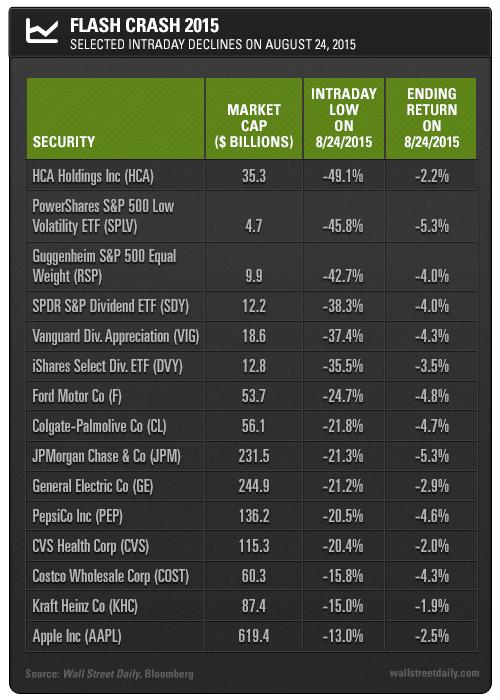

Large, bellwether stocks were going “bidless.” For example, General Electric (NYSE:GE), JPMorgan (NYSE:JPM), Ford Motor (NYSE:F), PepsiCo (NYSE:PEP), Colgate-Palmolive and CVS Health (NYSE:CVS) all declined over 20% at one point before bouncing back.

Amid the turmoil, many exchange-traded funds (ETFs) deviated significantly from their underlying net asset values. The popular dividend ETFs – SPDR S&P Dividend ETF (NYSE:SDY), Vanguard Dividend Appreciation ETF (NYSE:VIG) and iShares Select Dividend ETF (NYSE:DVY) – were particularly hard hit.

I’ve compiled a list of some of the more remarkable low “prints” in the table below:

Macro events may have been the overall catalyst for this broader market selloff, but these brief, sharp declines in individual stocks occur because of a lack of liquidity. In other words, the number and size of the bids were insufficient to handle the volume of sell orders.

This is an example of how high-frequency trading (HFT) leads to market instability. During times of market stress, market-making algorithms are less likely to provide liquidity than human traders tasked with maintaining an orderly market. Basically, because of HFT, there’s less liquidity when risk aversion spikes and everyone wants to sell. This is a recipe for disaster.

Furthermore, in the post-crisis era, bouts of risk aversion have proliferated without stimulus. Late last year, I warned that we would have another flash crash in the absence of quantitative easing (QE). Well, we just had one.

To be sure, Monday’s 5.3% intraday decline in the S&P 500 was smaller than the 8.6% drop on May 6, 2010. But make no mistake, the U.S. stock market experienced an extraordinary liquidity event on Monday, and there are likely more to come.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.