The Federal Reserve Has Declared The Winner In The Generational Financia

Charles Hugh Smith | Jan 26, 2015 12:57AM ET

The policy of safeguarding Boomer benefits with asset bubbles will lead to the destruction of the unprepared, the unwary and those who foolishly trusted our "leadership" and central bank to tell them the truth.

Though it is exceedingly politically incorrect to mention it publicly, a financial war between the generations is being fought in the U.S. and every other developed nation that has promised social welfare benefits to its burgeoning class of retirees.

The war is being fought on multiple fronts: political promises, interest rates, housing, central bank policies and official rates of inflation, to name a few of the top battlefields.

Though no one in power will state this publicly, the Federal Reserve has already declared the winner of the generational war: the Baby Boomers won and Gen-X and Gen-Y lost. Fed policies insure the Boomers will benefit from financial bubbles inflated by the Fed, and the following generations will lose--not just this year or next year, but for decades to come.

Any nation that offers its retirees social welfare benefits (pensions and healthcare) faces a no-win demographic crunch: the number of retiring people entering the class of beneficiaries far exceeds the number of additional full-time jobs being created. In other words, it's not just a matter of having enough young people to support the rapidly expanding cohort of retirees--there must be enough good-paying full-time jobs for the young people so they can pay high taxes to fund the retirees' benefits and support their own consumption/saving.

Let's cover the fundamentals of the mismatch between what was promised to retiring Baby Boomers and the generations that must support their retirement.

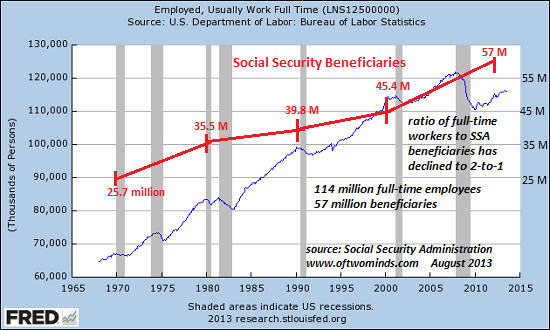

The fact is that the number of full-time jobs paying more than minimum wage has stagnated while the number of retirees qualifying for pensions and healthcare benefits has soared. In the good old days of expansion, there were roughly 10 full-time workers for each retiree drawing social benefits (Social Security and Medicare).

The ratio fell to 5-to-1, then to 3-to-1, and is now 2-to-1: that is not a ratio that is sustainable without crushing tax burdens on the young.

Estimates are even worse in other developed nations. In Europe, the ratio of retirees over 65 to those between 20 and 64 will soon reach 50%--and that's of the population, not of people with full-time jobs paying taxes to fund social welfare programs. (source: Foreign Affairs, July/August 2014, page 130)

All government social welfare programs are pay-as-you-go. The Trust Funds touted in propaganda are illusions, backed by nothing but the promise to sell more Treasury debt.

The Problem with Pay-As-You-Go Social Programs: They're Ponzi Schemes (November 5, 2013)

While the costs of defined-benefit programs such as Social Security can be extrapolated relatively accurately, the program's revenues cannot be predicted because they come from wages. If recession slashes millions of jobs, or earned income declines as wage increases slip below the rate of inflation (which is precisely what's been happening for the past 6 years), revenues won't meet wildly optimistic forecasts that presume high, sustained wage and employment growth forever.

No official forecast of tax revenues supporting Social Security and Medicare ever factor in a recession, much less a decade or two of declining wages. If the forecasts were more realistic, the programs would be revealed as insolvent.

That is of course a political impossibility, so delusional forecasts are issued and accepted as "real" lest the unpalatable reality be recognized.

Defined-benefit programs such as Social Security have costs that can be estimated with some accuracy, but programs such as Medicare are open-ended: their costs cannot be predicted. Every attempt to control the ballooning costs of healthcare benefits for the retired lowers the rate of growth for a year or two, and then the costs soar once again as the number of beneficiaries and costs of delivering ever-expanding services both explode higher.

As a result of these fundamentals, the Powers That Be face a dilemma: they cannot reveal the insolvency of these huge social welfare programs, even though the insolvency is guaranteed by demographic and global-economic dynamics.

There are a very limited number of financial solutions to this dilemma.

1. Taxes can be raised. This is problematic for several reasons. One is that taxes on the self-employed and upper-middle class are already 40%-50%, as I have outlined many times. Two, the number of "wealthy" people (households earning $250,000 or more) is tiny compared to the 100+ million army of social welfare program beneficiaries.

Higher taxes and junk fees are already suppressing consumption. Every dollar of additional tax paid is a dollar that won't be spent by the household that earned the dollar.

Tax the rich is politically popular but in practical terms, it doesn't generate the revenues that are expected, for the simple reasons that A) the number of wealthy is relatively tiny and B) the super-wealthy either move their capital elsewhere or they buy political favor-tax breaks.

2. Slash benefits and limit the total Medicare costs per beneficiary. Since young people tend not to vote and older people tend to vote, this is a political non-starter, at least until 90+% of young people start voting.

3. Raise interest rates to 10+% to encourage saving and to generate a healthy return on pension funds and retirement accounts. The net result of 10% yields is the immediate collapse of the Fed-fueled asset bubbles in housing, bonds and stocks. All these currently bubblicious assets would implode.

This is also a non-starter, because the financial/political Aristocracy and owners of these assets would be devastated by the implosion of the bubbles.

4. Inflate bubbles in housing, stocks and bonds to boost the value of pension funds, retirement accounts, and government tax revenues from capital gains by pushing interest rates to zero and extending credit to speculators, financiers and marginally qualified borrowers.

The Federal Reserve has clearly chosen #4 as the only politically palatable solution. While asset bubbles create the politically positive illusion that pension funds can pay the benefits promised, retirement accounts are swelling in value and tax revenues are rising thanks to higher property taxes and capital gains taxes, this legerdemain comes with a heavy price:

Younger generations are either priced out of assets such as housing or they are forced to buy assets at inflated prices-- prices that will inevitably implode as these stupendous speculative bubbles pop. When the bubbles pop, the young people who bought into the illusion that asset bubbles can expand forever will be underwater, and not for a year or two but for a generation.

The system rewards silence and complicity. Everyone bellying up to the social welfare trough is implicitly encouraged to support the Status Quo, lest their share of the swag be diminished. That the trough will collapse is not important to each beneficiary; what's important is that their share of the swag is not diminished, even if cuts are the only sustainable way to save the programs from collapse.

I am a Baby Boomer, and in 4 short years I will be entitled to belly up to the trough and extract hundreds of thousands of dollars in open-ended benefits (at least for Medicare). I have long proposed that the Boomers collectively fall on our swords and accept the draconian cuts necessary to align our benefits with the cold reality of declining wages and employment.

The equally cold reality is that the current "solution" impoverishes the younger generations and generates a tsunami of risk that will wash away the Status Quo--including the benefits of the Boomers.

Right now, we as a nation are greedily collecting the financial fish flopping around as the coming tsunami pulls the water out of the bay and briefly exposes the sea floor. The Federal Reserve and our self-serving political "leadership" is reassuring us the water has left for good and we are free to collect the free fish forever.

This is a blatant lie. The demographic and economic tsunami is gathering force over the horizon, and the policy of safeguarding Boomer benefits with asset bubbles will lead to the destruction of the unprepared, the unwary and those who foolishly trusted our "leadership" and central bank to tell them the truth.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.